Alarming Growth in Americans "on Disability" Could Bankrupt Social Security

Politics / Government Spending Apr 11, 2013 - 12:56 PM GMTBy: Money_Morning

Ben Gersten writes:Since the start of the recession in December 2007, one in four workers who stopped looking for employment and dropped out of the U.S. labor force found another source of money: collecting disability from Social Security.

Ben Gersten writes:Since the start of the recession in December 2007, one in four workers who stopped looking for employment and dropped out of the U.S. labor force found another source of money: collecting disability from Social Security.

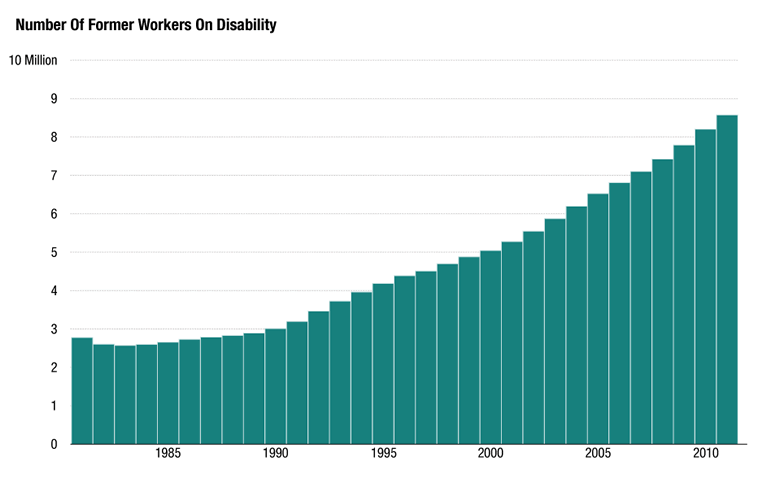

And in that same time span, the number of Americans receiving benefits from the Social Security Disability Insurance (SSDI) program has grown by more than 25%.

That's brought the percentage of Americans who might otherwise be working but are on SSDI to 5.8% of the total labor force, compared with just 1.7% in 1970.

Last year, Social Security paid nearly $220 billion in disability checks and related Medicare costs to more than 8.8 million people and 2.1 million of their spouses and children. (Those on disability for two years become eligible for Medicare.)

It's not just aging baby boomers who are adding to the soaring number of those collecting disability. Of the nearly 9 million former workers currently receiving federal disability payments, more than 2.5 million are in their 20s, 30s and 40s - traditionally prime working years.

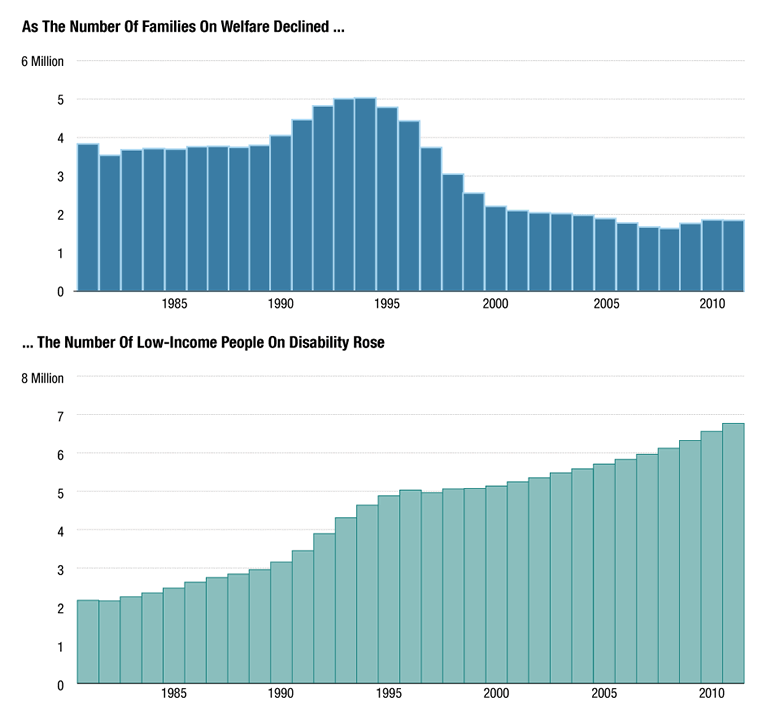

What's behind the huge increase remains unclear, but statistics show a definite connection between the decrease in the welfare rolls, beginning in the mid-1990s, and a sharp rise in the number of people collecting disability.

