Gold Brutal Price Crash - The Final Liquidation of the Gold Bug

Commodities / Gold and Silver 2013 Apr 14, 2013 - 07:08 PM GMTBy: Michael_Swanson

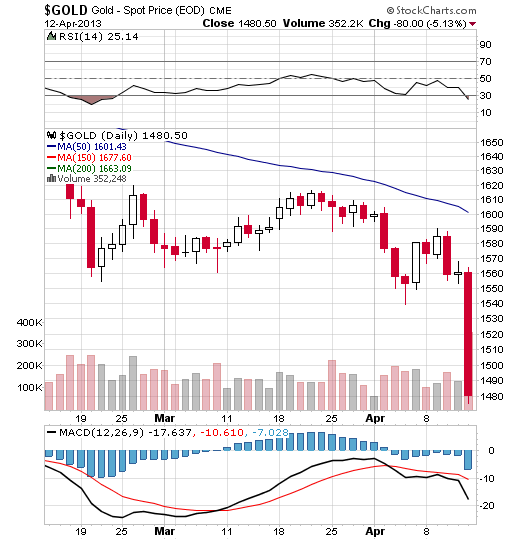

What you are witnessing in the gold market right now is the final liquidation of the gold bug. On Friday gold fell $84 an ounce for a 5.38% drop while the HUI gold stock index fell 6%. Big bad moves. What is worse these drops have come after months of falling gold prices all while the S&P 500 has gone higher.

What you are witnessing in the gold market right now is the final liquidation of the gold bug. On Friday gold fell $84 an ounce for a 5.38% drop while the HUI gold stock index fell 6%. Big bad moves. What is worse these drops have come after months of falling gold prices all while the S&P 500 has gone higher.

This has been a very painful time for gold and silver bugs. While they have lost money they have for the most part watched the broad US stock market go up, which means that while their gold positions went down in value those not invested in gold and in just about anything else made money while they lost money. It feels awful to do that. There is only one word for this - brutal.

Gold bugs have been holding on to their positions since gold last made a peak in the Fall of 2011. Since then the HUI has dropped 53% since it topped out on September 8, 2011. They have held on through some frightening declines and seeming bottoms that provided nothing but false hope. Last year we saw a potential bottom in the Spring and a rally in the Fall that led to nothing but another top and a nosedive into this year and into the present.

The reward for believing in gold has been to be punished over and over again. Many gold bugs bought into gold with the idea that it was a safe haven - that to buy into the US stock market or stocks anywhere else in the world was just too risky to do. Didn't the 2008 stock market crash prove that? Didn't the European crisis of last year show us all the risks of debt? Not exactly - as European markets have boomed since last summer with Greece of all places being the fastest gaining market in the world.

But many have said that only gold can go up. That only gold will provide a way to make money. They promised that if you bought gold you would come out a winner while one day everyone else will lose money. Now it seems that all of the promises have proven to not be true and that gold has been the big disappointment.

Now many are selling disgust. CNBC is saying that gold is done, because Ben Bernanke and President Obama have put the country on the verge of a coming economic boom. They say command and control economics is the future and anyone who doubts this by owning gold is a dinosaur. In the last month we have seen days in which good economic news comes out that gold has gone done in value. Then on days when bad news has been announced gold goes down too instead of doing up.

Then on Friday the Cyprus government said it would sell gold and give the proceeds to the European Monetary Union to finance its bank bailouts as it gives up its national birthright. It seems no news is good for gold. Goldman Sachs sent a note to clients last week telling them to short gold. Marc Faber told a reporter this weekend that he thinks gold could drop to $1,300 an ounce before bottoming.

Many are saying gold is over and there are some now that have held on to their gold positions for years and are now selling. Some are taking that money and moving it into the S&P 500 in obedience to the talking heads on CNBC and really more in fear of missing out on more stock market gains than anything else. If that turns out to be a mistake well at least they won't be alone - so for many there is emotional comfort in that. They'll lose money with everyone else and that isn't as bad as possibly being all alone in gold while your neighbors in their boring mutual funds make money not knowing what they are doing. But that is not prudent investment behavior.

