Stock Market, Gold, Time to Get Very Bearish

Stock-Markets / Financial Markets 2013 Apr 22, 2013 - 03:28 PM GMT If you review Friday morning’s outlook on the SPX, you will find a projection for where it might go on that day. Here is the actual result in comparison. It turned out that the SPX was forming an Expanding Diagonal in wave c. The last zigzag formed in the afternoon shows up as complete at the trendline.

If you review Friday morning’s outlook on the SPX, you will find a projection for where it might go on that day. Here is the actual result in comparison. It turned out that the SPX was forming an Expanding Diagonal in wave c. The last zigzag formed in the afternoon shows up as complete at the trendline.

This version of the Wave action shows Primary Wave [1] ending at 1541.86 and suggests more rally this morning since the retracement did not even reach a 38.2% Fibonacci level.

However, I wish to present this alternative as well, suggesting that the SPX did reach its 38.2% retracement at the close on Friday. Other than a few squiggles left this morning, it may resume its decline at or near the open. This morning’s ES futures reached 1556.95 (equivalent to 1562.00 cash) this morning and has reversed back down. It is currently near the 50% retracement (cash). European stocks have reversed from their highs this morning, so, depending on the progress of the decline in Europe, we may see SPX also in reversal by then. This version suggests that SPX starts its decline into Wave (3) of [3] of Cycle Wave I, which may extend approximately 160 points.

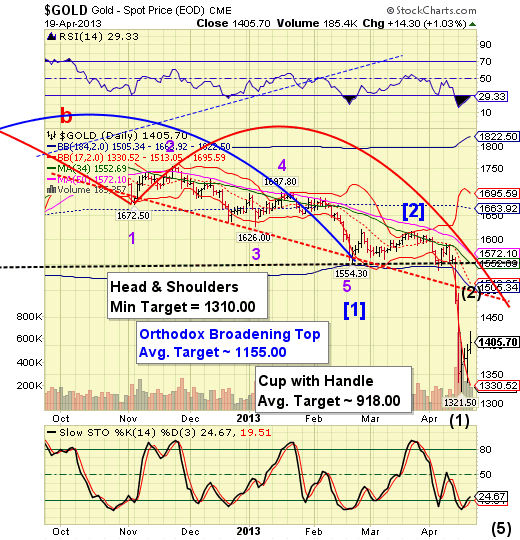

Gold futures rallied this morning to 1438.35, but have turned over and have given up 10 points of the rally already. The Orthodox Broadening Top suggests that gold may now decline to the vicinity of 1155.00.

Most of the articles on gold in ZeroHedge are explaining how the gold “smash down” was overdone and the gold will recover. The essential theme is, “Protect yourself from the coming hyperinflation!” Would that it were so. The decline in gold and coming decline in stocks is deflationary. True, the Fed and BoJ are printing like mad, but the deleveraging and hoarding of cash by the banks is stronger. The velocity of M2 is breathtakingly negative.

In any event, The Cycles Model suggests that today is the Trading Cycle Pivot that will send gold into possibly the worst tailspin in its history over the next 4 weeks.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.