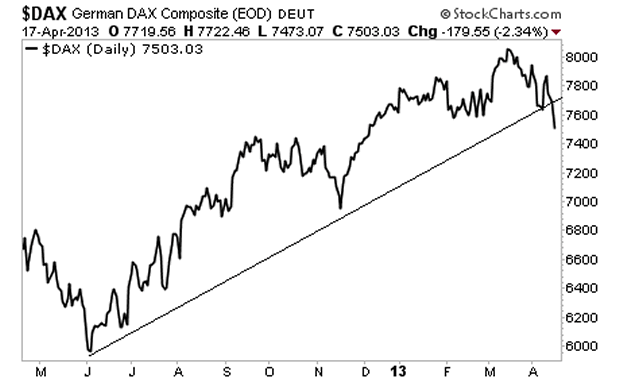

German Stock Market Just Took Out Its Economic Recovery Trendline

Stock-Markets / Germany Apr 18, 2013 - 06:38 PM GMTBy: Graham_Summers

More signs of trouble.

We’ve been told countless times that Europe was “fixed.” The problem with this is that the market is beginning to realize this is not true.

Much of the European recovery counts on Germany. The ECB owns the printing presses… but without Germany’s support, the Euro is done for.

However Germans are only going to be supportive of the Euro up to a point. That point is when the German economy contracts enough that Germany has its own problems to deal with, rather than focusing on Europe’s.

That point appears to be approaching. Germany’s economy contracted in the fourth quarter of 2012. The country has since seen its credit rating downgraded to A from A+ by Egan Jones.

The German stock market, the DAX, has officially taken out its trendline from the June 2012 low when European Central Bank President Mario Draghi promised “unlimited bond buying” to support Europe.

This is bad news for the rest of Europe. With Angela Merkel seeking re-election in September this year, Germany will be less likely to OK any more bailouts.

Europe better pray nothing goes wrong between now and then.

Watch the DAX and the Spanish Ibex. Spain as noted in Monday’s market commentary is the European canary in the coalmine. If it starts to drop… and the German DAX follows… then the contagion is back.

Investors take note, the markets are sending multiple signals that things are not going well in the world.

I’ve been warning subscribers of my Private Wealth Advisory that we were heading for a dark period in the markets. I’ve outlined precisely how this will play out as well as which investments will profit from another bout of Deflation.

As I write this, all of them are SOARING.

Are you ready for another Collapse in the markets? Could your portfolio stomach another Crash? If not, take out a trial subscription to Private Wealth Advisory and start protecting your hard earned wealth today!

We produced 72 straight winning trades (and not a SINGLE LOSER) during the first round of the EU Crisis. We’re now preparing for more carnage in the markets… having just seen another SIX trade winning streak…

To join us…

Graham Summers

Chief Market Strategist

Good Investing!

PS. If you’re getting worried about the future of the stock market and have yet to take steps to prepare for the Second Round of the Financial Crisis… I highly suggest you download my FREE Special Report specifying exactly how to prepare for what’s to come.

I call it The Financial Crisis “Round Two” Survival Kit. And its 17 pages contain a wealth of information about portfolio protection, which investments to own and how to take out Catastrophe Insurance on the stock market (this “insurance” paid out triple digit gains in the Autumn of 2008).

Again, this is all 100% FREE. To pick up your copy today, got to http://www.gainspainscapital.com and click on FREE REPORTS.

Graham also writes Private Wealth Advisory, a monthly investment advisory focusing on the most lucrative investment opportunities the financial markets have to offer. Graham understands the big picture from both a macro-economic and capital in/outflow perspective. He translates his understanding into finding trends and undervalued investment opportunities months before the markets catch on: the Private Wealth Advisory portfolio has outperformed the S&P 500 three of the last five years, including a 7% return in 2008 vs. a 37% loss for the S&P 500.

Previously, Graham worked as a Senior Financial Analyst covering global markets for several investment firms in the Mid-Atlantic region. He’s lived and performed research in Europe, Asia, the Middle East, and the United States.

© 2013 Copyright Graham Summers - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Graham Summers Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.