Economic and Social Abnormality Reigns, American's Loving Their Servitude

Politics / US Politics Apr 23, 2013 - 06:14 PM GMTBy: James_Quinn

“The real hopeless victims of mental illness are to be found among those who appear to be most normal. Many of them are normal because they are so well adjusted to our mode of existence, because their human voice has been silenced so early in their lives that they do not even struggle or suffer or develop symptoms as the neurotic does. They are normal not in what may be called the absolute sense of the word; they are normal only in relation to a profoundly abnormal society. Their perfect adjustment to that abnormal society is a measure of their mental sickness. These millions of abnormally normal people, living without fuss in a society to which, if they were fully human beings, they ought not to be adjusted.” – Aldous Huxley – Brave New World Revisited

“The real hopeless victims of mental illness are to be found among those who appear to be most normal. Many of them are normal because they are so well adjusted to our mode of existence, because their human voice has been silenced so early in their lives that they do not even struggle or suffer or develop symptoms as the neurotic does. They are normal not in what may be called the absolute sense of the word; they are normal only in relation to a profoundly abnormal society. Their perfect adjustment to that abnormal society is a measure of their mental sickness. These millions of abnormally normal people, living without fuss in a society to which, if they were fully human beings, they ought not to be adjusted.” – Aldous Huxley – Brave New World Revisited

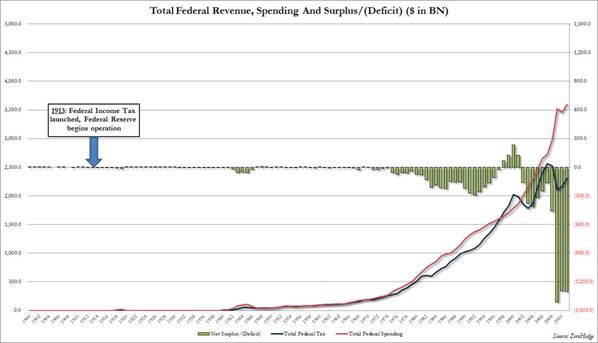

The political class set in motion the eventual obliteration of our economic system with the creation of the Federal Reserve in 1913. Placing the fate of the American people in the hands of a powerful cabal of unaccountable greedy wealthy elitist bankers was destined to lead to poverty for the many, riches for the connected crony capitalists, debasement of the currency, endless war, and ultimately the decline and fall of an empire. Ernest Hemingway’s quote from The Sun Also Rises captures the path of our country perfectly:

“How did you go bankrupt?"

Two ways. Gradually, then suddenly.”

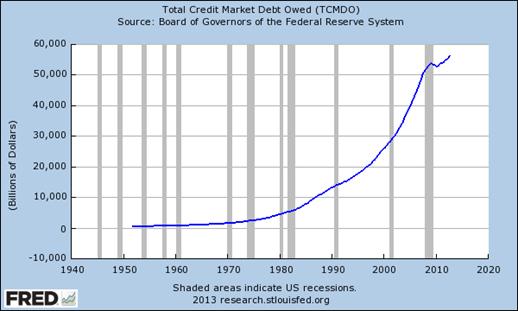

The 100 year downward spiral began gradually but has picked up steam in the last sixteen years, as the exponential growth model, built upon ever increasing levels of debt and an ever increasing supply of cheap oil, has proven to be unsustainable and unstable. Those in power are frantically using every tool at their disposal to convince Boobus Americanus they have everything under control and the system is operating normally. The psychotic central bankers, “bought and sold” political class, mega-corporation soulless chief executives and corporate controlled media use propaganda techniques, paid “experts”, talking head “personalities”, captured think tanks, and the willful ignorance of the majority to spin an increasingly dire economic descent as if we are recovering and getting back to normal. Nothing could be further from the truth.

There is nothing normal about what Ben Bernanke and the Federal government have done over the last five years and continue to do today. Truthfully, nothing has been normal since the mid-1990s when Alan Greenspan spoke the last truthful words of his lifetime:

“Clearly, sustained low inflation implies less uncertainty about the future, and lower risk premiums imply higher prices of stocks and other earning assets. We can see that in the inverse relationship exhibited by price/earnings ratios and the rate of inflation in the past. But how do we know when irrational exuberance has unduly escalated asset values, which then become subject to unexpected and prolonged contractions as they have in Japan over the past decade?”

