Dow Jones Lags Gold Returns by 200% - Open Your Eyes!

Commodities / Gold & Silver Mar 13, 2008 - 02:46 PM GMT

Are you a commodities investor with friends that think you are "crazy" for investing in precious metals? Do these same friends advise you to indefinitely "buy and hold" a large amount of "well diversified" mutual funds for the "long term"? We are continually amazed at how few investors seem to open their eyes to changes all around them, including what is really happening in the financial markets.

Are you a commodities investor with friends that think you are "crazy" for investing in precious metals? Do these same friends advise you to indefinitely "buy and hold" a large amount of "well diversified" mutual funds for the "long term"? We are continually amazed at how few investors seem to open their eyes to changes all around them, including what is really happening in the financial markets.

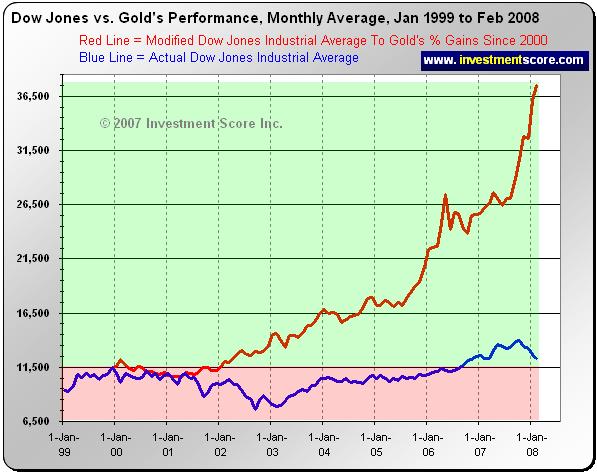

The following chart illustrates what would have happened to the Dow Jones Industrial average if it had increased in value at the same percentage rate as gold has since the year 2000.

In the above chart the blue line represents the actual monthly price of the Dow Jones Industrial Average. The red line in the above chart represents the percentage gains of gold factored into the price of the Dow Jones since 2000. In other words, if the Down Jones had performed as well as gold actually has in percentage gains since 2000, the Dow Jones Industrial Average would now be worth approximately 37,400 points. This chart helps illustrate just how significantly better gold has outperformed the Dow Jones Industrial Average since roughly 2000. If an investor had "bought and held" the Dow Jones Index since the year 2000 their investment would barely have broken even after eight years. This is a very large period of time for such poor investment performance. When inflation is factored into the equation of the Dow Jones, the actual return is extremely poor.

But your friends are likely to point out that stocks outperform commodities in the long term. We recognize that from 1980 to 2000 the Dow Jones Industrial Average far outperformed gold in terms of investment performance but this is exactly our point. In our opinion investments are cyclical and not linear. In the 1970's commodities had a major bull run that significantly outperformed stocks just as stocks outperformed commodities in the following decades. We do not concern ourselves with which investment class is the ultimate investment of all time but rather which investment class is undervalued relative to other investments at any given time.

Unfortunately it appears most investors have a very short term bias and put too much emphasis on their recent experiences instead of history. We believe most investors are bias towards one strategy of investing because that strategy is what worked for them in previous years. Sadly, most of these investors will not learn that their former method for investing may no longer be effective until it is too late.

We wonder what the mainstream media such as television networks, news papers, radio stations and social mood would be like if the Dow Jones Industrial Average were to consistently hit new highs, with a value as high as 37,000 points. Based on the Medias apparent bias on US stocks, likely encouraged by sponsors and advertising revenue, we believe the coverage would be extreme. Interestingly, gold and commodities in general have grown many hundreds of percent points since 2000 yet few members of the media have noticed this significant development in the markets. More coverage on these types of investments would help countless investors find out about such opportunities within a short time. Instead we believe most investors will find out about the mega commodities bull market when it is once again overvalued and at risk of a serious correction. As usual, the cycle will eventually turn and the naive public will likely come late to the party and be destined for failure.

In the big picture we are concerned with what is undervalued now and likely to increase in value in the future, rather than what has already increased in value and therefore should always increase in value. We believe the former is a much more realistic strategy for making money in the financial markets. If you wish to learn more about our investment philosophies and strategies please visit www.investmentscore.com to read more and sign up for our free newsletter. Also, if you know anyone who may benefit from this information please feel free to forward it to their attention.

We try to take positions when most others are not and sell when most others are not. If you are interested in learning about how we do so, we recommend you visit our website at www.investmentscore.com . Here you may also subscribe to our free newsletter.

By Michael Kilback

Investmentscore.com

Investmentscore.com is the home of the Investment Scoring & Timing Newsletter. Through our custom built, Scoring and Timing Charts , we offer a one of a kind perspective on the markets.

Our newsletter service was founded on revolutionary insight yet simple principles. Our contrarian views help us remain focused on locating undervalued assets based on major macro market moves. Instead of comparing a single market to a continuously moving currency, we directly compare multiple major markets to one another. We expect this direct market to market comparison will help us locate the beginning and end of major bull markets and thereby capitalize on the largest, most profitable trades. We pride ourselves on cutting through the "noise" of popular opinion, media hype, investing myths, standard over used analysis tools and other distractions and try to offer a unique, clear perspective for investing.

Disclaimer: No content provided as part of the Investment Score Inc. information constitutes a recommendation that any particular security, portfolio of securities, transaction or investment strategy is suitable for any specific person. None of the information providers, including the staff of Investment Score Inc. or their affiliates will advise you personally concerning the nature, potential, value or suitability or any particular security, portfolio of securities, transaction, investment strategy or other matter. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents may or may not own precious metals investments at any given time. To the extent any of the content published as part of the Investment Score Inc. information may be deemed to be investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Investment Score Inc. does not claim any of the information provided is complete, absolute and/or exact. Investment Score Inc. its officers, directors, employees, affiliates, suppliers, advertisers and agents are not qualified investment advisers. It is recommended investors conduct their own due diligence on any investment including seeking professional advice from a certified investment adviser before entering into any transaction. The performance data is supplied by sources believed to be reliable, that the calculations herein are made using such data, and that such calculations are not guaranteed by these sources, the information providers, or any other person or entity, and may not be complete. From time to time, reference may be made in our information materials to prior articles and opinions we have provided. These references may be selective, may reference only a portion of an article or recommendation, and are likely not to be current. As markets change continuously, previously provided information and data may not be current and should not be relied upon.

Investmentscore.com Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.