Gold Bullion Panic Buying

Commodities / Gold and Silver 2013 Apr 17, 2013 - 03:37 PM GMTBy: GoldCore

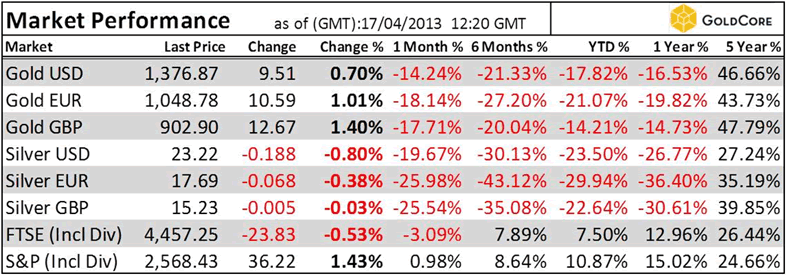

Today’s AM fix was USD 1,379.00, EUR 1,046.12 and GBP 903.14 per ounce.

Today’s AM fix was USD 1,379.00, EUR 1,046.12 and GBP 903.14 per ounce.

Yesterday’s AM fix was USD 1,378.00, EUR 1,054.00 and GBP 900.48 per ounce.

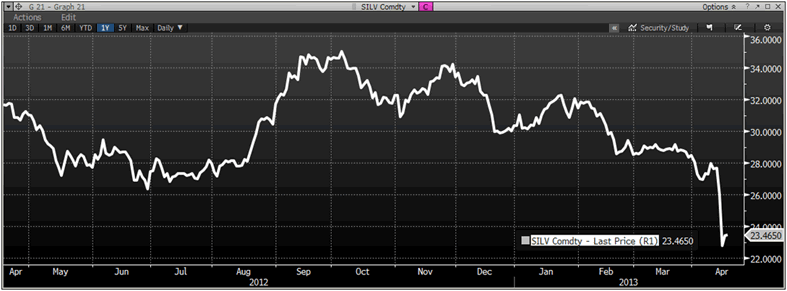

Gold rose $16.40 or 1.21% yesterday to $1,373.40/oz and silver also finished up 2.63%.

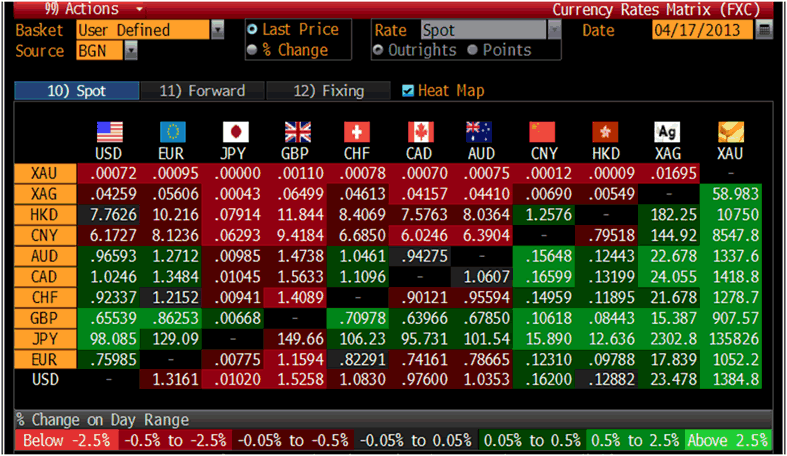

Cross Currency Table – (Bloomberg)

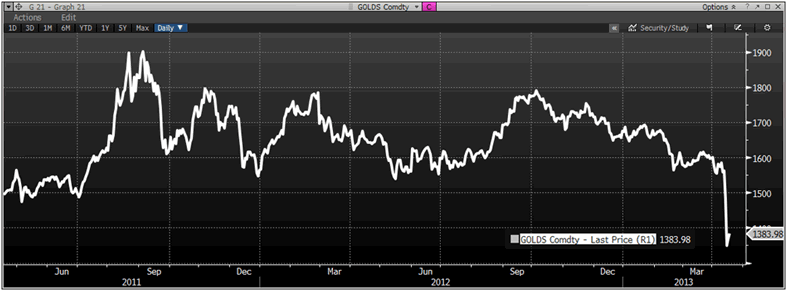

There are reports of very strong demand for coins and bars from buyers internationally who believe that the sell off that saw gold fall to a two-year low is overdone.

Very significant demand is being seen throughout the world for physical bullion – in Japan, India, Australia, the U.S., Europe and elsewhere. The speculative raid by one or two banks which led to the price crash is being seen as a gift by eager buyers internationally.

