Cyprus Crisis the Story of All Western Nation-states

Politics / Credit Crisis 2013 Apr 02, 2013 - 12:16 PM GMTBy: Peter_Schiff

The news of the month comes from the large Mediterranean island of Cyprus, where Keynesian economic planning left the economy facing complete bankruptcy. The result was an unprecedented step forward in the financial collapse of the West: direct forfeiture of bank deposits.

The news of the month comes from the large Mediterranean island of Cyprus, where Keynesian economic planning left the economy facing complete bankruptcy. The result was an unprecedented step forward in the financial collapse of the West: direct forfeiture of bank deposits.

Despite official protestations to the contrary, this fallout will spread to a bank near you.

A Crystal Ball

The recent history of Cyprus is a microcosm of the story of all Western nation-states.

Under a comprehensive entitlement system, the real economy shrank while the banking system grew. Cyprus came to be a low-tax, high-yield banking haven - mainly for Russian oligarchs. By the most recent measure, the banking sector held assets worth 7 times Cyprus' annual GDP.

Unfortunately but predictably, the Cypriot banking system parked much of these funds in Greek sovereign debt. The ongoing crisis in Greece, then, threatened to sink Cyprus.

The Russian government had already given Cypriot banks a €2.5 billion loan in December 2011, but still considered a "buyout" of Cyprus' national assets in light of the new crisis. Unfortunately, closer analysis revealed that there was little of value there besides a pile of increasingly worthless paper.

Saving The Union

Popular opinion in Brussels is that the worst outcome for the euro currency union would be if one of the member-states were forced out. On this pretext, the ECB has so far bailed out the banking systems of Portugal, Ireland, Greece, and Spain.

When Cyprus faced a run on its banks two weeks ago, the eurocrats stepped in with a new proposal to shore up reserves: forfeiture of 9.9% on deposits over €100K and 6.7% below that level. This has come to be known as a "bail in."

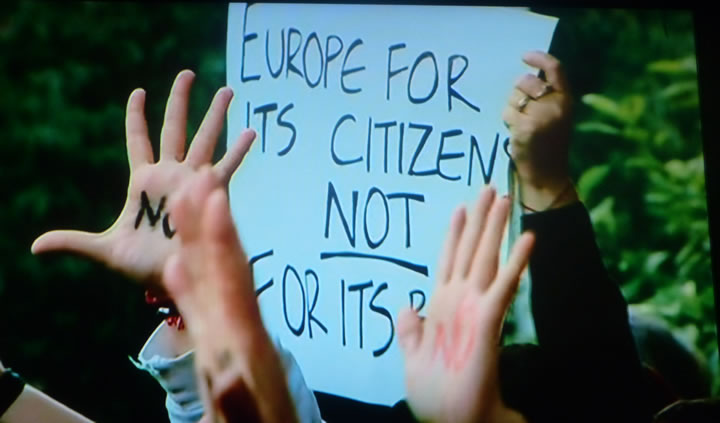

The reaction was immediate and intense. Cypriots took to the streets to protest the anticipated losses and breach of the government's deposit insurance guarantees for amounts under €100K; riot police were deployed. The Russian government was upset it was not consulted and that its citizens' deposits would face even steeper losses. The talking heads lamented the grave precedent that this move would set.

Right or Popular?

An old proverb goes, "What is right is not always popular, and what is popular is not always right." I would take that one step further and say that in recent times, popular opinion is almost always a contra-indicator.

In this situation, again, the pundits and politicians are worried about the wrong thing. They are calling any potential depositor losses a "seizure" or "tax." But this presumes that bank customers are otherwise guaranteed the return of all assets on deposit. While this may be the conventional wisdom nowadays, it is economically incoherent. Depositors losing money is exactly what is supposed to happen when a bank collapses!

The real problem developed over the preceding decades when Western governments led citizens and investors to believe that there was an explicit guarantee on small deposits and an implicit guarantee on every other investment in the banking system - from large deposits to corporate bonds to sovereign debt reserves. This is moral hazard writ large and it has become a Ponzi scheme as capital has been misallocated away from productive uses - leaving little of value to back up increasing deposits. This is especially true in a country like Cyprus, where bank deposits were high-yielding.

