Discerning the Value of Economic Information

Economics / Economic Statistics Apr 18, 2013 - 08:45 AM GMTBy: David_Galland

It has become tradition at La Estancia de Cafayate for Casey Research to host an intimate conference in conjunction with the Harvest Celebration. In the most recent of the series, Bill Bonner, editor of the Diary of a Rogue Economist and a friend of long standing, kicked the program off with a thought-provoking discussion about the nature of information.

It has become tradition at La Estancia de Cafayate for Casey Research to host an intimate conference in conjunction with the Harvest Celebration. In the most recent of the series, Bill Bonner, editor of the Diary of a Rogue Economist and a friend of long standing, kicked the program off with a thought-provoking discussion about the nature of information.

With a nod to Nietzsche, Bill dissected the nature of information into two categories.

The first sort is that which is derived from direct observation. For an example, Bill pointed to the tangible information that comes from living in a tribal village. As a member of the tribe, you knew your neighbors, you knew what sort of crops would grow in the different seasons, where and when to hunt, etc.

Paraphrasing Bill, "If a member of the tribe came running into the village yelling that an enemy tribe was about to attack, you would have direct knowledge that there was an enemy tribe residing in the area and that the fellow doing the yelling wasn't the sort to just make it up. So you could be certain an attack was likely."

Given this high quality of information, Bill continued, you would be able to make an informed judgment about what action to take. You could, for instance, prepare to defend your village against the intruders, take flight, or remain and hope for the best. Regardless of how you acted, at least you knew you were acting on good information.

By contrast, there is the second type of information, that which Bill calls "public information." This is the sort of information that people believe is "true," but only tangentially and without having personally observed it. In other words, it is extremely poor-quality information, the sort of thing regularly ginned up in modern times by the media to attract eyeballs on advertisements, or promoted by politicians or businesses to further their own interests.

It's Bill's hypothesis that because the evolution of the human mind occurred against a backdrop of life-and-death decision-making based on hard information, our modern minds are genetically ill-equipped to deal with public information. In other words, we evolved trusting that the information we were receiving was reliable, leaving us susceptible to believing that substantially all the information we receive today is reliable.

Making the point, Bill referred back to the case of the villagers being alerted by a fellow villager to a pending attack. So alerted, the villagers knew all they needed to know in order to decide which of the aforementioned actions to take.

But what happens when, in today's world, someone comes running into the virtual village shouting "The globe is warming, the globe is warming"? Or, "The economy needs quantitative easing!"

Because of the entirely understandable evolutionary prerequisite that we pay attention to hard information or risk being erased from the genetic pool, the human mind is essentially wired to accept that the threat from global warming is real… or that quantitative easing is needed. Or that Iraq somehow posed a threat requiring the spending of trillions of dollars and wasting untold lives to blow it to pieces.

How can we really know that any of this public information is true? We can't. Yet with a sufficient amount of arm-waving in the global media, large swaths of the populace accept the information as true, setting in motion a giant snowball of political policy and the attendant massive misallocation of resources.

Into the Wild

As a related aside, during the two-day break between the events, Doug and Ancha Casey, John Mauldin, and I made the trip to Bill Bonner's estancia – a fairly grueling four-and-a-half-hour drive on bad roads (and in some parts, no roads at all) into the mountains above Cafayate.

Like many of Bill's friends, I was never quite sure why anyone would want a home on a property that is a seven-hour drive from the nearest commercial airport, and most of the drive on washboard roads. But when you get there, you understand. The estancia encompasses a massive and surprisingly verdant valley – I think on the order of 200,000 hectares – a veritable Shangri-La stretching as far as the eye can see.

Now, Bill is a pretty well-off guy, but unlike many people who have amassed considerable wealth, Bill generally shuns the superficial trappings in favor of simple pleasures and in undertaking hands-on projects that are anything but simple. For instance, along with his sons and a couple of gauchos, he designed and built a small villa with three vaulted ceilings, using methods perfected by the Romans (he got the basic idea from a book on Roman architecture).

Very impressive, but more to the point, over the course of his life and his many studies, Bill has become a skeptic about much and maybe most of what he hears in the media, or that spews forth from the mouths of the politicians. Instead, he has developed a Missouri-like attitude of needing to observe something himself before believing it.

The important idea that Bill shared and that I am trying to share, is that if you take the time to step back and analyze the information you receive and parse it into that which you know to be true based on your own observations, as opposed to what is popularly accepted as true simply because it was printed in a news journal or said in a broadcast, your attitude about many things may change.

It may take some time and practice to hone your skills in separating discernible facts from public information that may actually be utter fiction… but the payoff in adopting this attitude can be significant.

