Stock Market Long Cycle- Part II

Stock-Markets / Cycles Analysis Apr 09, 2013 - 06:48 PM GMTBy: Ed_Carlson

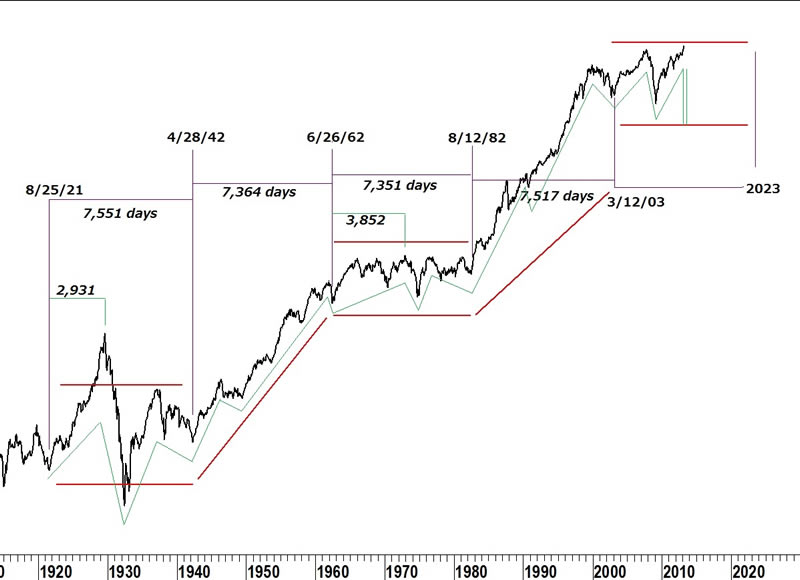

In last week's Commentary I showed how Lindsay's long cycle divided the historical chart of the Dow into what we normally refer to as secular bull and bear markets and noted how closely related each cycle was in its time duration. I also pointed out how the cycle lows Lindsay identified were somewhat different than what other analysts use but that he did so using very specific, rules-based methods to identify those cycle lows rather than just "eye-balling" a chart. These rules are explained in the book An Aid to Timing. Using this approach enables us to forecast the low of the current secular bear market (2023).

Extending my idea of counting the distances of previous secular bear and bull markets I wanted to see where the highs occurred in the previous secular bear market long cycles. We can then see how a forecast based on this approach matches Lindsay's other models for forecasting the high of the current secular bear market.

The time from the low of the long cycle on 8/25/21 until its high on 9/3/29 was 2,931 days - 38.8% of the total distance of 7,551 days (and very close to the Fibonacci ratio of 38.2%).

The time from the low of the long cycle on 6/26/62 until its high on 1/11/73 was 3,852 days - 52% of the total distance of 7,351 days (and close to the Fibonacci ratio of 50%).

If we count 2,931 days and 3,852 days from the long cycle low on 3/12/03 we derive the forecast dates of 3/21/11 and 9/27/13.

Another approach is to use the obvious Fibonacci ratios, 38.2% and 50%, to forecast the expected high. With this approach we can apply both ratios to each long cycle duration; 50% x 7,551 = 3,776 days, 38.2% x 7,351 = 2,808 days.

Counting these intervals from the 3/12/03 low targets highs on 11/18/10 and 7/13/13.

Based on this very broad approach, the high of the long cycle should fall between March and September of this year. Next week I will continue to refine the forecast.

Request a free copy of the April Lindsay Report at the website Seattle Technical Advisors.com

Ed Carlson, C.M.T.

A full examination of the current equity market using the methods of George Lindsay including the standard time spans (as well as the Three Peaks and a Domed House and other models) is available.

http://www.seattletechnicaladvisors.com/contactus.html

© 2013 Copyright Ed Carlson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.