Returning U.S. Dollar and the S&P 500 Relationship

Stock-Markets / Stock Markets 2013 Apr 22, 2013 - 10:22 AM GMTBy: Donald_W_Dony

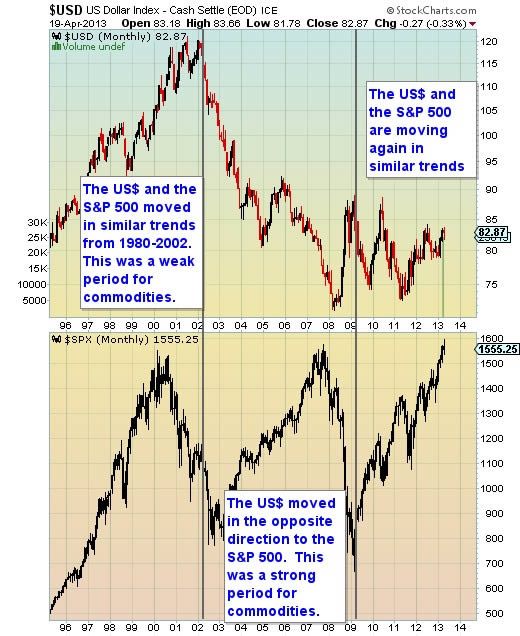

During the 1980s and 1990s, the U.S. dollar and the S&P 500 moved in near parallel trends. This relationship was particularly close from 1995 to 2000. This five year stretch produced some of the highest performance from both securities. Yet when the dollar started to fall in 2002 that relationship was broken until 2009.

During the 1980s and 1990s, the U.S. dollar and the S&P 500 moved in near parallel trends. This relationship was particularly close from 1995 to 2000. This five year stretch produced some of the highest performance from both securities. Yet when the dollar started to fall in 2002 that relationship was broken until 2009.

Throughout the 1980s and 1990s, the US$ and the U.S. index steadily advanced together. However, this 20-year period represented a challenging time for commodities as a higher dollar forces natural resource prices lower.

As the dollar began to fall in 2002 due to mounting debt, the S&P 500 now moved in the opposite direction to the dollar. The US$ took on a new role as a short term safe haven verses the long term hold of the 80s and 90s.

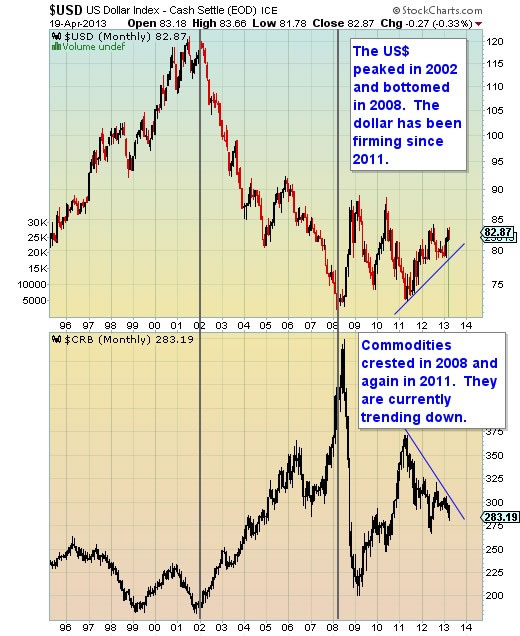

Commodity prices also a ended 20-year bear market in 2002 once the dollar rolled over. Natural resource prices continued to rise until the dollar bottomed in 2008.

Now the US$ appears to have returned to the same relationship with the S&P 500 of two decades ago. Since the dollar bottomed in 2008, the US$ and the S&P 500 seem to be back to parallel paths.

Bottom line: The dollar has been stabilizing and rising during this current bull market instead of moving in the opposite direction to the U.S. index. This suggests that the connection of the 80s and 90s may have returned. It also implies that commodity prices will likely remained depressed as long as the dollar advances.

Investment approach: A rising dollar and S&P 500 favours basic industry, financials, healthcare, consumer products and technology. It disfavours materials, gold and commodities.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2013 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.