Gold Price Plunge - Where's the Opportunity?

Commodities / Gold and Silver 2013 Apr 17, 2013 - 03:50 PM GMTBy: Rory_Gillen

Never a dull day in markets! With Japan entering the central bank quantitative easing game, currency devaluation as a global theme is accelerating, yet the gold price has just succumbed to the most serious correction since the gold bull market started in 2001.

Never a dull day in markets! With Japan entering the central bank quantitative easing game, currency devaluation as a global theme is accelerating, yet the gold price has just succumbed to the most serious correction since the gold bull market started in 2001.

As I write, the gold price has fallen 10% in the past two days, and has now declined decisively through key support levels in the $1,525-1,550 area that had held good for the past 16 months. The gold price is now down 25% from the peak. The gold bulls have been mauled. Yet, it can't be too surprising. Gold offers no income, and it appears that the reasons for buying have become less clear cut of late. The key US economy is improving, equities (overall) are doing well and inflation, as a threat, is nowhere in sight.

Over the centuries, gold has protected investors against inflation. But that is all gold does. It is not a productive asset, and over the long-haul has never matched the returns from real businesses (equities), and most likely never will.

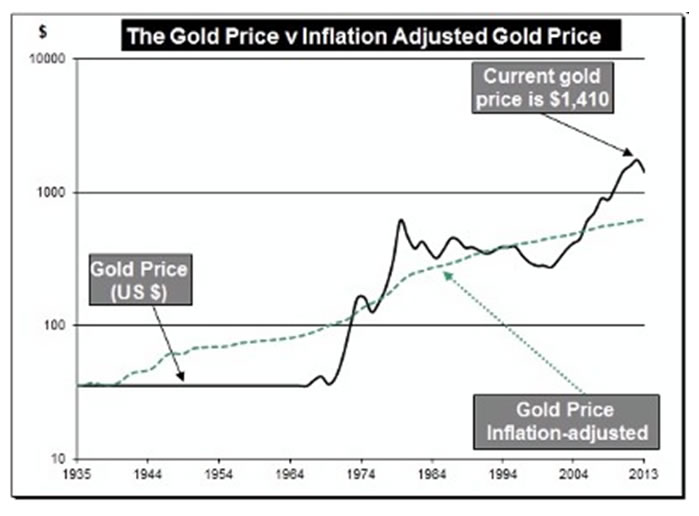

As I outlined previously, for some time now the difficulty with an unqualified bullish gold argument has been that the gold price has already priced in a substantial uptick in inflation, accordingly to my calculations at least. The enclosed chart highlights two gold prices. The first (solid) line highlights the actual gold price from $35 dollars an ounce in 1935 to the current price of $1,410 an ounce. The second (broken) line highlights what the gold price would have been, and would now be, had the gold price simply risen in price to match recorded inflation. The chart has been suggesting for some time that the gold price is ahead of itself.

At the top of the last great gold bull market in January 1980, the gold price had over-shot the likely rise in inflation, and spent 20 years correcting. From 2001 to the current date, the price of gold has risen from a low of $255 an ounce to $1,410 an ounce, which has not only made up for the initial undervaluation, but additionally has priced in investors expectations of a substantial rise in inflation.

The trouble, of course, is that there is no sign of an out-of-control inflationary spiral, not yet anyhow. With all the quantitative easing, it is natural to conclude that inflation is the inevitable outcome. I buy that argument, too. The tricky point is timing. Perhaps the slowdown in emerging markets, falling commodity prices and now a falling gold price are signaling that deflationary forces are, once again, gaining the upper hand. In that context, a correction in the gold bull market seems entirely logical to me.

In markets, of course, the baby often gets thrown out with the bath water. While those holding gold from higher levels might be nursing some losses, spare a thought for the gold miners. Collectively, this subsector of the global equity market is down well over 50% from August 2011 levels. The world's largest gold producer, Barrick Gold, is back to 2005 share price levels, currently trades at its balance sheet value and on just 6 times expected 2013 earnings, and offers a dividend yield of 3.3% (covered by earnings 5 times). Bears of the gold miners say that their earnings have not been benefiting from the strength of the gold price. Perhaps the bears lenses are not long enough. From 2003 to 2012, Barrick Gold increased its earnings from $0.32 to $3.73 a share for an 11-fold increase (source: Valueline).

My own view is that inflation will appear in spades, in time, in one form or another. Currency devaluation lowers the value of your assets abroad; the inverse of inflation if you like. Gold, in my view, is a great protector against the inevitable devaluation of currencies which are currently burdened by too much debt in the global economy. Whether you see it or not, the consequences of currency devaluation are that your local currency assets are worth less, just the same as if inflation was rampant.

But gold is not the only protector. In fact, the speed and severity of the decline in gold mining share prices has probably just given us the tell-tale buy signal of capitulation in markets - the scary cascading decline in prices, as everyone heads for the exit at the same time. If good fundamental values are on offer at the end of the selling frenzy then the buy signal becomes compelling.

In other words, the gold price could be a side-show, and if it even stabilises around current levels, on a 2-3 year view, the outsized returns from here are more likely to be delivered by the gold miners.

Rory Gillen

GillenMarkets.com

Rory is the founder of GillenMarkets.com and the author of 3 Steps to Investment Success along with being a regular contributor to the media on issues affecting the financial services industry. He is a qualified Chartered Accountant, a former senior fund manager with Eagle Star, Ireland (now Zurich Ire.) and a co-founder of Merrion Capital in 2000 where he was Head of Equity Research among other roles for several years. In all, he has spent over twenty five years working in the financial services industry. He founded GillenMarkets in 2005 as a stock market training company and obtained approval from the Central Bank of Ireland to provide investment advice in 2009. He is married with three children and lives in Greystones, Co. Wicklow, Ireland

© 2013 Copyright GillenMarkets - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.