For example, rather than getting all worked up over something like global warming, you might reflect on the observable fact that virtually every generation has been plagued by prophets of doom – overpopulation, the coming ice age, Ebola, HIV, bird flu, swine flu, global warming, etc., etc. – and so simply don't concern yourself with it.

(The doomsters seem to be tuning their Hype-O-Matics into the idea that the world is about to be wiped clean by a super-meteorite. In fact, the threat is so severe that the US Senate is now holding hearings, with one legislator actually asking that Bruce Willis make an appearance… you know, because he starred in a sci-fi movie dealing with the topic.)

In prehistoric times, anyone running into the village shouting that the enemy was about to attack when they weren't would quickly find themselves hanging upside down over a fire. By contrast, in modern times, with the warnings cloaked in pseudoscience or religiosity and rebroadcast globally by the complacent and complicit media, the purveyors of such bad information tend to end up being feted at rubber-chicken dinners and padding their pockets with grant money from universities and governments.

Recently, I got into a discussion on this general topic with a fellow Estanciero, and we both concurred that living here in a remote wine-growing town far from the "noise" of the modern world has had a tremendously beneficial effect on our stress levels. The "news" – or public information, as Bill would term most of it – has almost zero presence in our daily lives.

Why Bifurcating Your Information Matters

In addition to saving yourself time and worries by mostly ignoring public information, learning to discern the difference between the two can lead to better decision making, in your everyday life and in your investments.

As a case in point, during the conference here, someone in the audience asked a question about quantitative easing. Doug Casey took hold of the microphone and replied along the lines of, "People need to stop using constructs such as 'quantitative easing.' Those are just terms that politicians have come up with to obfuscate the truth. The proper term for quantitative easing is currency debasement, plain and simple."

Going back to the observable, we know from history what happens when a king or officialdom adopts a policy of energetic currency debasement: the currency units being debased invariably become worth less and less. There is no example in history where debasing a currency doesn't drive the purchasing power down over time. And certainly none where debasing a currency causes it to appreciate over time.

Jumping back to public information, "everyone" knows that the dollar is king... the best car in the junkyard, the two-ply toilet paper in a world where all other currencies are mere single ply. But is that accepted truth actually true?

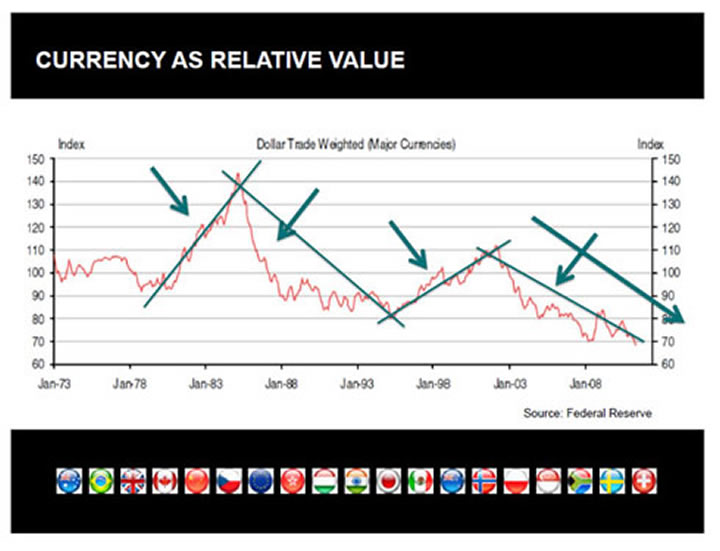

Take a look at the following two charts, taken from the presentation that Frank Trotter, president of EverBank Direct, gave in Cafayate. The first shows the US dollar against 19 major currencies. It's hard not to note that the mighty dollar has been in a long-term downtrend.

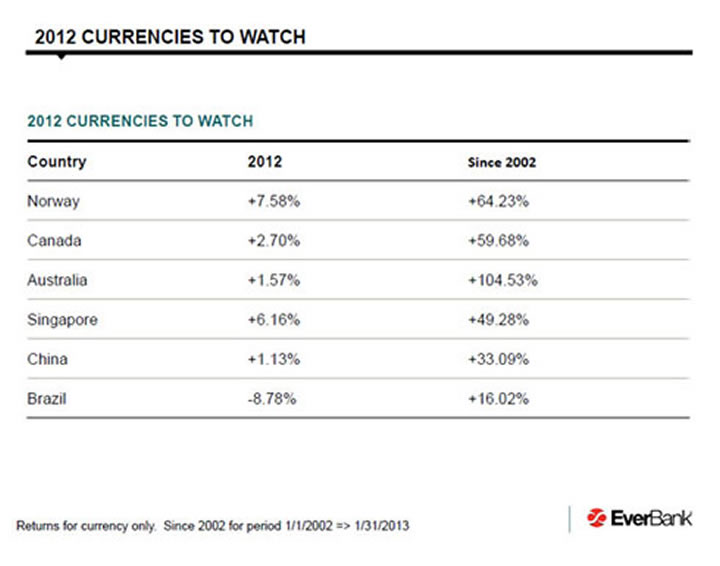

The second of Frank's charts shows the one- and ten-year performance – through 2012 – of some of the EverBank World Currency team's favorite currencies against the dollar.

