Euro and Gold Topping, Japan Not in Control of its Destiny

Stock-Markets / Financial Markets 2013 Apr 09, 2013 - 06:40 PM GMT It appears that XEU has finally completed its Intermediate Wave [2] and is ready for a strong Wave [3]. XEU has both a Broadening Top and a Head & Shoulders pattern to help Wave [3] along.

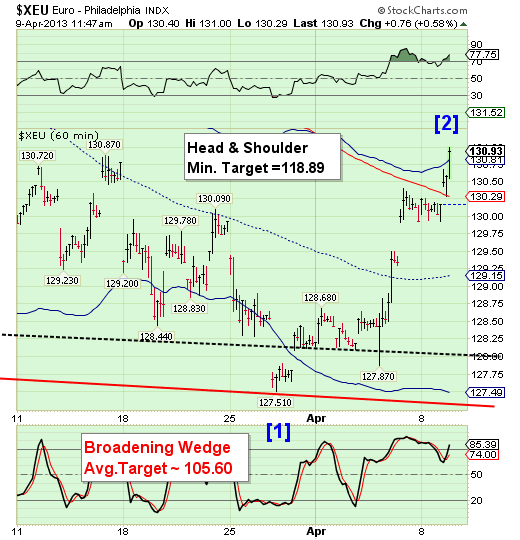

It appears that XEU has finally completed its Intermediate Wave [2] and is ready for a strong Wave [3]. XEU has both a Broadening Top and a Head & Shoulders pattern to help Wave [3] along.

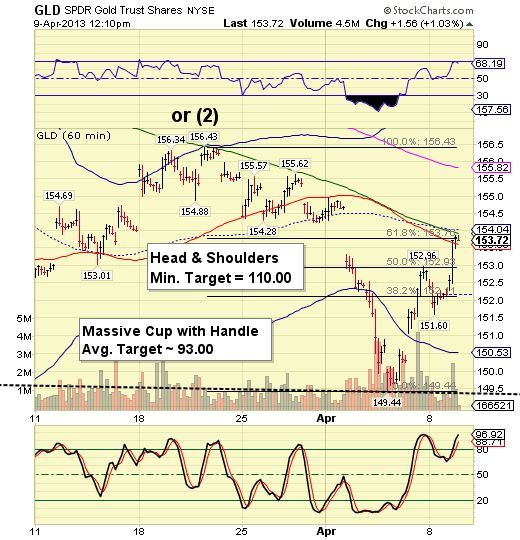

GLD is also finished with its smaller degree second wave, or nearly so. It has made a small attempt at hourly mid-Cycle resistance at 154.04, but has not achieved it. On the other hand, it has achieved a 61.8% retracement. This is a fast retracement (4.3 trading days), which means that the decline will be powerful.

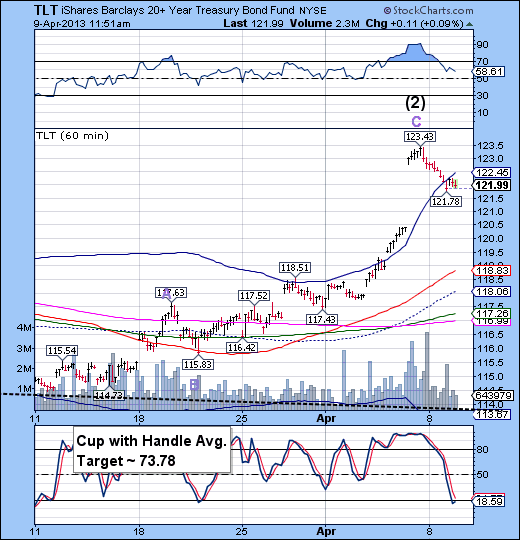

The Friday high in TLT still holds (25 days in USB, 28 days in TLT), which makes this Trading Cycle left-translated and bearish. One should not be long in Treasuries.

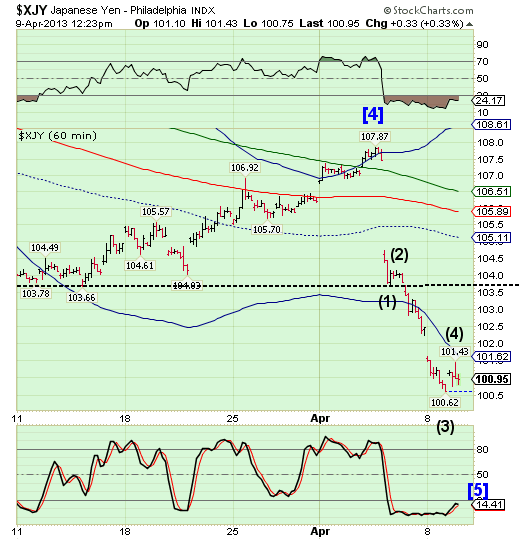

The Yen may be finishing its Intermediate Wave [5] beneath the Head & Shoulders neckline, which is very bearish. The Cycles Model suggests a Trading Cycle low next week. It will very likely be followed by a retest of the neckline prior to a very powerful Cycle Wave III. This particular neckline may be washed out, but the next support and potential neckline occurs at 98.94.

(ZeroHedge) We started off the overnight session with various pseudo-pundits doing the count-up to a 100 in the USDJPY. It was only logical then that moments before the 4 year old threshold was breached, the Yen resumed strengthening following comments from various Japanese politicians who made it appear that the recent weakening in the currency may suffice for now. This culminated moments ago when Koichi Hamada, a former Yale professor and adviser to Japanese Prime Minister Shinzo Abe, told Reuters that level of 100 yen to dollar is suitable level from the perspective of competitiveness. The result has been a nearly 100 pip move lower in the USDJPY which puts into question the sustainability of the recent equity rally now that the primary carry funding pair has resumed its downward trajectory.

No, the Japanese are not really in charge of their destiny.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.