Gold Panic Cycle Begins! Will Stocks Follow?

Commodities / Gold and Silver 2013 Apr 23, 2013 - 04:45 PM GMT The kind of behavior that we see in ZeroHedge, Seeking Alpha, Goldman Sachs, bullion dealers, media icons and other blogspots is definitely not indicative of a crash low in gold. People lining up in china and India to buy gold may give us an insight into cultural norms, but this behavior is not a market signal to buy. In fact, it is just the opposite. Retail behavior will never supersede institutional capacity to hold gold. This is a deflationary unwinding of leveraged holdings by banks and hedge funds.

The kind of behavior that we see in ZeroHedge, Seeking Alpha, Goldman Sachs, bullion dealers, media icons and other blogspots is definitely not indicative of a crash low in gold. People lining up in china and India to buy gold may give us an insight into cultural norms, but this behavior is not a market signal to buy. In fact, it is just the opposite. Retail behavior will never supersede institutional capacity to hold gold. This is a deflationary unwinding of leveraged holdings by banks and hedge funds.

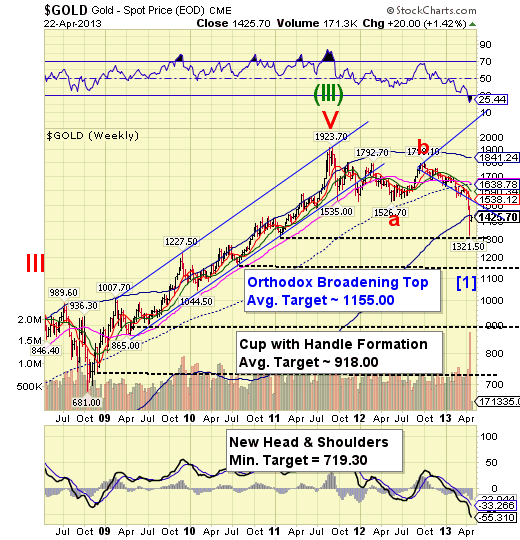

My Cycles Model now tells me that we are entering the “panic phase” of the gold sell-off. We still have the “old” targets yet to be achieved and a new Head & Shoulders target, based on last week’s bounce.

Take notice that the bounce was stopped by weekly Cycle Bottom resistance at 1436.32. The bounce high was 1438.80.

The panic is about to begin.

Today is day 323 of the June 4 Master Cycle. The Cycle Pivot is 322.5, so I would infer that the turn may come sometime this morning.

I believe that a liquidity crisis has already begun, starting with gold and commodities.

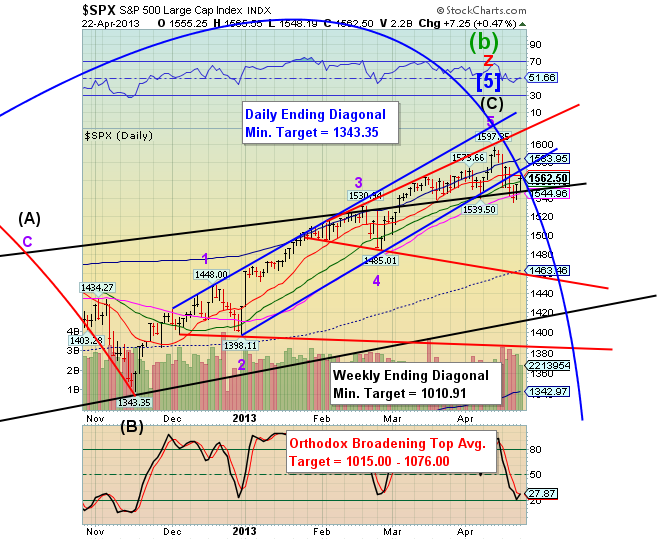

Today it may show up in stocks (and bonds), I might add. All of the prior Flash Crashes began once the 50-day moving average was crossed. Currently that stands at 1544.96. You will notice that 1545.00 is also where the upper trendline of the weekly Ending Diagonal lies. This will end the “throw-over” phase of Super Cycle wave (b).

A typical Wave (3) decline should take the SPX down nearly 160 points. That suggests the lower trendline of the Weekly Ending Diagonal may be challenged in the next day or two. That virtually assure us that the Primary Wave [1] decline may take the SPX down to 1010.91.

Another 300+ point decline in gold could trigger this type of reaction in the SPX in just a few days. While many analysts are still pointing up in the SPX, I would venture to tell you the downside risks.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.