No Significant Capital Flows Into Gold From So Called ‘PIIGS’ Yet

Commodities / Gold and Silver 2013 Mar 28, 2013 - 05:16 PM GMTBy: GoldCore

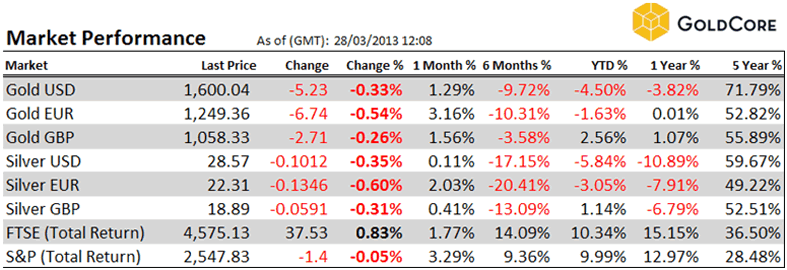

Today’s AM fix was USD 1,602.50, EUR 1,253.13 and GBP 1,057.41 per ounce.

Today’s AM fix was USD 1,602.50, EUR 1,253.13 and GBP 1,057.41 per ounce.

Yesterday’s AM fix was USD 1,591.00, EUR 1,243.75 and GBP 1,052.39 per ounce.

Silver is trading at $28.60/oz, €22.44/oz and £18.97/oz. Platinum is trading at $1,583.00/oz, palladium at $768.00/oz and rhodium at $1,200/oz.

Spot gold and silver closed at $1,606.40/oz and $28.79/oz.

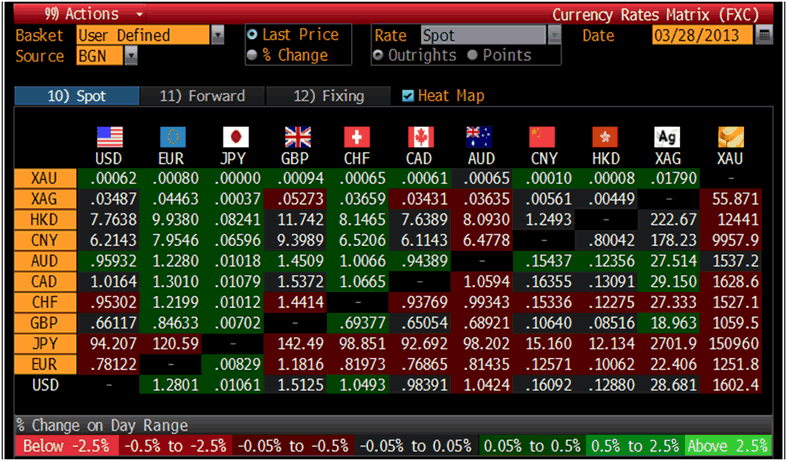

Precious Metals and Currencies Table – (Bloomberg)

Gold continues to consolidate above $1,600 an ounce today supported by widespread concerns that the expropriation of Cyprus deposits could become a blueprint for solving banking crises in the Eurozone.

This is increasing gold's safe haven appeal and will continue to do so in the coming months. As will the real risk of deepening financial instability in the euro zone stoked by the crisis in Cyprus where hundreds of anxious depositors are withdrawing as much of their savings as they can after their banks reopened.

Depositors in Luxembourg, Slovenia, Spain, Italy, Portugal and Ireland will be made more nervous by the scenes of queues outside banks in Cyprus today.

Gold is on track for a 1.6% gain in March, its first monthly rise in six.

