Zero Interest Rates is Not Economic Stimulus, Rather a Death Knell

Interest-Rates / Credit Crisis 2013 Apr 04, 2013 - 07:34 PM GMTBy: Jim_Willie_CB

The propaganda has been thick over the last few years, especially since the US banking system suffered a fatal heart attack in September 2008. It has not recovered since, still insolvent, still wrecked, having returned a zombie center with a USTBond carry trade core and continued money laundering basement lifeline. The Jackass is tired beyond words, beyond description, of hearing that the Zero Percent Interest Policy is being kept as a stimulus measure to encourage continued economic recovery. It is neither a stimulant, nor is the USEconomy in recovery mode. The official 0% rate signals a death knell to the national financial foundation and economic vibrancy, the climax event slow in its pathogenesis following the departure from the Gold Standard in 1971. The official 0% FedFunds rate (call it 25 basis points, no matter) is a direct signal of terminal illness for the entire capitalist structures within both the United States and its Western partners who stupidly or helplessly follow its lead. They followed the US lead in the housing & mortgage bubble disaster with complete wreckage, yet they continue to follow the US monetary lead. They claim to have no choice. They do indeed have a choice, to discard the USDollar and to sell out of the USTreasury Bond, to impose a Gold Standard.

The propaganda has been thick over the last few years, especially since the US banking system suffered a fatal heart attack in September 2008. It has not recovered since, still insolvent, still wrecked, having returned a zombie center with a USTBond carry trade core and continued money laundering basement lifeline. The Jackass is tired beyond words, beyond description, of hearing that the Zero Percent Interest Policy is being kept as a stimulus measure to encourage continued economic recovery. It is neither a stimulant, nor is the USEconomy in recovery mode. The official 0% rate signals a death knell to the national financial foundation and economic vibrancy, the climax event slow in its pathogenesis following the departure from the Gold Standard in 1971. The official 0% FedFunds rate (call it 25 basis points, no matter) is a direct signal of terminal illness for the entire capitalist structures within both the United States and its Western partners who stupidly or helplessly follow its lead. They followed the US lead in the housing & mortgage bubble disaster with complete wreckage, yet they continue to follow the US monetary lead. They claim to have no choice. They do indeed have a choice, to discard the USDollar and to sell out of the USTreasury Bond, to impose a Gold Standard.

The Gold Trade Standard is coming into view. The East is no longer following the US lead, as a rebellion against the USDollar and its toxic USTreasury Bond is well along. The Eastern giants Russia and China are forging a new path, to install a new Gold Trade Standard that thumbs its nose at the Western banking system and the FOREX currency market. Its marketplace will be the Eurasian Trade Zone, and its gold central bank will be the BRICS Development Fund (clever name to disguise its eventual function). Last holiday weekend, a public article was penned by the Jackass, but due to the limited opportunity for the Easter and Passover times, the article entitled "USDollar: Ring-Fenced & Checkmate" was posted only on the Gold Seek website (CLICK HERE) as a personal favor.

The Gold Trade Standard is coming into view. The East is no longer following the US lead, as a rebellion against the USDollar and its toxic USTreasury Bond is well along. The Eastern giants Russia and China are forging a new path, to install a new Gold Trade Standard that thumbs its nose at the Western banking system and the FOREX currency market. Its marketplace will be the Eurasian Trade Zone, and its gold central bank will be the BRICS Development Fund (clever name to disguise its eventual function). Last holiday weekend, a public article was penned by the Jackass, but due to the limited opportunity for the Easter and Passover times, the article entitled "USDollar: Ring-Fenced & Checkmate" was posted only on the Gold Seek website (CLICK HERE) as a personal favor.