And Goldman Sachs isn't always right. What Goldman Sachs does with its own money and what it tells clients can be two different things. Back in March of 2000 Goldman Sachs talking head Abby Cohen told people to keep buying Internet stocks just as they topped. In July of last year Goldman Sachs sent a note to clients telling them to SHORT the S&P 500 due to what they thought were signs of economic weakness in the US economy. That was a mistake and this call now to short on gold on their behalf will be proven to be one too.

"So what is going on then?" you probably are asking. Why is gold falling? What does this mean? Are all the economic risks gone? Is deflation coming? Is Fed QE the miracle CNBC's Steve Liesman says it is? Yes there are some who hate gold bugs, because they represent doubts over the Federal Reserve. They wish they would become extinct.

But gold is not going away. Here is the thing. No one really knows exactly why gold is falling, because there probably is not some big economic reason for it. The truth is markets are cruel. They go up and trap people at tops and then fall far enough to cause as many people to sell on a bottom as they can. This is how bull and bear markets work.

Bear markets do not come to an end when news all of a sudden gets better. They come to an end when every potential seller in them sells out. This is what really causes bear markets - more selling than buying. Gold has been in a bear market now since 2011. However, that is a two year bear cycle within a long-term secular bull market cycle that has been going on for gold now for over a decade and is not over yet.

There are two things you need to realize. When this gold bear market is over a new bull market will begin and those that are invested in that bull market will make an absolute killing. Gold is still up over 580% from 2001 even with its decline of the past two years. And since then gold has gone through two other major declines which lasted over a year that led to awesome gains once they ended. There is no reason to think this time will be different.

Whatever you do you need to make sure that you are in gold during that next bull market. To sell now would mean to give that up. Perhaps though you have to sell. Maybe you own too much. Maybe you are on margin. Maybe you are a hedge fund with investors that now will have no more patience for your gold positions with the S&P 500 going up the past few months. You see bear markets force people to sell for many reasons. Hundreds of millions of dollars are being forced out of the gold market right now.

Second you have to realize that there is nothing easy about trying to make big bucks out of a financial market, because financial markets are cruel. If you thought the gold game was going to be easy than grow up. But realize that nothing else will be any easier. Don't think for a second that the S&P 500 is going to remain an easy game for people either. Since I've been in the financial markets there have been two massive stock market wipeouts that were just as bad - if not worse - than what we are witnessing in gold right now. And I am sure eventually once this bull market in the US stock market ends there will be another cruel bear market that will wipeout another round of investors.

This is how the stock market works and this cycle will never end. You see bull markets thrive on buying. They depend on more people putting more money into use to drive them higher. As people buy they get bullish. If someone has money and is on the sidelines he has doubts about the market. But once he buys he pushes those doubts away and proclaims himself to be a bull! That is why at major market tops bullish sentiment is widespread and just about everyone you know is in. But when there are no buyers left to get in the bull market ends as sellers take control.

As bear market start people hold on in hope. Each rally that comes appears to be the start of a new bull market, but as each successive rally disappoints more and more people sell. Sellers take control of the market. Whether the news is good or bad the market drops anyway.

You see the NEWS DOES NOT MATTER. In bull markets bad news is bought and in bear markets all news gets sold. The news means nothing. All that matters is whether the sellers are in control or the buyers. All that matters is whether the market is in a bull market or a bear market and that is ALL YOU NEED TO KNOW. Trying to figure out why gold is dropping right now is a total waste of your time. It is dropping because it has been in a bear market for almost two years now and at the end of bear markets you can get crashes and extremes in bearish sentiment as every person who is a potential seller finally sells in a giant capitulation. What you are witnessing is not some grand change in the world economy, but the mass liquidation of all remaining gold bugs. It is simply the natural process of a bear market cycle that started in the Fall of 2011.