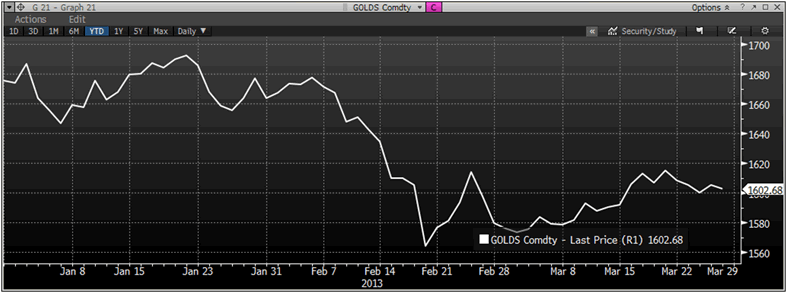

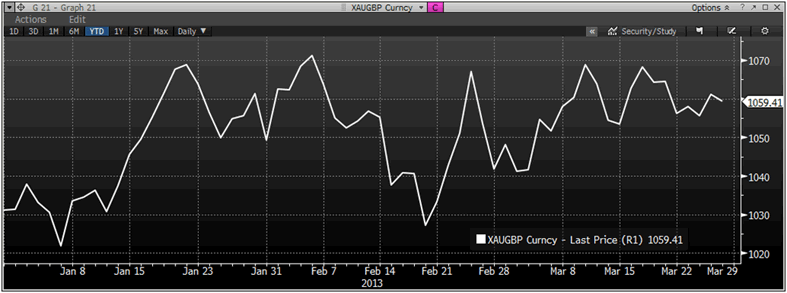

For the quarter, gold is 4.3% lower in dollar terms and 1.4% lower in euros. However, signalling that the demise of gold is greatly exaggerated, gold is 3.7% higher in Japanese yen and 2.6% higher in sterling.

Gold in USD, YTD – (Bloomberg)

The quarter or year to date charts suggest that gold is consolidating and given that the major fiscal, financial and monetary challenges that continue to face the EU and all major economies, we continue to be believe gold remains in a secular bull market.

Currency debasement is set to continue and this allied to the risk of wealth confiscation makes physical bullion a vital asset to own.

Gold in Sterling, YTD – (Bloomberg)

GoldCore have been very busy on the sell side in recent weeks which suggests we are close to a bottom. This week was the first week in three where there were more buyers than sellers.

There were a lot of new account openings after the Cyprus crisis began and in recent days, particularly from Spain and Italy, but there have been no huge flows into gold and nothing on the scale of the Lehman panic.

There are real and growing concerns out there among the European public but as of yet the mass of retail and savers and investors are not concerned enough or more likely not aware enough to diversify into gold.

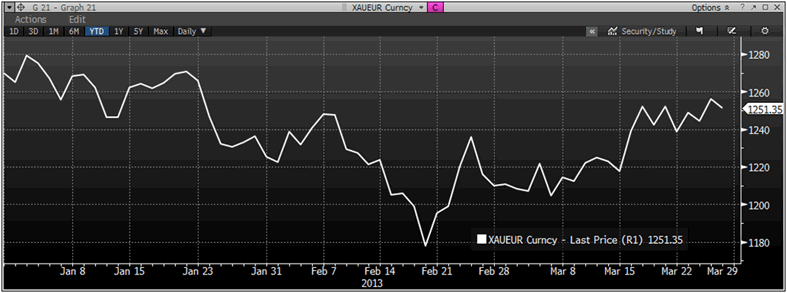

Gold in Euros, YTD – (Bloomberg)

Whoever thought we'd see the issue of safety of deposits come into question?

We did. Since the Lehman Brothers debacle and near collapse of the world’s financial system, we said that there was a possibility that what happened in Argentina and Russia - capital controls including deposit withdrawal restrictions and other draconian measures- would likely be seen in massively indebted periphery nations.

However, we thought such regressive moves would come from misguided and desperate national governments - not from supranational organisations such as the EU and the IMF and from the ECB.

We believe that growing awareness of the risk for individuals and businesses of keeping all their savings and capital in deposit accounts and a gradual realisation of the importance of diversification will lead to significant capital flows into gold.

As one astute financial journalist said to me “ ‘cash in the bank’ doesn’t have quite the same ring to it anymore.”

In most European countries, except for Germany, Austria and Switzerland, cash has been ‘king’ for some time, but that has now changed. This is especially the case as the expropriation was not the doings of the Cypriot government rather it was that of the Troika - the EU, the ECB and the IMF.

Gold is financial insurance which protects against inflation and expropriation of financial assets - such as pensions and now deposits.

Recent events show the wisdom of the old Wall Street adage to always keep 10% of one's wealth in gold and hope it does not work.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.