U.S. Dollar to Become Next Japanese Yen?

Stock-Markets / Financial Markets 2013 Apr 12, 2013 - 10:18 AM GMT Michael Lombardi writes: Gold prices on the Tokyo Commodity Exchange have jumped 7.8% since April 4, when the central bank of Japan announced its new and aggressive round of asset purchases. (Source: Wall Street Journal, April 9, 2013.)

Michael Lombardi writes: Gold prices on the Tokyo Commodity Exchange have jumped 7.8% since April 4, when the central bank of Japan announced its new and aggressive round of asset purchases. (Source: Wall Street Journal, April 9, 2013.)

The Bank of Japan has become notorious for printing extreme amounts of paper money. It wants to end the economic misery the country has faced for many years.

Dear reader, this all brings me to one key point: gold bullion has a shiny future in spite of the price correction it is currently going through.

Just as gold bullion prices are soaring in Japan today, it will eventually be the same situation here at home. The main reason gold bullion prices skyrocketed in Japan was the devaluation of the yen. The Japanese currency has declined in value by 30%, compared to other major currencies, in a very short period of time.

As I write this, the Federal Reserve is still printing $85.0 billion in new money a month with no end in sight. In the future, I believe there will be consequences for money that has been “printed out of thin air.”

Gold bullion has been a store of value for thousands of years—much longer than any fiat currency. It acts as a hedge against inflation. At the end of the day, the U.S. dollar is a paper-based fiat currency that’s backed by nothing.

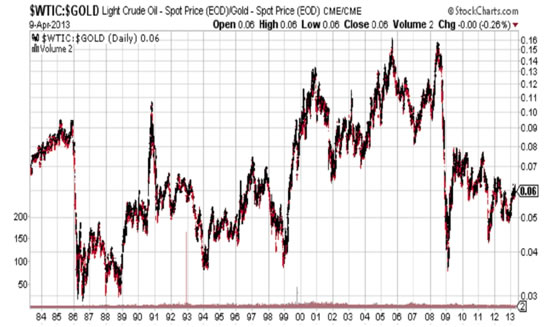

The long-term stock chart below represents crude oil prices in terms of gold bullion.

Chart courtesy of www.StockCharts.com

This long-term chart clearly shows that the price of crude oil hasn’t really increased in terms of gold since 1990. Inflation caused by the fiat currency has made crude oil look expensive.

Yes, I know that since the beginning of the year, gold bullion prices haven’t performed very well. But that doesn’t mean the precious metal has lost its use. What still holds true is that central banks are buying up gold bullion with two hands—they know they need the yellow metal to protect what they have as the question of the U.S. dollar as a reserve currency comes into play.

I am bullish on gold bullion, and my reasons for being bullish remain the same; I don’t expect printing presses of central banks around the world to stop anytime soon. They will continue to print paper money in hopes of bringing “economic growth” to their respective countries. But just as the Roman and the German empires once learned, and as Japan is learning today, the more paper money created, the more worthless it eventually becomes.

Damage to the fundamental monetary system of the U.S. has already been done. Just look at the balance sheet of the Federal Reserve and how much the U.S. government owes to its creditors. More money printing and more debt will weaken the U.S. dollar further, while it continues to bode well for gold bullion.

Michael’s Personal Notes:

The headlines keep flashing: S&P 500 keeps hitting a new record—almost daily! Optimism is increasing to levels not seen since 2007. And I continue to ask why.

As I have been harping on about in these pages, the disparity between the U.S. economy and the key stock indices is increasing as the days go by. Key stock indices are moving beyond what is reality.

That reality is that economic conditions in the U.S. are taking a wrong turn—they are screaming, “Danger ahead!” But sadly, key stock indices like the S&P 500 are ignoring the signals.

Unemployment, one of the major issues faced by the U.S. economy, showed further deterioration in March. The amount of jobs added was pathetic. It’s an indication that businesses in the U.S. economy aren’t hiring as some think.

In the same vein, consumers in the U.S. economy are turning pessimistic. The Consumer Confidence Index reported by the Conference Board fell more than 12% from February to March. (Source: Conference Board, March 26, 2013.) Keep in mind that if consumers aren’t feeling good about their money, then they don’t go out and buy. As a result, companies in the key stock indices see their profitability come under pressure.

And places where the media tell us “things are improving” are actually still in the doldrums. Consider the U.S. housing market. Home prices are still depressed—even with some gains witnessed in 2012—because of institutions buying single-family homes. At the end of 2012, 27.5% of all homes with a mortgage in the U.S. economy had negative equity—that’s 13.8 million American homeowners! (Source: Zillow, February 20, 2013.)

The reason behind the rise in the key stock indices mainly has to do with easy monetary policy and money printing. It’s almost as if investors are being forced to take higher risks because returns are limited elsewhere. Take a look at the following chart showing margin debt (the amount of money borrowed to invest in stocks) in the New York Stock Exchange (NYSE):

Chart copyright © Lombardi Publishing Corporation, 2013

Margin debt reached $366.14 billion in February of this year. This amount was the highest since June 2007, when margin debt was $378.24 billion. (Source: New York Stock Exchange web site, last accessed April 10, 2013.) In July 2007, close to the time the key stock indices made their all-time highs, margin debt in the NYSE reached its highest level ever—$381.37 billion.

Be very careful with stocks, dear reader. Key stock indices may rise a little further, but their downside risks are piling up fairly quickly.

Source - http://www.profitconfidential.com/gold-investments/u-s-dollar-to-become-next-japanese-yen/

By Mitchell Clark, B.Comm. for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.