The Greenspan led Federal Reserve created two epic bubbles in the space of six years which burst and have done irreparable harm to the net worth of the middle class. Rather than learn the lesson of how much damage to the lives of average Americans has been caused by creating cheap easy money out of thin air, our Ivy League self-proclaimed expert on the Great Depression, Ben Bernanke, has ramped up the cheap easy money machine to hyper-speed. There is nothing normal about the path this man has chosen. His strategy has revealed the true nature of the Federal Reserve and their purpose – to protect and enrich the financial elites that manipulate this country for their own purposes.

Despite the mistruths spoken by Bernanke and his cadre of banker coconspirators, he can never reverse what he has done. The country will not return to normalcy in our lifetimes. Bernanke is conducting a mad experiment and we are the rats in his maze. His only hope is to retire before it blows up in his face. Just as Greenspan inflated the housing bubble and exited stage left, Bernanke is inflating a debt bubble, stock bubble, bond bubble and attempting to re-inflate the housing bubble just in time for another Ivy League Keynesian academic, Janet Yellen, to step into the banker’s box. This genius thinks Bernanke has been too tight with monetary policy. It seems inflated egos are common among Ivy League economist central bankers who think they can pull levers and push buttons to control the economy. Results may vary.

The gradual slide towards our national bankruptcy of wealth, spirit, freedom, self-respect, morality, personal responsibility, and common sense began in 1913 with the secretive creation of the Federal Reserve and the imposition of a personal income tax. Pandora’s Box was opened in this fateful year and the horrors of currency debasement and ever increasing taxation were thrust upon the American people by a small but powerful cadre of unscrupulous financial elite and the corrupt politicians that do their bidding in Washington D.C. The powerful men who thrust these evils upon our country set in motion a chain of events and actions that will undoubtedly result in the fall of the great American Empire, just as previous empires have fallen due to the corruption of its leaders and depravity of its people. Creating a private central bank, controlled by the Wall Street cabal, and allowing the government to syphon the earnings of workers through increased taxation has allowed politicians the ability to spend, borrow, and print money at an ever increasing rate in order to get themselves re-elected and benefit the cronies, hucksters and bankers that pay the biggest bribes. None of this benefit the average American, who sees their purchasing power systematically inflated and taxed away. This is not capitalism and it is not a coincidence that war and inflation have been the hallmarks of the last century.

“A system of capitalism presumes sound money, not fiat money manipulated by a central bank. Capitalism cherishes voluntary contracts and interest rates that are determined by savings, not credit creation by a central bank. It is no coincidence that the century of total war coincided with the century of central banking.” – Ron Paul

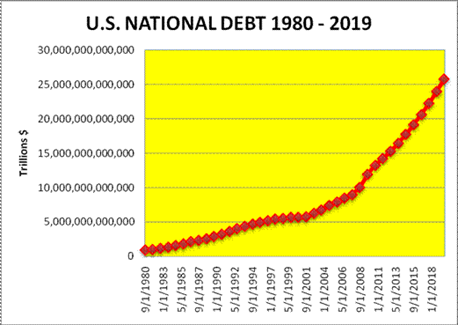

As you can see, the bankruptcy of our country and our culture began gradually, accelerated after Nixon closed the gold window in 1971, really picked up steam in 1980 when the debt happy Baby Boom generation came of age, and has “suddenly” reached maximum velocity as we approach the true fiscal cliff. There were many checkpoints along the way where fatefully bad choices were made. They include the New Deal, Cold War, Great Society, Morning in America, Dotcom New Paradigm, Housing Wealth Retirement Plan, Obamacare, and present belief that creating more debt will solve a problem created by too much debt. The Federal Reserve allowed interventionist politicians to fight two declared wars (World War I, World War II), fight five undeclared wars (Korea, Vietnam, Gulf, Afghanistan, Iraq), conduct hundreds of military engagements around the globe, occupy foreign countries, begin a war on poverty that increased poverty, begin a war on drugs that increased the amount of available drugs, and finally start a war on terror that has increased the number of terrorists and pushed us closer to national bankruptcy. The terrorists have already won, as the explosion of stupidity and irrational fear has allowed those in power to acquire more power and dominion over our lives.