Some of these former workers now dependent on disability benefits are afraid to give them up - even if they want to work, they can't afford to lose the security blanket their disability checks provide.

Steve Goss, the chief actuary at Social Security, estimates that by 2016 the SSDI reserves will run out, but the disability payments will go on. That's because money will be moved from the overall Social Security retirement fund, now on course to run out of funds by 2035, to cover the disability payments.

These five charts show exactly how this disturbing trend has been developing - and could deplete the Social Security fund.

5 Must-See Charts on the Number of Americans on Disability

Since 1980, the number of former workers on disability has more than tripled from 2.8 million to 8.8 million today.

Source: Social Security Administration

In 1996, President Bill Clinton signed his landmark welfare reform act. The welfare rolls declined, but at the same time, the number of low-income people on disability rose dramatically.

Source: Department of Health and Human Services, Social Security Administration

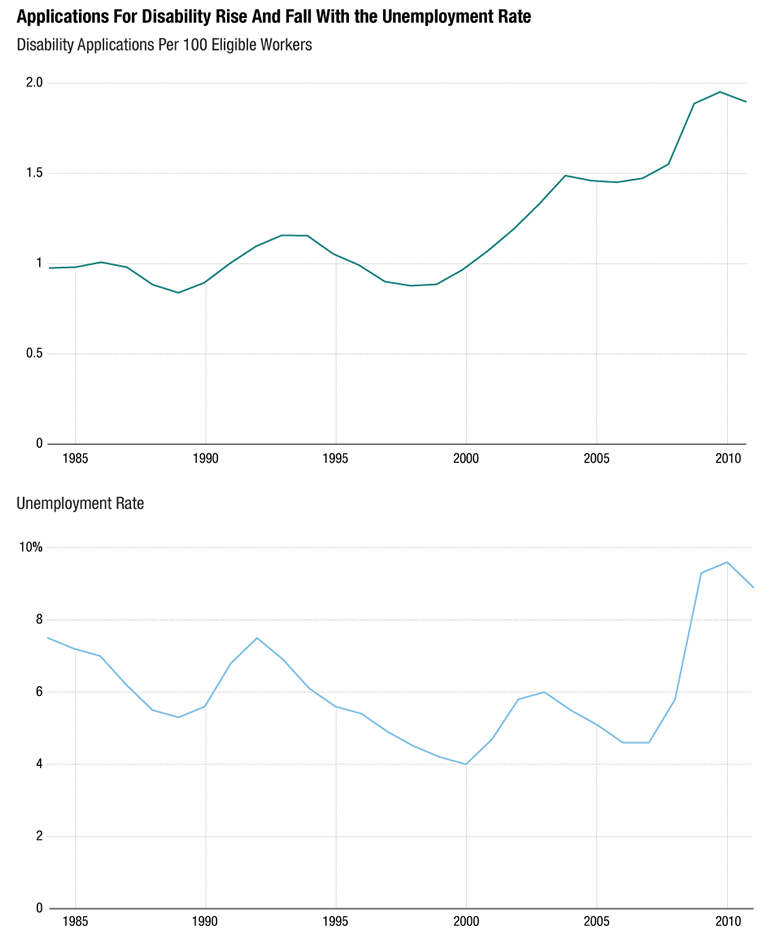

This graph shows that as unemployment increases, so do disability applications.

Source: Bureau of Labor Statistics, Social Security Administration

Are you worried about your retirement future, with the Social Security retirement fund rapidly declining? Don't miss our recent story: The Scariest Facts about America's Retirement Crisis

Source :http://moneymorning.com/2013/04/10/...

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.