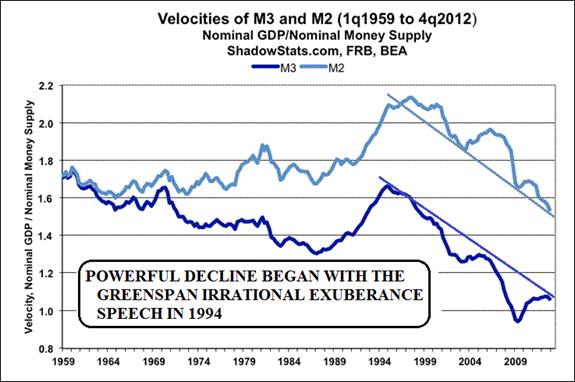

MONEY VELOCITY DYING ON THE VINE

It deserves extreme emphasis that the United States has put a zero price on money, and therefore two extremely important consequences are immediate. The first is that all capital is falsely priced, which causes a cancer to flow and filter throughout the entire business sector where capital is at work. Secondly, all financial assets are improperly priced, from stocks to bonds to property that ranges from commercial buildings to farmland to port facilities. The USEconomy suffers from capital mortality and capital wreckage. The US Federal Reserve by keeping the official rate near zero for four years, has in effect subjected the USEconomy to a death sentence. Evidence is seen in the Money Velocity. The USFed told the nation in early 2009 that the 0% was temporary. It was not, and the Jackass called them liars then, correctly so. They oversee ZIRP forever and QE to Infinity.

Notice the severe decline in money velocity. Even the incompetent economists recognize the importance of money flowing through the economic arteries. The banks are debilitated by a sclerosis which has spread to the body economic. The finger of blame goes initially to Sir Alan Greenspasm, who was the architect of monetary inflation management. The Mr Magoo lookalike urged the nation to tap into home equity for sustained consumption. He personally urged the renewed housing bubble, which enabled him to leave office an apparent winner. He never advocated a new business cycle, only a new speculative cycle. Greenspasm defended to the hilt the sophistication of the risk offload vehicles in derivatives, those toxic unregulated bank chits sold in the underground market where rats prevail. Beware that nothing has been solved, nothing has been attempted in solution, and the money velocity bears out the gradual death process of money itself. Money is tired, soon to be retired. It has no value in interest yield. It has no value indirectly, due to its free creation and distribution by the chief capital moron bottle washer (liquidity room) in charge of the USFed. He boasted of the electronic printing press with zero cost. Its heavy usage has rendered capital within the USEconomy to have zero value. It is in a grand retirement trend, in response to rising costs and shrinking profitability. Capital gradually in the US is dying.

An historical event look shows the decline in the effectiveness of money has a much longer established pattern. The trend down in money velocity has been in progress since the 1980 decade. My firm belief as an analyst and statistician is that the forfeiture and abandonment of industry from the USEconomy had a devastating effect over the decades. The legitimate income from tangible work was removed. The nation grew devoted and dependent upon asset bubbles for wealth and disposable funds for consumption, not actual work. The United States has pushed itself into a corner with a monetary straitjacket, a criminal banker elite class in charge, and a systemic failure that approaches rapidly. The harsh police state will be the outcome from refusal to liquidate the big US banks.

GRAND WET BLANKET & RISING TIDE OF COSTS

Capital destruction is not perceived by the harlot economist coven. They are paid to regard the 0% banner and QE operation as wildly stimulative. It is not. It is rather a grand wet blanket that smothers the capital at work, or drowns it from a rising tide of costs. The income side is slowed since legions of savers are denied a proper reward for putting their savings capital into the system, put to work. The pension funds are found wanting on income yield, as they take extra risks to find the required yield. The USFed has in essence forced the nation to adopt the moral hazard, to face the risks from the likes of mortgage bonds, and to suffer grand losses. Those folders full of bank CDs (certificates of deposit) earn a piddling 1% to 2% in interest, far less than the running rate of price inflation most evident in food and gasoline. The ZIRP policy pushes the grand distortions and imbalances within the USEconomy and its obscene forces. Few realize that the income from savings and bonds is equally prominent as consumer borrowing. The savings interest paid slows the USEconomy down in a powerful manner. However, consumer interest rates have not reduced much really, since borrowers are considered greater risks, the banks not so willing to lend. The entire wet blanket causes an attack on capital and its smother from rising costs. The wet blanket on the USEconomy is the grand robe of the banker royalty, purple in color from the de-oxygenated blood condition.