Right now the sentiment surrounding this gold market is just about as bad now as I've ever seen it. For instance see this comment from the blog Theshortsideoflong.com:

I have hinted at the extreme depressed sentiment including the following important indicators:

• In early March COT reported Gold short positions reached the highest level in over a decade

• In early March Gold's Public Opinion reached one of the lowest levels in at least a decade

• Last week COT reported Silver short positions reached the highest level in almost two decades

• Last week Silver's Public Opinion reached one of the lowest levels in at least a decade

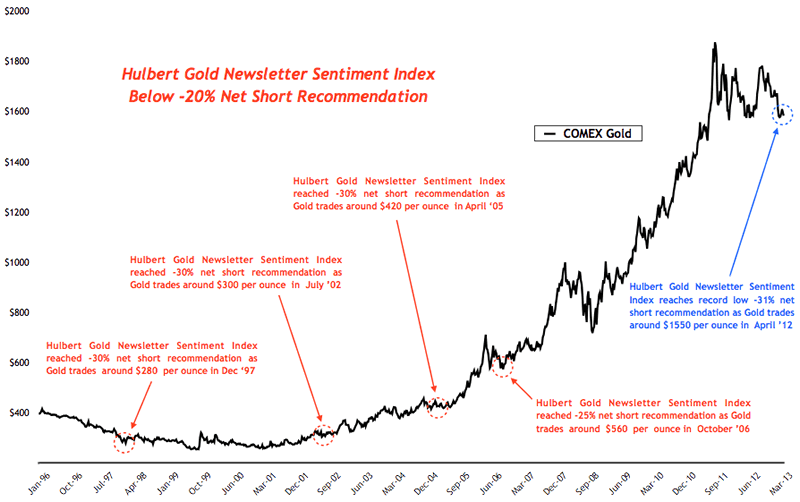

The latest development worthy of "decade extreme" or "record extreme" within the Precious Metals sector, comes to us thanks to Mark Hulbert Financial Digest. According to Mark's latest WSJ column, there has been a huge plunge in exposure of various Gold newsletter advisors. Currently, the Hulbert Gold Newsletter Sentiment index (HGNSI) is at -31% net short, a historical record low since the inception of the survey in 1997. Essentially, this means that the average Gold newsletter advisor is telling subscribers and various other clients to be short Gold with 31% of their portfolio.

I just want to plead with you, do not give up on gold! You see no one cannot predict at what exact price the current gold price drop is going to end, but I can tell you two things for sure. I can tell you first of all that gold stocks are super cheap now on a fundamental basis with many gold stocks paying big dividends - dividends bigger than you can get from buying a US treasury bond. Newmont for example has a P/E of 10 and is paying a dividend over 4.30%.

I know you are probably thinking well they were cheap a month ago too and that doesn't mean that gold and gold stocks can't go lower. And yes you are right! They can. But one thing we both know for sure all bear markets come to an end and this one will too. And once it does gold prices will explode in value and a whole new cycle of gold investors will make a mint off of it.

I plan on being a part of that. I have a little gold and gold stock position so this drop has barely made a dent in my portfolio. You see I own positions in markets all over the world and gold has just been a tiny part of my portfolio. I didn't want to buy a whole lot of it until I was sure the bear trend was over.

Now I am getting excited about the idea of buying more of it. Tomorrow morning I am going to send premium WSW Power Investors my game plan for doing just that. We are all learning lessons from these markets. You never stop learning.

If you have had no choice but to sell gold positions because of this decline or feel like you must due to the impact a further drop in gold would have on your portfolio or your job if you are a fund manager then the lesson you need to take away from this is not that gold is now bad, but that you need to manage your money differently in the future. The mistake you made was not in owning gold, but in owning too much of it or not reducing your position at the right time and taking some profits if you sold years ago.

