Arizona Set To Use Gold and Silver As Currency

Commodities / Gold and Silver 2013 Apr 22, 2013 - 12:38 PM GMTBy: GoldCore

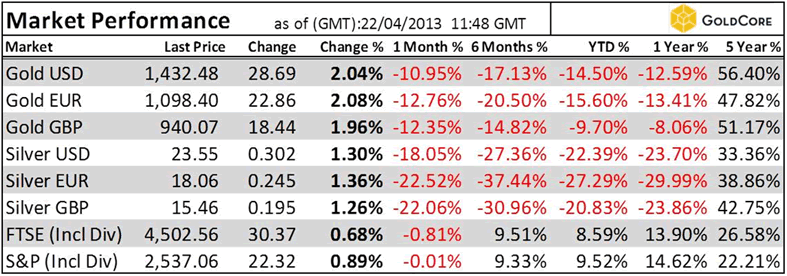

Today’s AM fix was USD 1,425.00, EUR 1,092.54 and GBP 935.04 per ounce.

Today’s AM fix was USD 1,425.00, EUR 1,092.54 and GBP 935.04 per ounce.

Friday’s AM fix was USD 1,414.00, EUR 1,080.46 and GBP 920.63 per ounce.

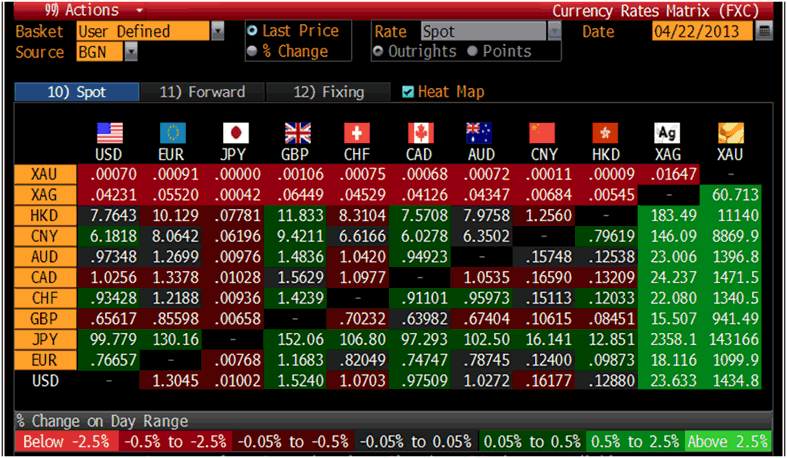

Cross Currency Table – (Bloomberg)

Gold climbed $12.90 or 0.93% on Friday to $1,400.90/oz and silver finished up 0.04%. Gold and silver both traded down for the week at 5.86% and 11.39%.

The state of Arizona may become the second state to use gold and silver coins as legal tender.

Last week, Arizona lawmakers passed a bill that makes precious metals legal tender. Arizona is the second state after Utah to allow gold coins created by the U.S. Mint and private mints to be used as currency. More than a dozen states have legislature underway to pass similar measures.

The move was launched by people who fear the Federal Reserve is not tackling the federal deficit and is thus debasing and devaluing the dollar. Some even fear, that if the Fed continues on the existing path it could lead to hyperinflation.

Miles Lester, who represents a group called Arizona Constitutional Advocates, said during a recent public hearing on legal-tender legislation that "the dollar is on its way out. It's not a matter of if; it's a matter of when."

The upcoming U.S. FOMC meeting next week is April 30th and May 1st and will be closely watched by investors.

Supporters of the legislation look forward to a day when citizens can make purchases from debit cards linked to gold depositories.

