Why Gold Price Really Crashed and What You Can Do About It

Commodities / Gold and Silver 2013 Apr 18, 2013 - 11:11 AM GMTBy: Money_Morning

Keith Fitz-Gerald writes: The news is great at telling us what's happening. But knowing what's happening is a lot different than understanding what happened - and that's what makes the difference between an average investor and truly great investors.

Keith Fitz-Gerald writes: The news is great at telling us what's happening. But knowing what's happening is a lot different than understanding what happened - and that's what makes the difference between an average investor and truly great investors.

Gold's crash Monday is a perfect example. The media was falling all over itself as one pundit after the other came on TV to talk about how gold was falling and how far off its highs it was. Few tied the devastating slide to real economic events -- let alone made the connection to actual trading.

But that's my bread and butter. Today I'm going to tell you what really happened and why - from a market insider's perspective. Then I'm going to tell you what to expect next and, most importantly, how you can use the situation to your advantage.

There are three fundamental things going on - all of which are at a very high level and all of which are completely transparent to most investors:

1) Japan caused the biggest single one-day gold sell off in 30 years.

No one sold their gold holdings by choice; many big players were "forced" to sell gold to meet margin calls associated with Japanese bond holdings that have gone wild since "Abenomics" came on to the scene.

You see, newly elected Japanese Prime Minister, Shinzo Abe, and his sidekick Haruhiko Kuroda - Bernanke's contemporary at the Bank of Japan -- have embarked on "Abenomics," or the injection of $1.4 trillion into the Japanese monetary system over the next two years as a means of stimulating the moribund Japanese economy. This will effectively double the Japanese monetary base to 270 trillion yen, or $2.9 trillion USD.

That's hard to grasp in an era of trillion-dollar budgets, so let me put what they're doing into perspective. In order to hit his targets, Kuroda is effectively going to have to inject, print, stimulate or quantitatively ease to the tune of approximately $150 billion a month - that's 76% more than the $85 billion a month Uncle Ben and the Fed have been kicking in here, in an economy that's roughly one-third the size.

As far as I'm concerned, Godzilla just walked out of Tokyo Bay. This is a regime change in the truest sense of the word. It's also the first shot in a 1930s-style currency war, the case for which I laid out in this Money Morning article last February. But that's a story for another time.

Back to the issue at hand.

Kuroda's actions have caused Japanese bond and currency volatility to rise markedly in recent weeks - both have had six sigma events in recent weeks - meaning they have moved several standard deviations past what institutional risk management models are built to accommodate.

The 5-Year Japanese Government Bond Volatility was bad enough.

Figure : ZeroHedge.com

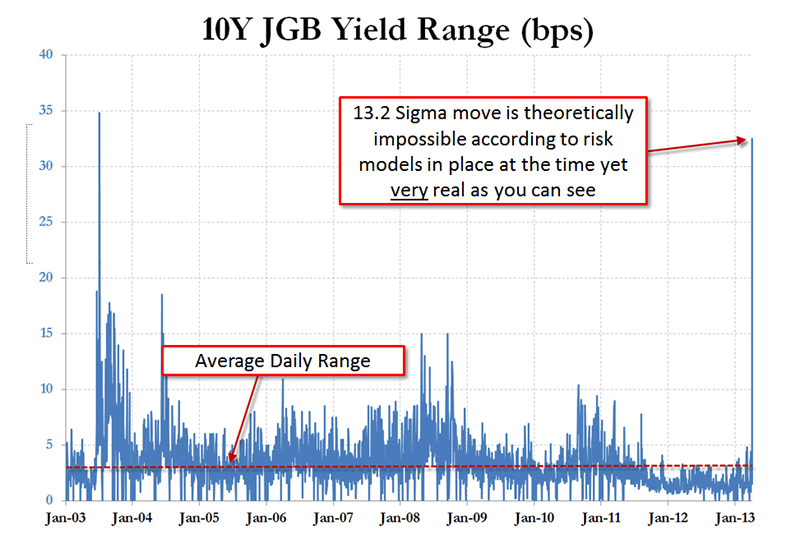

But the jump in 10-Year Yield Range Volatility was something else entirely. It actually experienced a 13.2 sigma move - meaning it was 13.2 standard deviations from "normal" behavior. Statisticians will tell you that's exceedingly rare...which is why I, of course, will point out that this is the second time Japanese yields have hit these levels in 10 years. Wall Street's wizards are clearly not as smart as they think they are.