Abnormality Reigns

“We live surrounded by a systematic appeal to a dream world which all mature, scientific reality would reject. We, quite literally, advertise our commitment to immaturity, mendacity and profound gullibility. It is as the hallmark of the culture. And it is justified as being economically indispensable.” - John Kenneth Galbraith

When I critically scrutinize the economic, political, financial, and social landscape at this point in history, I come to the inescapable conclusion that our country and world are headed into the abyss. This is most certainly a minority viewpoint. The majority of people in this country are oblivious to the disaster that will arrive over the next decade. Some would attribute this willful ignorance to the normalcy bias that infects the psyches of millions of ostrich like iGadget distracted, Facebook addicted, government educated, financially illiterate, mass media manipulated zombies. Normalcy bias refers to a mental state people enter when facing a disaster. It causes people to underestimate both the possibility of a disaster occurring and its possible effects. This often results in situations where people fail to adequately prepare for a disaster, and on a larger scale, the failure of governments to inform the populace about the impending disaster. The assumption that is made in the case of the normalcy bias is that since a disaster hasn’t occurred yet, then it will never occur. It also results in the inability of people to cope with the disaster once it occurs. People tend to interpret warnings in the most optimistic way possible, seizing on any ambiguities to infer a less serious situation.

The unsustainability of our economic system built upon assumptions of exponential growth, ever expanding debt, increasing consumer spending, unlimited supplies of cheap easy to access oil, impossible to honor entitlement promises, and a dash of mass delusion should be apparent to even the dullest of government public school educated drones inhabiting this country. I don’t attribute this willful ignorance to normalcy bias. I attribute it to abnormalcy bias. In a profoundly abnormal society, adjusting your thinking to fit in appears normal, but is just a symptom of the disease that has infected our culture. There is nothing normal about anything in our society today. If you were magically transported back to 1996 and described to someone the economic, political, financial and social landscape in 2013, they would have you committed to a mental institution and given shock therapy.

Even though we’ve been in a 100 year spiral downwards, things still appeared relatively normal in 1996 when Greenspan uttered his “Irrational Exuberance” faux pas that so upset his Wall Street puppet masters. The ruling class had not yet repealed Glass-Steagall (pre-requisite for pillaging the muppets), created the internet bubble, fashioned the greatest control fraud in world history (housing bubble unrecognized by Ben Bernanke), or taken advantage of mass hysteria over 9/11 to begin the never ending war on terror and expansion of the Orwellian state. The citizens, and I use that term loosely, of this country have allowed those in control of the government and media to convince them the situation confronting us is just a normal cyclical variation that will be alleviated by tweaking existing economic policies and trusting that Ben Bernanke will pull the right monetary levers to get us back on course. The stress inflicted on their brains in the last thirteen years of bubbles and wars has made the average person incapable of distinguishing between normality and abnormality. What they need is slap upside of their head. Is there anything normal about these facts?

- The Federal Reserve’s balance sheet in 1996 consisted of $422 billion, of which 91% were Treasury securities. Today it consists of $3.25 trillion, of which only 56% are Treasury securities, and the rest is toxic home mortgages, toxic commercial mortgages, and whatever other crap the Wall Street banks have dumped on their books. Their balance sheet is leveraged 57 to 1 and Bernanke has promised his Wall Street bosses he will add another $750 billion before the year is out. Is there anything normal about a central bank adding twice as much debt to its balance sheet in less than twelve months than existed on its entire balance sheet in 1996?

- The National Debt at the end of fiscal 1996 was $5.25 trillion. It increased by $250 billion that year. The GDP of the country was $7.8 trillion. Our national debt as a percentage of GDP was only 67% and our annual deficit was only 3% of GDP. At the time, the country was worried about these outrageous levels of debt. Today the National Debt stands at a towering $16.8 trillion. It has increased by a staggering $1.12 trillion in the last twelve months. The GDP of the country today is $15.7 trillion. Our national debt as a percentage GDP has soared to 107%. Our annual deficits now exceed 7% of GDP on a consistent basis. Our budgets are on automatic pilot, with the $20 trillion level to be breached by 2016. Is it a normal state of affairs when the GDP of your country rises by 100% over seventeen years, while your debt rises by 320%?