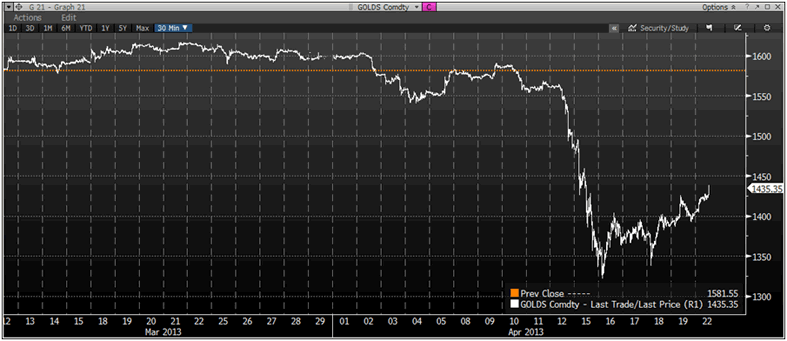

Gold in USD, 1 Month, by 30 minutes – (Bloomberg)

Opponents point to the volatility of gold and silver as currency after the fall in price that occurred last week. However proponents point out that the fall in gold prices last week was due to the speculative raid of Wall Street banks who the Federal Reserve is supporting and works closely with.

Using gold and silver as currency would protect people from inflation, currency debasement, predatory banks and an increasingly volatile and vulnerable financial system.

Utah has had the law on the books for the past 2 years and is working on a system for using the precious metals as currency.

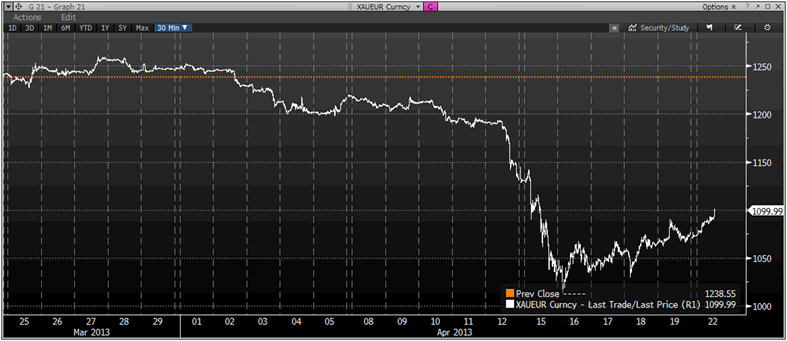

Gold in Euros, 1 Month, by 30 minutes – (Bloomberg)

The Arizona Senate Bill 1439 would allow the holder of gold or silver coins or bullion to pay a debt.

However, the coins must be issued by the U.S. government or approved by a court, like an American Eagle Coin. Oddly the government does not require that persons or business must use or accept gold or silver as legal tender in contravention of the U.S. Constitution.

The sponsor of the bill, Republican Sen. Chester Crandell, would need a final state Senate vote after approval by the House, and if passed the law would not take effect until 2014.

Crandell said, "The whole thing came from constituents".

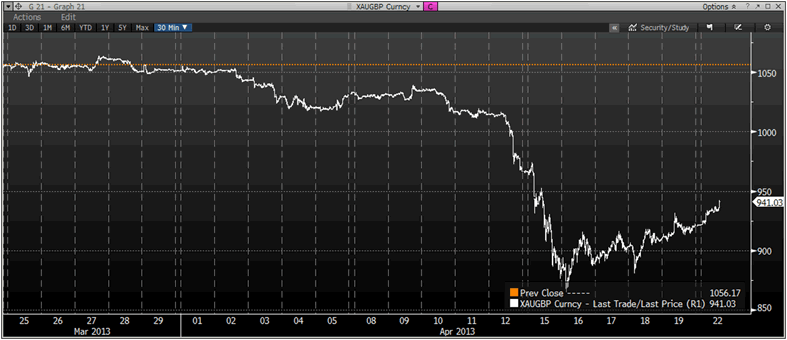

Gold in British Pounds, 1 Month, by 30 minutes – (Bloomberg)

The debate on whether gold and silver should be used as an alternative currency will continue and deepen as people realise how fiat currencies are set to be devalued in the coming months – potentially sharply.

A 5-10% allocation to physical bullion in your possession or in allocated accounts remains crucial to all wishing to protect their wealth from wealth confiscation. Whether that be by inflation or by pension, brokerage account or deposit confiscation – all of which have been seen in recent months and will be seen again.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.