Of course, not shown in this mix is the performance of gold, the über-currency, over the same time periods. In 2012 gold rose by only about 3.5%, but for the ten-year period, it rose from $278 to $1,657, a gain of about 500%.

I'll have a bit more to say about gold, and particularly gold stocks, momentarily… but before that, I want to toss out one more item of observable information as it relates to today's economy, political environment, and the outlook for the dollar.

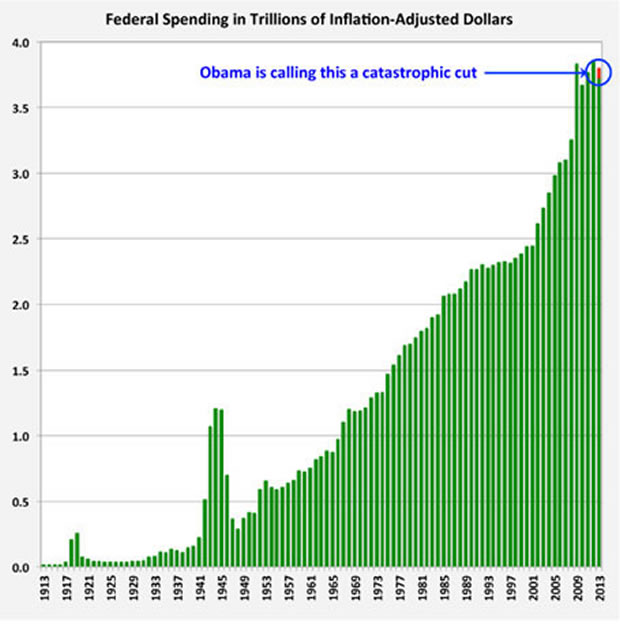

The chart here is of federal spending in trillions of inflation-adjusted dollars. That means that the increase in spending shown accurately reflects the growth in government in real terms (as opposed to reflecting the decline in purchasing power from the currency debasement).

It also shows the scale of the purportedly draconian cuts in federal spending to be made as part of proposed austerity measures… revealing all the hand waving about the severe consequences of said cuts as just so much public information… or, if you prefer, misinformation.

What you can also observe from this chart is that the federal government has grown into a behemoth, a huge prop under the economy… the world's largest economy, for the record. The idea that the politicians will find the backbone to cut this level of spending back to the point where it balances the budget is ludicrous. Even if enough of them wanted to make such cuts, the ensuing depression would trigger a public backlash that would see them voted out of power in the proverbial blink of an eye.

Which is to say that the current trend of currency debasement is almost certainly going to continue until it simply can't anymore.

And that brings me back to gold and particularly gold stocks.

Downturn Millionaires

Even though the first of the two events here in Cafayate was beginning, the partners of Casey Research got together and decided that the state of the gold share market had reached such a dismal state that we had to take action on behalf of those of our subscribers with investments in these markets.

And so we hit the phones and email and arranged for Jonathan Roth, a highly respected journalist and film maker, to fly down to Argentina, picking up a crew in Buenos Aires on the way. Our purpose was to tap into the minds of some of the conference speakers, as well as mining share experts back in North America who were invited to join by live video feed.

The program, which some wit back in the office named Downturn Millionaires, has as its primary mission to put today's junior mining share markets into clear perspective.

And that perspective, I am convinced after moderating the impromptu webinar, is that the meltdown in the junior resource stocks over the last year has created a once-in-a-generation opportunity for life-changing profits. That's because while gold bullion has been largely flat over the last 12 months, the junior gold and silver shares have been positively bombed out.

And by bombed out, I refer to the observable fact that even great companies – with great management teams, money in the bank, and large proven resources of gold and silver in supportive political jurisdictions – have seen their share prices lose over 50% of their market value over the past 12 months.

That this has occurred against the backdrop of only a modest consolidation in gold bullion prices and a massive global commitment by central bankers to currency debasement, represents a huge disconnect.

So, what's it to be? Is the long bull market in precious metals and precious-metals shares over? Or does the disconnect point to just the sort of once-in-a-generation profit opportunity for those bold enough to act (selectively, of course)?

The program features Doug Casey, Bill Bonner, Rick Rule, John Mauldin, and Louis James, the globe-trotting senior editor of our International Speculator service who talks about the specific stocks to add to your portfolio today.

The program is now live on the Casey Research site. Because of the importance of the topic, we have made it available to everyone to watch for free.

Register to watch this online video event now.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.