BERNANKE ASSURED SYSTEMIC FAILURE

By promising QE until job growth and economic recovery, Bernanke has assured systemic failure. The USFed monetary policy is rendering harm to the USEconomy in a pervasive powerful systematic process, a death process, an irreversible pathogenesis. The widespread hedge practices against monetary inflation go toward commodities, lifting cost of everything. They hedge to protect their wealth from the official debasement process conducted in desperation by the USFed as central bank. The hedging is done globally. The entire sickening unfolding of events and powerful effects make for a tremendous blind spot to economists, since QE is a huge suppressant to USEconomy. The distortion to the entire pricing of assets is crippling, since cost of money is at the center.

USGOVT DEFICIT WILL GROW, NOT REDUCE

Warning: the USGovt budget deficit will spiral out of control. No recovery is occurring. Both the ObamaCare tax and the Social Security tax hike are inflicting damage on the USEconomy. The constant competition from Asia with its lower wages, lower fringe benefits, lower regulatory burden, and lower taxes, together imposes a tremendous obstacle for the USEconomy. Thus no expansion. The recovery is a marketing myth and propaganda platform toward which the old fascist kingpins in the 1930 decade would offer praise. The sequestered federal spending cuts will reduce economic activity, not restore fiscal health. The USGovt deficits will grow much larger, toward $1.5 trillion again in the next year or two. The morons at the helm and in the dead economic brain trust will put to work their vacant wisdom with austerity and thus introduce the poison pills. The United States faces a perfect storm.

The USFed monetary policy suppresses economic activity by raising the cost structure at a time when almost no businesses are expanding. The untold fact is that the hyper monetary inflation policy firmly in place, pledged to remain in place for another three years, will assure an attack on capital, an attack on business, with a certain rise in business segment shutdowns, with the corresponding job cuts. The nation has turned hopelessly stupid on all matters economic and financial, having totally lost its way. America has no concept or comprehension of capitalism or capital formation. The wretched report card will come in the form of a quickly rising USGovt deficit, which will be covered by the USFed central bank printing press that bears a Weimar nameplate. As the USDollar becomes isolated, so will the USFed in its no so hidden inflation operation to buy USGovt debt that nobody wants. Its bond principal value is zero, yet it sports a lofty high value in the marketplace of horrors. It is Third World toxic paper.

The USFed will become the near total buyer of the toxic USTreasury Bonds issued. Foreigners will not simply avoid the purchase of USTBonds. They will continue to react to the staggering deadly debasement to the USDollar, which undercuts the value of their savings stored in FOREX reserves. They will actively abandon the USTBonds, to find a dumping ground for them, like the vast new BRICS Development Fund, which will morph into a Gold Trade Central Bank. Nations of the world are forming the USDollar alternative on the trade side, not the banking and currency side. Once again like a breath of fresh air, banking will follow trade, a concept that not 2% of American economists understand, or wish to understand. The US Economists are equally culpable for the systemic failure, working side by side with the US bankers.

STRIP BERNANKE OF HIS PhD DEGREE

The Jackass will go so far as to urge the stripping of the PhD in Economics by one Benjamin Shalom Bernanke. In the last four years, he has proved vividly how his doctoral dissertation is incorrect. A flood of liquidity does not in any way remedy insolvency, as his thesis claimed. He is the principal architect of revisionist history concerning the Great Depression, used as qualification for succeeding Greenpasm. Without the Gold Standard in place, the United States would never have climbed out of the powerful depression 80 years ago. In the present day, since no Gold Standard is in place, the United States will face systemic failure, USGovt debt restructure (default), and severe ignominy. By the way, in all my years, only one time was seen a stripped doctoral degree. A college professor had his Statistics PhD removed, when a solid young mathematical statistician proved his thesis as false. Poor Archie! Bernanke provides the discredited proof by himself, with the principal victim being the US banking system. It is sclerotic, zombie, and hollowed out. The USEconomy's industry has been hollowed out since the 1980 decade, starting with Intel relocating to Japan and the Pacific Rim. The crowning blow was the dispatch of US industry to China, replete with Wall Street betrayals that followed their ransacking of Fort Knox. It is utterly amazing that 95% of American citizens do not care about the empty vaults in Fort Knox. Actually they are not empty, since they contain nerve gas in a great repository. Note the irony!