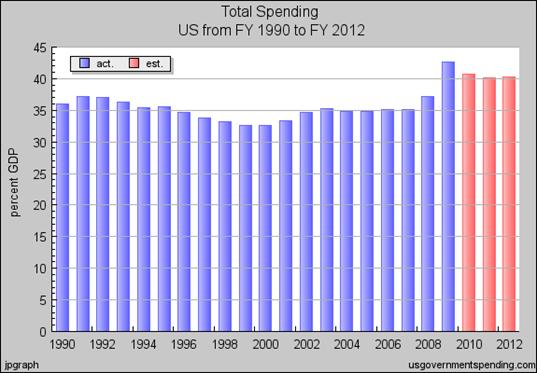

- Total government spending (Federal, State, Local) in 1996 totaled $2.7 trillion, or 35% of GDP. Today total government spending is $6.3 trillion, or 40% of GDP. In 1979, before the belief in government became a religion, total government spending was only 31.5% of GDP (27% in 1965). Are you receiving twice the service from government than you received in 1996? Are you safer from terrorists due to the massive expansion of the police state? Are your kids getting a much better education than they did in 1996? Have the undeclared wars benefitted you in any way, other than tripling the price of gas? Are the higher wage taxes, real estate taxes, school taxes, sewer fees, utility fees, phone fees, gasoline taxes, permit fees, and myriad of other government charges worth it? Is it normal for government to account for almost half of our economy?

- In 1996 personal consumption expenditures accounted for 67% of GDP, while private domestic investment accounted for 16% of GDP and we ran small trade deficits of 1% of GDP. Today, consumer spending accounts for 71% of GDP (despite the storyline about consumer retrenchment), while domestic investment has contracted to 13% of GDP and our trade deficits have surged to almost 4% of GDP. The Federal government has expanded their piece of the GDP pie by 130% since 1996, with the Department of War accounting for the bulk of the increase. Saving and capital investment is now penalized in this country. Is it normal for a country to borrow, consume and bleed itself to death?

- Consumer credit outstanding totaled $1.2 trillion in 1996, or $4,500 per every man, woman and child in the country. Today, the austere balance is now $2.8 trillion, or $8,800 per every man, woman and child inhabiting our debt saturated paradise. The more than doubling of consumer debt would be acceptable if wages were rising at a similar rate. But that hasn’t been the case, as wages have only advanced from $3.6 trillion in 1996 to $7.0 trillion today. With even the massively understated CPI showing 50% inflation since 1996 and 23% more Americans in the working age population (45 million), real wages have advanced by 30%. Using a true measure of inflation, real wages have fallen. Total credit market debt in 1996 was $19 trillion, or 243% of GDP. Today total credit market debt sits at an all-time high of $56.2 trillion, or 358% of GDP. Is it normal for credit market debt to increase at three times the rate of GDP?

- In 1996, personal income totaled $6.6 trillion, with wages accounting for 55% of the total, interest income on savings accounting for 12% and government entitlement transfers accounting for 14%. Today personal income totals $13.6 trillion, with wages accounting for 51% of the total, interest income on savings plunging to 7% due to Bernanke’s “Screw a Senior Zero Interest Policy”, and Big Brother entitlement transfers skyrocketing to 18%. In what Orwellian dystopian society is taking money from wage earners and redistributing it to non-wage earners considered personal income? Is it normal for a government to punish savers and makers in order to benefit the borrowers and takers?

- Prior to the financial collapse and during the mid-1990s prudent risk-averse savers could get a 4% to 5% return on money market accounts. Since the Wall Street created worldwide financial collapse, Ben Bernanke, at the behest of these very same Wall Street banks, has reduced short term interest rates to 0%. The result has been to transfer $400 billion per year from the pockets of savers and senior citizens into the grubby hands of bankers that have destroyed our economy. The prudent are left earning .02% on their savings, while the profligate bankers can borrow for 0% and earn billions by re-depositing those funds at the Federal Reserve. In what bizarro world this be a normal state of affairs?