Figure : Source: Bloomberg, Annotations Fitz-Gerald Research, LLC.

Not surprisingly, interest rate volatility jumped off the charts as well, reaching levels consistent with 1998 and 2003 - both of which marked earlier Japanese central bank inflection points.

The computers and the risk management officers went into panic mode.

As a result, anybody with "too much" exposure was effectively forced in knee-jerk reaction to liquidate anything they could to raise cash and bring their holdings back within acceptable risk limits lest they risk a Lehman-style meltdown.

Ordinarily, portfolio managers would make a beeline to Japanese bonds, which are both very liquid and highly marginable. In this case, however, knowing that Team Kuroda is going to function as a buyer of last resort, they turned to their next most marginable assets - the Japanese yen and gold - and sold enough to bring things in line for now.

When they run out of things to sell, they'll shift to "other assets" in the future, but the pool is pretty deep so I don't expect that to happen for a while yet.

And that brings me to...

2) U.S. and European institutions are rebalancing their investment models to compensate.

Most investors don't realize how the big boys play the game. They're not really gunslingers. In reality, most operate on very sophisticated quantitative models that structure everything from risk management to specific stock selection. Their models also typically include "tactical overlays" that help further mitigate risk and capitalize on opportunity - I know because I've worked on many of them over the years.

Long story short, when holdings reach certain thresholds - either up or down - and the "value at risk" exceeds specific risk management metrics, the models begin to adjust in what is essentially a monster rebalancing.

When risk is in line with expectations, this generally translates into assets being shifted around into portfolio segments that are underweighted or simply underperforming.

When risk is out of line like it was leading into Monday's blitz, this can result in a "fire sale," wherein lots of assets are put on the block as part of a process known as "cross-selling." That's what kicked things off in the after-hours markets as Asian exchanges came open and the "book" got passed, first through European exchanges and finally into U.S. markets when they opened.

The problem was exacerbated because when program selling kicks in, there is no buying allowed until the models come into line. This creates a situation where the "bids" - meaning the buyers - walk away so prices fall even faster. In practical terms, it's like half the markets - the buying half - simply vanish.

Compounding the problem...

3) Big traders were piling on the shorts.

This move was really not anything to do with fundamentals. It was all about big boys and their toys.

By actively shorting gold and other commodities, big traders hope to create a self-sustaining feedback loop that drives prices still lower in the immediate future. If they are successful, like they were this time, they'll laugh all the way to the bank.

Now here's the thing. Any speculator who sells into this because they panic actually fuels their greed, not to mention their profits, while also ensuring themselves a one-way trip to the poor house.

Investors like us, on the other hand, don't count. That's because we are using a combination of trailing stops that can't be gamed, while also changing up our tactics so as to specifically defend against this kind of nonsense; I'll have more on that in a minute.

How low will it go?

I don't think gold hitting $1,200 an ounce is out of the question ultimately, but that isn't what's important.

The real issue (and the real unknown) is how heavily leveraged the institutions are and how far out of line the VaR (value at risk) models have become.

If there's a fund or funds that are blowing up and they need a ton of cash, the drop could be pretty extreme even from these levels. If the institutions are simply adjusting their risk modeling, I'd expect a more moderate decline... and probably a period of "basing," too, where gold begins to establish a new, albeit lower, trading range.

Either way, though, don't be surprised by still more volatility and another price drop in the weeks ahead.

When will it turn?

If CFTC (Commodity Futures Trading Commission) data is any indication, that point may be sooner than most people expect. The April 9 COT (Commitment of Traders) report shows hedge funds and money managers adding to net longs - so the buying needed to turn the tide has already begun even as the big boys hope to squeeze yet more panic into profits.

At the same time, as I noted in last week's Reporter, entitled "Hedge Your Portfolio Against the Next Crash," central banks remain net buyers, having boosted their holdings by more than 15 million ounces in 2012.