EASTERN EXIT STRATEGY FROM USDOLLAR

The USFed stated publicly in early 2009 their desire to pursue an Exit Strategy. The Jackass on repeated occasions over three years ago refuted and contradicted their claimed path on monetary policy restoration to normalcy. My belief, borne out as the case, was that the USFed had painted itself into a corner, could not raise interest rates, and would be forced instead to monetize the USGovt debt, with no path offered toward normalcy. That is precisely what happened. Pardon my lack of deep formal training in Economics, since my wish was not to be encumbered by the limitations of economics credentials. The economist corps is little more than a gaggle of Wall Street harlots and USGovt apologists that operate the propaganda to produce constantly deceptive messages. There is an Exit Strategy, but it is evident in the East. The Eastern nations are assembling a Eurasian Trade Zone and a BRICS central bank (aka Development Fund) with which they will exit the USDollar global reserve standard. In doing so, they will not require to fill their banking systems any longer with toxic USTBonds. The end of the USDollar as global reserve is near, visible in tangible form.

The propaganda has never run so thick, whether on the sluggish economic recovery, the benefits of new national health care, the housing market rebound, or the threat of terrorism. The majority of Amerkans gobble the Goebbels garbled spew from the bank nazis. One is left to wonder if the US systemic breakdown and failure will be blamed on Iran or North Korea. Maybe blame will befall the Arabs, who are close to abandoning the Petro-Dollar defacto standard. When they accept Euros, Pounds, Yen, and Francs for crude oil, the game is over the lights turned off on the USDollar reign of terror. Some climax events are very near, warned by Cyprus, set up by legislation, created by a gradual methodical isolation of the USDollar for its rejection as global reserve currency. Most Americans regard the USDollar as their currency, with zero knowledge or awareness of its function as a global reserve, the staple item within myriad banking systems across the world. For their error, they will face catastrophic losses to their life savings, unless they have invested in Gold & Silver bars and coins.

LIQUIDATE BIG BANKS OR SYSTEMIC FAILURE

Some important messages should be heard. At the macro level, the entire financial system has become hopelessly sclerotic. The chronic Western financial crisis is more like a monetary war for elites to retain control of the production of money, the setting of rules, the process of confiscation, while they desperately attempt to preserve the fiat currency system with the USDollar as its flagship. That ship should fly the Skull & Crossbones as its flag. The refusal to liquidate the big insolvent banks stands as the quintessential message of corruption and control to execute the Fascist Business Model, which will result in systemic failure. With MF-Global and Robo Foreclosure Fraud and Cyprus Bank Taxes, layered atop the QE to Infinity, the fascist bankers are finally unmasked. They were never defeated in the 1940 decade. They migrated to the banks in Switzerland, London, and New York. The big banks no longer serve as capital formation engines. They no longer serve as business investment partners. They are pure predators. At a micro level, they are giant hollow reeds ripe with bond fraud, phony accounting, insider trading, replete with financial market parasite functions. They are not credit engines for commerce, but rather carry trade platforms and money laundering centers.