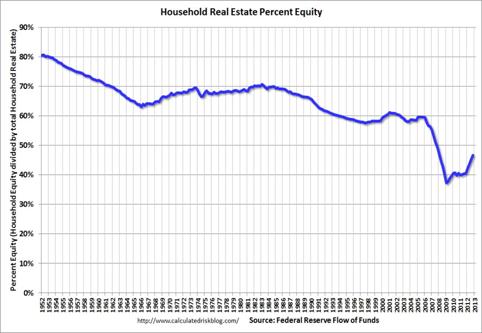

- Total mortgage debt outstanding in 1996, before the epic Wall Street produced housing bubble, was $4.7 billion. Today, even after the transfer of almost $1 trillion of bad debt to the balance sheet of the American taxpayer, the amount of mortgage debt is an astounding $13.1 trillion. Despite home values rising since 1996, there are 20% of all households still in a negative equity position. Total household real estate equity was 60% in 1996, plunged below 40% in 2009, and has only slightly rebounded to 47% today because Wall Street dumped the bad mortgages on the backs of the American taxpayer. Is it normal for mortgage debt to triple and home equity to plunge in a rationally functioning world? Is it normal when 25% of all existing home sales are distressed sales and another 30% are sales to Wall Street hedge funds like Blackrock?

- In 1996 there were 200 million working age Americans, with 134 million (67%) in the labor force, 127 million (63.5%) employed, and 66 million (33%) not in the labor force. Today there are 245 million working age Americans, with 155 million (63%) in the labor force, 143 million (58%) employed, and 90 million (37%) supposedly not in the labor force. The number of working age Americans has increased by 22.5%, while the number of those employed has advanced by only 12.5%. The population to employment ratio has reached a three decade low as millions have given up, been lured into college by cheap plentiful government debt, or developed a mysterious ailment that has gotten them into the SSDI program. Is it normal for millions of Americans to leave the labor force when the economy is supposedly recovering?

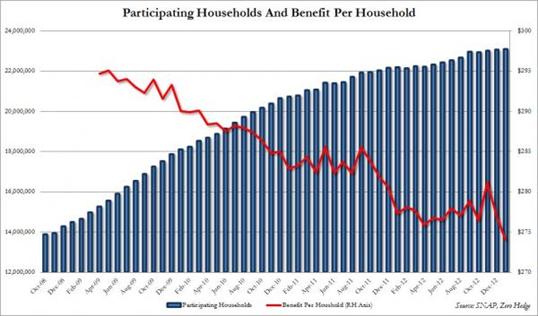

- In 1996 there were 25.5 million Americans on food stamps, or 9.6% of the population, costing $24 billion per year. Today there are 47.8 million Americans on food stamps, or 15% of the population, costing $75 billion per year. Historically, the number of people in this program would rise during recessions and recede when the economy recovered, just as a safety net program should function. According to our government keepers the economy has been in recovery since late 2009. The number of people entering the food stamp program has gone up by 7 million since the recession officially ended. This is not normal. Either the government is lying about the recession or they are screwing the taxpayer by encouraging constituents to enter the program in an effort to gain votes. Which is it?

- The price of oil averaged $20 per barrel in 1996 and it cost you $1.20 per gallon to fill your tank. Oil averaged $85 per barrel in 2012 and currently hovers around $90 per barrel. Most Americans are now paying between $3.50 and $4.00 per gallon to fill their tanks. This result seems abnormal considering the propaganda machine is proclaiming we are on the verge of energy independence. After two Middle East wars, 6,700 dead American soldiers, 50,000 wounded American soldiers, and $1.5 trillion of national wealth wasted, this is all we get – a tripling in gas prices and creation of thousands of new terrorists?