Gold in USD, Daily – (Bloomberg)

Gold sales from Australia’s Perth Mint, which refines nearly all of the nation’s bullion, surged after prices plunged, adding to signs that gold’s slump to a two-year low is spurring increased demand.

“The volume of business that we’re putting through is way in excess of double what we did last week,” Treasurer Nigel Moffatt said by phone, without giving precise figures. “There’s been people running through the gate.”

The Perth Mint’s sales of gold coins climbed 49 percent to 97,541 ounces in the three months ended March 31 from a year earlier, according to data from the facility in Western Australia that was founded in 1899.

Silver in USD, 1 Year – (Bloomberg)

“There’s been significant sales made as people see this as great value,” Moffatt said yesterday. “Gold owners are very reactive to significant market movements.”

We are the Perth Mint’s Approved Dealer in the European Union and have experienced a similar jump in demand yesterday and this morning. We saw massive selling on Monday as speculative buyers dumped positions in panic but yesterday came stabilization and there were more buyers than sellers. As the day progressed the demand for bullion increased and prices stabilised.

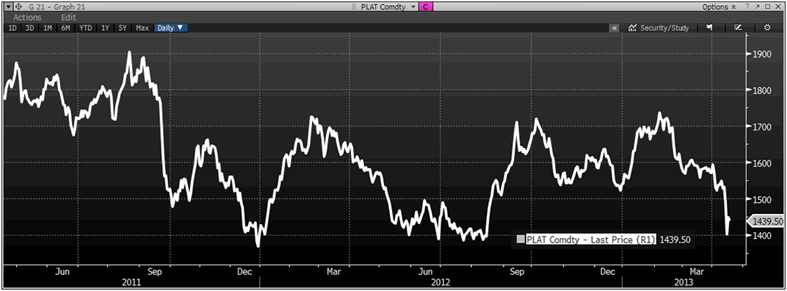

Platinum, Daily – (Bloomberg)

Today has seen more buying than selling and what selling there is, is of unallocated gold with some of the sellers shifting to buying physical in an allocated account or for delivery.

Conversation with mints, refineries and other bullion dealers confirm a similar pattern with very significant physical demand being seen yesterday and today.

In Asia, the fall in gold has been greeted by physical buyers leading to a supply shortage of gold bars in both Hong Kong and Singapore.

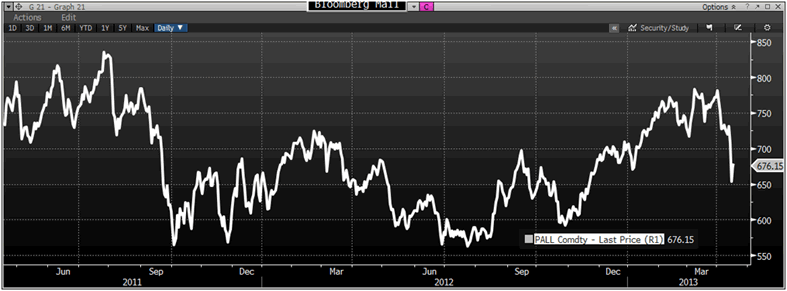

Palladium, Daily - (Bloomberg)

Gold buyers in India, the world’s biggest consumer, are flocking to stores to buy gold jewelry, coins and bars. “This is a perfect time to buy as prices will only go up from here,” said Vishal Mehta, a 33-year-old garment dealer, while ordering coins according to Bloomberg.

“I usually buy one gold coin a month, but this time I am buying two.”

In India, the world’s largest gold consumer, the plunge may make bullion more affordable, said Mehul Choksi, chief executive officer of Gitanjali Gems Ltd., the nation’s biggest retailer of jewelry and diamonds by sales.

The same is being seen in Japan. Reuters report that Yujiro Yamashita, 63, made his way to Tokyo's posh Ginza district to buy the precious metal for the first time in 20 years after he woke up to news of the fall in gold prices.

Yamashita and other contrarian, individual Japanese investors understand that gold is a volatile investment, but say that buying the precious metal is better than the alternatives including the devaluing yen.

Japanese individual investors doubled gold purchases on April 16 at Tokuriki Honten Co., the country’s second-largest retailer of the precious metal.

Gold is headed much higher over the next decade, investor Jim Rogers said today, adding that he may start buying after a so-called selling climax. Gold was set for a correction and recent decline may be it, he said on Bloomberg Television.

Gold is now poised to move higher as the physical market reacts after the decline, according to HSBC Holdings Plc.

Gold’s drop has been excessive as there are still a lot of troubles out there according to UBS.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.