If the big US banks are not liquidated, absolutely no solution will come, and systemic failure will eventually occur. They are not too big to fail institutions. They are not systemically important financial institutions. They are the criminal syndicate foundation headquarters. If they are liquidated, the nation will enter a USGovt debt default. It is that simple. Our compromised leadership crew will impose fascist police state rather than liquidate the big banks where power center lies. Tainted money and bribery with threats has changed the nation at the top, the Congress a den of thieves and panderers. As the Italian Mafia prefers to say, the fish rots from the head down. Thus the need for removing guns, as the great USDollar devaluation comes and price shock will arrive on the household doorsteps in the form of much higher food prices (bread, milk, eggs) and much higher energy prices (gasoline, electricity).

Since the big US banks will never be liquidated, instead the nation will be liquidated. Its wealth will be subjected to a vanishing act. The nation's households suffered the loss of home equity, under exploit by the banking sector. Their bond fraud and contract fraud and a plethora of other criminal activity have been converted into mere business costs, under the tarp of the Fascist Business Model. The nation's pensioners have suffered the loss of income, no longer given a justified yield on their life savings. The futures contract players have been given fair warning by the MF-Global private account thefts, with an echo from the Peregrine Financial Group matching private account thefts. The recent bankruptcy law revision and financial regulatory bill revision have given clear warning in their many insidious provisions. Next comes the vanishing of private bank accounts, private pension accounts, private stock accounts, private mutual fund accounts, and private bank safety deposit boxes. The loss will not be total in most cases. The sleepy dopey bombarded nation is about to receive a wake-up call, since all past calls have resulted in the doze button hit, a drowsy pause for a few more months (years) of sleep.

END GAME MOTIVE TO IMPOVERISH

A sinister vile malicious motive is coming into view, hidden for years within legislation, pushed to the fore by newer regulatory legislation. What is coming is a magnificent vanishing act of wealth itself, since the Western economic system has suffered diverse Ponzi symptoms for 20 to 30 years. Its financial foundation has been built on money fashioned from debt. A major debt downgrade on private savings, brokerage accounts, pension funds, and more is scheduled, since money is disguised debt. Worse, a pernicious attack is set to be waged on private wealth. The first volley was to strip citizens of their home equity, that prized homestead nest egg of wealth. The second volley has been more hidden, the removal of wealth held in the stock market. It is held up in value by hyper monetary inflation. Its purchase power in value diminishes by the month during the currency debasement process.

The unmasked evil motive has been to buy time. The real purpose of the Zero Percent Interest Policy, complete with its monetary straitjacket in Global QE to Infinity, is to bail out the elite bankers and to delay the systemic breakdown. The only dominant buyer in USTreasury Bonds is the US Federal Reserve, the army of foreign creditors having departed the room long ago when QE2 was launched. The ZIRP & QE morgue toe tags are designed a) to provide a high volume buyer of toxic mortgage bond and related fraud-ridden instruments, b) to keep USGovt borrowing costs down, thus preventing an enormous rise in budget deficits, c) to enable Wall Street speculation in financial markets, with zero cost money, d) to create the USTBond carry trade arena for the big banks, investing in long-term USTBonds, and e) to finance the wars of aggression that attempt to secure supply, while enabling contract fraud. But the ugliest attack on private wealth is left for last, which will shock the nation and introduce the unmistakable police state. It will herald entry to the de-Industrialized Third World.

THE 2005 BANKRUPTCY LAW

The law has come front and center into view. Its features, reinforced by the Financial Regulatory Bill (aka Dodd-Frank Law) have never been more important than now. The individual side to the reformed bankruptcy provisions received the most attention, including for the Jackass. It removed the Chapter 7 wipeout of debts in offset by assets, done formerly in sweeping step. Once done, the deck cleared, fresh air abounded, the path made new. However, it made standard Chapter 13, in restructure of debt with respect to income, establishing a lifetime of tax obligations. But the corporate side is far more pernicious, learned only two years ago by the Jackass. It subordinated all bank assets under the derivatives owned by financial firms. The subordinated structure still exists, like senior & junior bond holders, savings accounts, certificates of deposit, mutual funds under management, money market funds, but these all lie subordinated UNDER the vast derivatives, the unregulated contracts. The updates to these laws are clear as a cloudless day in bright sunshine. The United States and United Kingdom, even Canada, have enacted laws that serve as guidelines in the preservation of the largest banks, by forcing the vanishing of private accounts. Better described, the laws offer guidelines on the death of the big banks, since they will be washed clean of assets, including those of private citizens. The insidious Bail-In Laws will catch attention. Their invocation in Cyprus was the alarm sounded. Not many Americans heard it clearly, still distracted, still dopey, still gullible, still incredulous. It could never happen here?!?!