You have to have a really bad case of normalcy bias to be able to convince yourself that everything that has happened since 1996 is normal. Every fact supports the reality that we’ve entered a period of extreme abnormality and our response as a nation thus far has insured that a disaster of even far greater magnitude is just over the horizon. Anyone with an ounce of common sense realizes the social mood is deteriorating rapidly. We are in the midst of a Crisis period that will result in earth shattering change, but the masses want things to go back to normal and don’t want to face the facts. The cognitive dissonance created by reality versus their wishes will resolve itself when the next financial collapse makes 2008 look like a walk in the park. But, until then most will just stick their heads in the sand and hope for the best.

Loving Your Servitude

“Liberty is lost through complacency and a subservient mindset. When we accept or even welcome automobile checkpoints, random searches, mandatory identification cards, and paramilitary police in our streets, we have lost a vital part of our American heritage. America was born of protest, revolution, and mistrust of government. Subservient societies neither maintain nor deserve freedom for long.” – Ron Paul

The most disgraceful example of abnormality that has infected our culture has been the cowardice and docile acquiescence of the citizenry in allowing an ever expanding police state to shred the U.S. Constitution, strip us of our freedoms, and restrict our liberties. Our keepers have not let any crisis go to waste in the last seventeen years. They have also taken advantage of the willful ignorance, childish immaturity, extreme gullibility, historical cluelessness, financial illiteracy and techno-narcissism of the populace to reverse practical legislation and prey upon irrational fears to strip the people of their constitutionally guaranteed liberties and freedoms. If you had told someone in 1996 the security measures, laws, and police agencies that would exist in 2013, they would have laughed you out of the room. Every crisis, whether government created or just convenient to their agenda, has been utilized by the oligarchs to expand the police state and benefit the crony capitalists that profit from its expansion. The character of the American people has been found wanting as they obediently cower and beg for protection from unseen evil doers. The propagandist corporate media reinforces their fears and instructs them to submissively tremble and implore the government to do more. The cosmic obliviousness and limitless sense of complacency of the general population with regards to a blatantly obvious coup by a small cadre of sociopathic financial elite and their army of bureaucrats, lackeys and jackboots is a wonder to behold.

The 1929 stock market crash and ensuing Great Depression was primarily the result of excessively loose Federal Reserve monetary policy during the Roaring 20’s and the unrestrained fraud perpetrated by the Wall Street banks. The 1933 Glass-Steagall Act was a practical 38 page law which kept Wall Street from ravenously raping its customers and the American people for almost seven decades. The Wall Street elite and their bought off political hacks in both parties repealed this law in 1999, while simultaneously squashing any effort to regulate the financial derivatives market. The day trading American public didn’t even look up from their computer screens. Over the next nine years Wall Street went on a fraudulent feeding frenzy rampage which brought the country to its knees and then held the American taxpayer at gunpoint to bail them out. The Federal Reserve arranged rescue of LTCM in 1998 gave the all clear to Wall Street that any risk was acceptable, since the Fed would always bail them out. Just as they did in the 1920’s, the Federal Reserve set the table for financial disaster with excessively low interest rates and non-existent regulatory oversight.

The downward spiral of our empire towards an Orwellian/Huxley merged dystopian nightmare accelerated after the 9/11 attacks. Within one month those looking to exert hegemony over all domestic malcontents had passed the 366 page, 58,000 words Patriot Act. Did the terrified masses ask how such a comprehensive destruction of our liberties could be written in under one month? It is apparent to anyone with critical thinking skills that the enemy within had this bill written, waiting for the ideal opportunity to implement this unprecedented expansion of federal police power. Electronic surveillance of our emails, phone calls and voice mails, along with warrantless wiretaps, and general loss of civil liberties was passed without question under the guise of protecting us. Next was the invasion of a foreign country based upon lies, propaganda and misinformation without a declaration of war, as required by the Constitution. Our government began torturing suspects in secret foreign prisons. The shallow, self-centered, narcissistic, Facebook fanatic populace has barely looked up from texting on their iPhones to notice that we have been at war in the Middle East for eleven years, because it hasn’t interfered with their weekly viewing of Honey Boo Boo, Dancing With the Stars, or Jersey Shore. They occasionally leave their homes to wave a flag and chant “USA, USA, USA”, as directed by the media, when a terrorist like Bin Laden or Boston bomber is offed by our security services, but for the most part they can live their superficial vacuous lives of triviality unscathed by war.