I think they'll easily double that in 2013, led by central banks from emerging markets who are only too happy to pick up the pieces the West is so cavalierly casting aside at the moment.

And, finally, interest rates will ultimately rise, creating yet another updraft. Depending on how fast that happens, the upward move could go slowly, as the markets adjust to macro-economic pressures, or it could be the reverse of Monday's slide because risk management models begin to run the other way and the big boys find themselves needing to be net buyers.

What can we do about it?

In a word - lots.

First, rely on your trailing stops to capture profits if you've already got gold holdings. You are running trailing stops aren't you?! We talk about these constantly in Money Morning and we use them rigorously to protect our hard-earned gains against just such institutional nonsense.

Trailing stops, in case you are not familiar with them, are risk management tools - stop-loss orders really - that are set at some percentage below your purchase price or the high set since you bought something.

For instance, let's say you buy a stock at $10. You set a 25% trailing stop. It turns out the stock doesn't meet expectations and drops by 50%...all the way to $5. At $7.50, though, your stop kicks in and you're out. That's 25%, so you take a loss that's far less than the masses who have held on.

What about the reverse? If the stock soars 75% to $17.50 a share, then weakens back to $10. Assuming you've been ratcheting your trailing stop up, you'd be out at $13.12, which is 25% below the $17.50 peak. So emotion, as my colleague Bill Patalon noted in a recent Private Briefing column on this topic, "is removed from the equation and you get to keep 31.25% in profits.

Many people may not be happy about that - until they realize a few weeks later that the stock has cratered to $2 a share, meaning that if you held on, your 75% profit would have swung to an 80% loss. Ouch!

It doesn't matter what investment you choose...gold, Apple...anything -- investment can be protected. No investor has to suffer the ravages of a bear market, at least not voluntarily anyway.

Sophisticated investors, by the way, can consider using put options to accomplish the same thing.

Second, change your tactics.

When the big boys get rattled - why doesn't really matter - that's often a great buying opportunity. My favorite way to capitalize on this is to change up tactics, shifting from a "buy it all at once" approach to a "buy it over time" discipline.

Dollar cost averaging works really well for this because it's simple and easy to implement. Plus it injects discipline into what is otherwise an emotionally charged situation - buying into steep declines. Over time, the advantage really adds up because dollar cost averaging helps you buy more when prices are lower and less when they are higher.

Studies suggest that this simple tactic can boost returns by several percentage points over time. I particularly like the fact that it puts you on an even playing field with the big boys...they can't "game" you if you're not playing by their rules and aren't putting yourself in a situation where they can take advantage of you.

Third, sharpen your pencil.

Many great companies get put on sale when the big boys panic and start "cross-selling." If you're sharp and have already got a "buy" list of the best and brightest that you'd like to own, you can pounce. It's one of the few times you can take "them" to the cleaners.

My favorites right now are the "glocals" I talk about so frequently. These are companies with fortress-like balance sheets and consistent, strong dividend track records in industry segments like biotech, energy and defense technology, all three of which the world needs rather than just wants.

The upshot on gold?

Many investors are fearful that the end of gold's run is near and I don't blame them one bit. It's hard not to think so under the circumstances that led to Monday's pummeling.

Every analyst from here to Saigon seems determined to revise forecasts lower. Societe Generale of France has issued a report entitled, The End of the Gold Era and none other than Goldman Sachs has issued missives advising clients that gold's done.

Fine...just remember that Wall Street has a long, sordid history of telling the public one thing and doing another.

If you're bothered by the thought of purchasing gold in the face of still more declines, try not to be. And, ask yourself if you'd rather buy something that's been put on sale or something that's too expensive?

No matter what happens with all the fancy modeling, no matter how the Fed, the ECB or the BOJ position themselves, fiat currencies are doomed to fail. History is very clear on this.

Gold, on the other hand continues to represent real wealth, and for this reason investors should continue to buy it...not all at once and not in isolation, but as part of a carefully reasoned, imminently practical and well-proven investment strategy.

Speculators...you're on your own.

Source :http://moneymorning.com/2013/04/18/why-gold-really-crashed-and-what-you-can-do-about-it/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.