Why do depositors or bondholders think they are entitled to interest without risk? That is not how markets work. We earn interest on these investments because we are loaning our assets to the bank. If the bank cannot repay us, we lose.

Unfortunately, to sustain the illusion of bank invincibility, most Western governments have turned to massive wealth transfers in the form of direct subsidies to banks, financed by the hidden tax of inflation.

The inflation tax accomplishes the same goal - reduces the real value of bank deposits and other assets values to accord with the actual capital base of the economy. But it is done in a backhanded way that allows myths to persist about the "safety" of the banking system and the "wisdom" of government management of the economy.

In fact, the inflation tax hurts savers twice: once by the lost interest from suppressed rates and again by the sapping of purchasing power. While the former only hurts depositors, the latter harms everyone holding and using the national currency, not just depositors.

Here's The Deal

After protests that threatened to topple the Cypriot government, a new deal was struck. The country's second largest bank, Laiki, will be shuttered with all deposits over the €100K insurance level wiped out. Accounts under that level would be transferred to the larger Bank of Cyprus, which will itself be confiscating 30-60% of deposits over €100K to shore up its reserves. Bondholders of both banks will also be wiped out. In return, the EU will give Cyprus a €10 billion bailout.

While this national bankruptcy is not being executed according to rule-of-law principles, it is still more honest than the policies of larger Western nation-states. It is a teachable moment, quite unlike the insidious treachery of inflationary solutions.

Cypriots, Europeans, and investors the world over are, for the first time in generations, getting the message that risk is real. Banks are not endless fountains of profit set on unshakeable concrete foundations. In fact, fiat fractional-reserve banking is an inherently unstable system.

Rising Alternatives

There are many signs that the Cypriot government's desperate attempts to keep its system afloat - capricious bailout dealing, an extended bank holiday, and widespread capital controls - have deeply shaken confidence in the entire Western financial system.

Just a few days ago, the Financial Times covered the post-Cyprus spike of interest and inflows into my 100% reserve Euro Pacific Bank. (EP Bank is based in the Caribbean and due to financial regulations, not available to US citizens.)

We're also seeing the rise of the "unbanking" movement, whether through barter associations, Bitcoin, or precious metals.

I have been on radio recently discussing the new Valcambi gold bar that has seen rising sales in Europe and now the US. The 50-gram bar can be broken into 1-gram pieces to be used in trade. This represents a radical shift in how precious metals customers are thinking about their investment. Now it's not just about putting away long-term savings, but even keeping gold ready for day-to-day trade.

The new online peer-to-peer currency Bitcoin saw a sharp spike in value coinciding with the unfolding crisis in Cyprus, even though its recent history has been highly volatile. Under normal circumstances, trading bank deposits for a brand new currency backed only by cryptography might seem foolish - but these are not normal circumstances.

Direct barter is on the rise as well. From Greece to Argentina, and even in my own backyard of Connecticut, I have read about barter clubs flourishing. While this offers some insulation against untrustworthy banks and currencies, participants will quickly learn why money arose in the first place: it allows people to save, invest, and trade outside of their immediate circle of trust.

The Future Is Clear

What happened in Cyprus was not an aberration. The Fed is already seizing the savings from your bank accounts as I write this. It is being done through the covert means of inflation, but rest assured that when the covert means become untenable, overt means will be used as well.

As I have previously written, through Anti-Money Laundering and other regulations, Washington has already erected a financial Berlin Wall around us. The only escape is to pull our savings from the fiat financial system.

While barter and high-tech alternatives compete for the attention of the newly "unbanked," I believe individuals, institutions, and governments are re-learning that gold and silver are the ultimate monetary assets. With every shock to the fiat system, more investors awaken to this fundamental truth.

Peter Schiff is CEO of Euro Pacific Precious Metals, a gold and silver dealer selling reputable, well-known bullion coins and bars at competitive prices.

Click here for a free subscription to Peter Schiff's Gold Letter, a monthly newsletter featuring the latest gold and silver market analysis from Peter Schiff, Casey Research, and other leading experts.

And now, investors can stay up-to-the-minute on precious metals news and Peter's latest thoughts by visiting Peter Schiff's Official Gold Blog.

Peter Schiff Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.