Dramatic Shifts in Stock Market Equity Fund Money Flows

Stock-Markets / Stock Markets 2013 Apr 22, 2013 - 04:57 AM GMTBy: Richard_Shaw

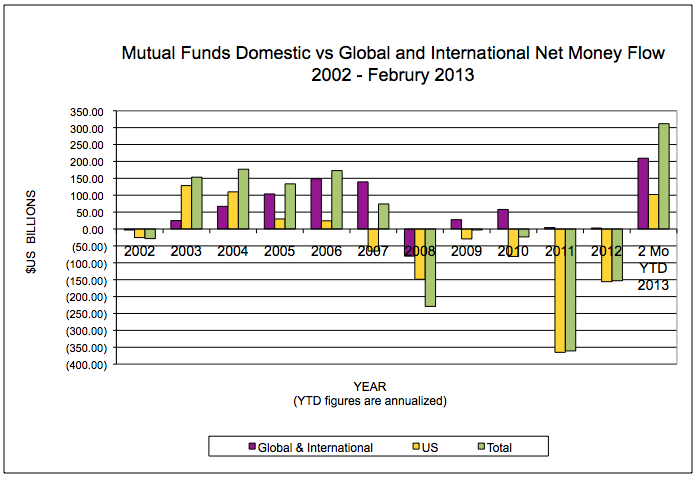

We’ve been tracking the differential flows between US domestic and international or global equity mutual funds since 2002 with Investment Company Institute Data. The shifts since the 2008 crash have been dramatic, as shown in this chart:

Mutual funds are probably overwhelmingly retail investor dominated, and are the principle 401-k vehicle. They still have many times more assets than ETFs.

The chart shows reversal from adding assets from the stock market bottom in 2003 through 2007 to wholesale exit in 2008.

In 2009 and 2010, there was a mixed bag of comparatively minor net asset growth and shrinkage. In 2011 and 2012, investors were once again exiting equities, but at an even faster rate than during the crash of 2008.

However, 2013 in the first two months shows a huge turnabout, with larger inflows to US funds than all years except 2003 and 2004 at the beginning of the last bull phase. Levels of investment in non-US or global funds recently are at levels we have not seen in the past 13 years.

[One potential data artifact is that 2013 is the annualization of 2 months of data, compared to true full year data for prior periods]

Interestingly, even though US stocks are outperforming the rest of the world, retail investors are putting over twice as much net new money into non-US or global funds as into US equity funds; while at the same time US stocks are rising and most other stocks are falling.

Are retail investors misinformed? Or, are they seeking to buy international markets when they are down in a “buy-low, sell-high” effort?

By Richard Shaw

http://www.qvmgroup.com

Richard Shaw leads the QVM team as President of QVM Group. Richard has extensive investment industry experience including serving on the board of directors of two large investment management companies, including Aberdeen Asset Management (listed London Stock Exchange) and as a charter investor and director of Lending Tree ( download short professional profile ). He provides portfolio design and management services to individual and corporate clients. He also edits the QVM investment blog. His writings are generally republished by SeekingAlpha and Reuters and are linked to sites such as Kiplinger and Yahoo Finance and other sites. He is a 1970 graduate of Dartmouth College.

Copyright 2006-2013 by QVM Group LLC All rights reserved.

Disclaimer: The above is a matter of opinion and is not intended as investment advice. Information and analysis above are derived from sources and utilizing methods believed reliable, but we cannot accept responsibility for any trading losses you may incur as a result of this analysis. Do your own due diligence.

Richard Shaw Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.