Maybe you are in cash and are feeling no pain at all though. I do not know what your personal position is on gold as I am writing this for myself and thousands of others who will read it. What all of us must do, no matter what our current investments are, is figure out what is the best way to make money in these markets going forward. If you believe like I do that gold will go higher once again once its current decline that started way back in the Fall of 2011 is over than you must figure out how you want to be a part of that next bull run in gold and precious metals. You need to figure out when you want to buy it and how much.

You need to figure out how you want to manage your money in a bull market. You see people buy in tops and sell on crashes over and over again never learning anything, because they never stop to learn from what they have already done. Once you learn then you make money in a sustainable manner.

Bull markets come and go. So do bear markets. These cruel cycles and patterns never will end, because they are human nature. With gold we are witnessing climatic bear market crash action. We are witnessing the liquidation of the gold bug and the beginning of a bottom. The only thing left once all of the potential sellers are gone will be the few strong hands left - those will be the people who just own a little bit so they don't get crushed so much they have to sell and those simply tough enough to hold on. They are the few and the brave.

What you have to think about though isn't being tough - but getting smarter when it comes to investing. Market action like this is when it makes sense to make plans to buy. Think about last year when European markets crashed and everyone said it was stupid to invest there. No one believed, because no one was left to believe. And now the gold bugs are almost all gone too.

To get future updates from me about the price of gold and actionable investment ideas subscribe to my free newsletter at

http://www.wallstreetwindow.com/newslettersubscribeforfree.htm

By Michael Swanson

WallStreetWindow.com

Mike Swanson is the founder and chief editor of WallStreetWindow. He began investing and trading in 1997 and achieved a return in excess of 800% from 1997 to 2001. In 2002 he won second place in the 2002 Robbins Trading Contest and ran a hedge fund from 2003 to 2006 that generated a return of over 78% for its investors during that time frame. In 2005 out of 3,621 hedge funds tracked by HedgeFund.Net only 35 other funds had a better return that year. Mike holds a Masters Degree in history from the University of Virginia and has a knowledge of the history and political economy of the United States and the world financial markets. Besides writing about financial matters he is also working on a history of the state of Virginia. To subscribe to his free stock market newsletter click here .

Copyright © 2013 Michael Swanson - All Rights Reserved.

Disclaimer - WallStreetWindow.com is owned by Timingwallstreet, Inc of which Michael Swanson is President and sole shareholder. Both Swanson and employees and associates of Timingwallstreet, Inc. may have a position in securities which are mentioned on any of the websites or commentaries published by TimingWallStreet or any of its services and may sell or close such positions at any moment and without warning. Under no circumstances should the information received from TimingWallStreet represent a recommendation to buy, sell, or hold any security. TimingWallStreet contains the opinions of Swanson and and other financial writers and commentators. Neither Swanson, nor TimingWallstreet, Inc. provide individual investment advice and will not advise you personally concerning the nature, potential, value, or of any particular stock or investment strategy. To the extent that any of the information contained on any TimingWallStreet publications may be deemed investment advice, such information is impersonal and not tailored to the investment needs of any specific person. Past results of TimingWallStreet, Michael Swanson or other financial authors are not necessarily indicative of future performance.

TimingWallStreet does not represent the accuracy nor does it warranty the accuracy, completeness or timeliness of the statements published on its web sites, its email alerts, podcats, or other media. The information provided should therefore be used as a basis for continued, independent research into a security referenced on TimingWallStreet so that the reader forms his or her own opinion regarding any investment in a security published on any TimingWallStreet of media outlets or services. The reader therefore agrees that he or she alone bears complete responsibility for their own investment research and decisions. We are not and do not represent ourselves to be a registered investment adviser or advisory firm or company. You should consult a qualified financial advisor or stock broker before making any investment decision and to help you evaluate any information you may receive from TimingWallstreet.

Consequently, the reader understands and agrees that by using any of TimingWallStreet services, either directly or indirectly, TimingWallStreet, Inc. shall not be liable to anyone for any loss, injury or damage resulting from the use of or information attained from TimingWallStreet.

Michael Swanson Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.