Protected are the Systemically Important Financial Institutions (SIMI), the pillars of corruption, the control towers for the fascist state. The USGovt will protect the SIMI institutions, as they interpret, not as the people interpret. The unmistakable conclusion is that a debt slave state is being created, where the people are to be stripped of wealth. Maybe it was never real anyway, since the money is debt in disguise, not bonafide money. The private individual assets are to be lost to dark room assets with no regulatory oversight, in a grand titration process of derivative acid (H+) acting against private wealth alkali (OH-) to produce fresh water held for the elite to drink. Here is where the vicious side is blatant and in your face. The declared losses to private assets will be at the full discretion of the syndicate bosses. The size of derivative exposure is 1000 times greater than private assets. Therefore, the law appears to be a device to impose national poverty via eradicated wealth, since the private wealth in no remote manner is of sufficient magnitude to restore the banks to health. Thus the interpreted debt slave state within the fascist police state.

The FDIC has been transformed, not to insure depositor wealth, but to remove it, to confiscate it, to tax it, and to make it vanish. Protection comes from removal of personal assets from the financial and banking system altogether. It would be best to use the banking system in a utility function, for cash flow purposes, maintenance of bill payment, the account balances kept to a minimum in case of confiscation suddenly during unscheduled bank holiday. Ideal to invest in Gold & Silver bars & coins, kept outside banks, preferably outside USA. A powerful wave of devastation comes.

GOLD MARKET DIVERGENCE

The Jackass forecast of 2009 and 2010 and 2011 and 2012 is coming to pass. The divergence between the paper Gold price dominated by futures contracts, and the physical Gold price dominated by purchase and delivery of the metal bars, has grown wide and will grow wider. While many are heard in the hue & cry of the declined supposed Gold price, it is not the Gold price. It is the corrupted paper Gold price that the deceived masses focus too much on. The professionals in the Gold market who actually act on contracts for large volume deliveries are noticing the strains on supply, which is fast disappearing. The true Gold price is much higher than advertised by the corrupted networks devoted to the financial syndicate in charge. The drainage of the COMEX and LBMA is hastened, made quick by the discount offered. The Boyz are draining their own blood on stage in full view, but the majority within the gold community are lamenting the falling corrupted price. What irony! The Boyz in New York and London are committing bank suicide on the global stage, yet the investor crowd cannot see. When the big US and London bank vaults are empty of gold bullion, the game will suddenly change. The power will shift to the East. The USDollar will be devalued, buried, replaced. The Gold Standard will rise in the East like the sun in a new dawn, but a standard based in trade settlement that will turn the West upside down.

The Shanghai Metals Exchange sports a significant useful practical Gold price spread, higher than the posted London and New York price. It has opened the door for arbitrage for the last two months or more. My firm suspicion is that the BRICS Development Fund will convert USTreasury Bonds by means of the Shanghai window, thus draining the London centers of their gold bullion. As of 8am today in London, the Shanghai Gold price had a 1591 handle, compared to a 1555 handle in London. That constitutes a $36/oz spread, very feasible for arb trades and the associated drainage of London metal. The professionals are having a field day, exploiting the artificially offered Gold price achieved from yet more naked gold futures contract shorting. The depletion of the SPDR Gold Trust (GLD shares) continues at a frenetic pace. The big US banks are shorting the GLD shares, removing its gold bar inventory overnight, and selling into the market. Or else they are covering their similar sales obligations in like manner. The key to the divergence is that as the phony paper Gold price declines more and more, it signals the demise of the COMEX itself, a shutdown. The event cannot happen without the price divergence, the fast falling paper Gold price versus the stable rising physical Gold price. When the COMEX goes dark, from depleted inventory, from vacated client players, the Gold price will actually not be known for some time. Then later, it will be on display from various key centers across the globe, including Shanghai where naked futures contract activity is not sponsored by the state.