The creation of the Orwellian Department of Homeland Security ushered in a further encroachment of our everyday freedoms. They attempted to keep the masses frightened through a ridiculous color coded fear index. Little old ladies, people in wheelchairs and little children are subject to molestation by lowlife TSA perverts. Military units conduct “training exercises” in cities across the country to desensitize the sheep-like masses, who fail to acknowledge that the U.S. military cannot constitutionally be used domestically. DHS considers military veterans, Ron Paul supporters, and Christians as potential enemies of the state. The use of predator drones to murder suspected adversaries in foreign countries, while killing innocent men, women and children (also known as collateral damage), has just been a prelude to the domestic surveillance and eventually extermination of dissidents and nonconformists here in the U.S. We are already becoming a 1984 CCTV controlled nation. DHS has been rapidly militarizing local police forces in cities and towns to supplement their jackbooted thugs. Obama’s executive orders have given him the ability to take control of industry. He can imprison citizens without charges for as long as he deems necessary. Attempts to control gun ownership and shutdown the internet is a prologue to further government domination and supremacy over our lives when the wheels come off this unsustainable bus.

The last week has provided a multitude of revelations about our government and the people of this country. The billions “invested” in our police state, along with warnings from a foreign government, and suspicious travel patterns were not enough for our beloved protectors to stop the Boston Marathon bombing. After stumbling upon these amateur terrorists by accident, the 2nd responders, with their Iraq war level firepower, managed to slaughter one of the perpetrators, but somehow allowed a wounded teenager to escape on foot and elude 10,000 donut eaters for almost 24 hours. The horde of heavily armed, testosterone fueled thugs proceeded to bully and intimidate the citizens of Watertown by illegal searches of homes and treating innocent people like criminals. The government completely shut down the 10th largest metropolitan area in the country for an entire day looking for a wounded 19 year old. The people of Boston obeyed their zoo keepers and obediently cowered in their cages.

The entire episode was an epic fail. The gang that couldn’t shoot straight needed an old man to find the bomber in his backyard boat. The people of Boston exhibited the passivity and subservience demanded by their government. Since the capture of the remaining terrorist, the shallow exhibitions of national pride at athletic events and smarmy displays of honoring the police state apparatchiks who screwed up - allowing the attack to occur and looking like the keystone cops during the pursuit of the suspects, has revealed a fatal defect in our civil character. We are living in a profoundly abnormal society, with millions of medicated mindless zombies controlled by a vast propaganda machine, who seemingly enjoy having their liberties taken away. Most have willingly learned to love their servitude. For those who haven’t learned, the boot of our vast security state will just stomp on their face forever. We’re realizing the worst dystopian nightmares of Orwell and Huxley simultaneously. This abnormalcy bias will dissipate over the next ten to fifteen years in torrent of financial collapse, war, bloodshed, and retribution. Sticking your head in the sand will not make reality go away. The existing social, political, and financial order will be swept away. What it is replaced by is up to us. Will this be the final chapter or new chapter in the history of this nation? The choice is ours.

“If you want a vision of the future, imagine a boot stamping on a human face - forever.

- George Orwell

“There will be, in the next generation or so, a pharmacological method of making people love their servitude, and producing dictatorship without tears, so to speak, producing a kind of painless concentration camp for entire societies, so that people will in fact have their liberties taken away from them, but will rather enjoy it, because they will be distracted from any desire to rebel by propaganda or brainwashing, or brainwashing enhanced by pharmacological methods. And this seems to be the final revolution” -Aldous Huxley, 1961

Join me at www.TheBurningPlatform.com to discuss truth and the future of our country.

By James Quinn

James Quinn is a senior director of strategic planning for a major university. James has held financial positions with a retailer, homebuilder and university in his 22-year career. Those positions included treasurer, controller, and head of strategic planning. He is married with three boys and is writing these articles because he cares about their future. He earned a BS in accounting from Drexel University and an MBA from Villanova University. He is a certified public accountant and a certified cash manager.

These articles reflect the personal views of James Quinn. They do not necessarily represent the views of his employer, and are not sponsored or endorsed by his employer.

© 2013 Copyright James Quinn - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

James Quinn Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.