The Jackass rejoices at the utter desperation in pushing down the paper Gold price. It signals a fierce unspeakable urgency to fight the inevitable collapse underway. The rumors are thick of a grand systemic event that arrives soon, very soon. One will recognize it by the multitude of citizens with mouths hung open in disbelief. The bank nazis will not see their massive pillars, their syndicate hives be ruined without stripping the US nation of its private wealth. The US is due for a Cyprus-like event soon, very soon. The remaining freedom afforded can be exercised in purchasing Gold & Silver bars and coins, after removing funds from the financial system governed and controlled and denominated by the USDollar. Time is running out. Signals are deafening as in screeching loud shrill.

THE HAT TRICK LETTER PROFITS IN THE CURRENT CRISIS.

From subscribers and readers:

At least 30 recently on correct forecasts regarding the bailout parade, numerous nationalization deals such as for Fannie Mae and the grand Mortgage Rescue.

"I have been a Hat Trick subscriber since 2005. I consider your publication beyond excellent. It is indispensable to understanding the mega-trends of the past such as the housing bust, bank insolvency, monstrous US Government $trillion debt, the Fed's QE to infinity with no feasible exit strategy, and more. Essentially, your analysis exposes and documents the massive corruption ruining the future of young and old alike in America. A simple thank you is really not sufficient to express my deep appreciation of the time and effort you put into the Hat Trick Letters."

(ElaineW in California)

"A Paradigm change is occurring for sure. Your reports and analysis are historic documents, allowing future generations to have an accurate account of what and why things went wrong so badly. There is no other written account that strings things along on the timeline, as your writings do. I share them with a handful of incredibly influential people whose decisions are greatly impacted by having the information in the Jackass format. The system is coming apart on such a mega scale that it is difficult to wrap one's head around where all this will end. But then, the universe strives for equilibrium and all will eventually balance out."

(The Voice, a European gold trader source)

"It has been my hope that the financial collapse would occur within a slower time frame, like a year from now. I have followed your articles on various sites for a while, and have to say that you are very perceptive and accurate as well as analytical. You have been more accurate, detailed and thorough than others, and your Big Picture analysis is usually spot on. I have noticed that it often becomes public news 3 to 6 months later. It is not easy connecting all the dots and understanding the implications one event has on everything else, then interweaving all the threads to grasp that big picture. I don't usually spend the money for a subscription,

but I feel your information is vital to know."

(KathyN from Arizona)

by Jim Willie CB

Editor of the “HAT TRICK LETTER”

Home: Golden Jackass website

Subscribe: Hat Trick Letter

Use the above link to subscribe to the paid research reports, which include coverage of several smallcap companies positioned to rise during the ongoing panicky attempt to sustain an unsustainable system burdened by numerous imbalances aggravated by global village forces. An historically unprecedented mess has been created by compromised central bankers and inept economic advisors, whose interference has irreversibly altered and damaged the world financial system, urgently pushed after the removed anchor of money to gold. Analysis features Gold, Crude Oil, USDollar, Treasury bonds, and inter-market dynamics with the US Economy and US Federal Reserve monetary policy.

Jim Willie CB is a statistical analyst in marketing research and retail forecasting. He holds a PhD in Statistics. His career has stretched over 25 years. He aspires to thrive in the financial editor world, unencumbered by the limitations of economic credentials. Visit his free website to find articles from topflight authors at www.GoldenJackass.com . For personal questions about subscriptions, contact him at JimWillieCB@aol.com

Jim Willie CB Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.