End of the Gold Bull Market- Ignore Banks' Bearish Statements

Commodities / Gold and Silver 2013 Mar 28, 2013 - 10:21 AM GMTBy: Jeff_Clark

Goldman Sachs has lowered its gold price projections and says the metal is headed to $1,200. Credit Suisse and UBS are bearish. Citigroup says the gold bull market is over.

Goldman Sachs has lowered its gold price projections and says the metal is headed to $1,200. Credit Suisse and UBS are bearish. Citigroup says the gold bull market is over.

So I guess it's time to pack it in, right?

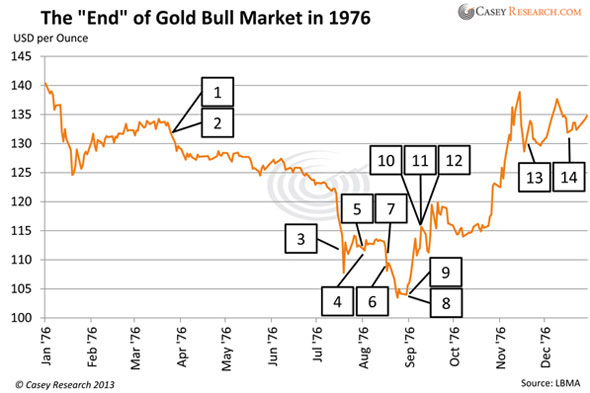

Not so fast. As we've written before, these types of analysts have been consistently wrong about gold throughout this bull cycle. Another reason to disagree, however, is history; we've seen this movie before. In the middle of one of the greatest gold bull markets in modern history – the one that culminated in the 1980 peak – gold experienced a 20-month, one-way decline. Every time it seemed to stabilize, the bottom would fall out again. From December 30, 1974 to August 25, 1976, gold fell a whopping 47%.

1976 had to be a tough year for gold investors. The price had already been declining for a year – and it just kept on sinking. Since that's similar to what we're experiencing today, I wondered, What were the pundits were saying then? I wanted to find out.

I enlisted the help of two local librarians, along with my wife and son, to dig up some quotes from that year. It wasn't easy, because publications weren't in digital form yet, and electronic searches had limited success. But we did uncover some nuggets I thought you might find interesting.

The context for that year is that the IMF had three major gold auctions from June to September, dumping a lot of gold onto the market. Both the US and the Soviet Union were also selling gold at the time. It was no secret that the US was trying to remove gold from the monetary system; direct convertibility of the dollar to gold had ended on August 15, 1971.

The public statements below were all made in 1976. You'll see that they aren't all necessarily bearish, but I included a range to give a sense of what was happening at the time, especially regarding the mood of the gold market. I think you'll agree that much of this sounds awfully darn familiar. I couldn't resist making a few comments of my own, too.

To highlight the timing, I put the comments into a price chart, pinpointing when they were said relative to the market. Keep in mind as you read them that the gold price bottomed on August 25, and then began a three-and-a-half year, 721% climb…

[1] "For the moment at least, the party seems to be over." New York Times, March 26.

[2] "Though happily out of the precious metal, Mr. Heim is no more bullish on the present state of the stock market than any of the unreconstructed gold bugs he's had so much fun twitting of late. He's urging his clients to put their money into Treasury bills." New York Times, March 26.

Me: These comments remind me of those today who poke fun at gold investors. I wonder if Mr. Heim was still "twitting" a couple years later?

[3] "'It's a seller's market. No one is buying gold,' a dealer in Zurich said." New York Times, July 20.

Turns out this would've been an incredible buyer's market – but only for those with the courage to buy more when gold dropped still lower before taking off again.

[4] "Though the price recovered to $111 by week's end, that is still a dismal figure for gold bugs, who not long ago were forecasting prices of $300 or more." Time magazine, August 2.

The "gold bugs" were eventually right; gold hit $300 almost exactly three years later, a 170% rise.

[5] "Meanwhile, the economic conditions that triggered the gold boom of 1973 through 1974, have largely disappeared. The dollar is steady, world inflation rates have come down, and the general panic set off by the oil crisis has abated. All those trends reduce the distrust of paper money that moves many speculators to put their funds in gold." Time magazine, August 2.

This view ended up being shortsighted, as these conditions all reversed before the decade was over. Does this sound similar to pundits today claiming the reasons for buying gold have disappeared?

[6] "Our own predictions are that gold will go below $100, with some hesitation possible at the $100 level." As stated by Mr. Heim in the August 19 New York Times.

Yes, this is the same gentleman as #2 above. I wonder how many of his clients were still with him a few years later?

[7] "Currently, Mr. LaLoggia has this to say: 'There is simply nothing in the economic picture today to cause a rush into gold. The technical damage caused by the decline is enormous and it cannot be erased quickly. Avoid gold and gold stocks.'" New York Times, August 19.

You can see that these comments were made literally within days of the bottom! Take note, technical analysts.

[8] "'Gold was an inflation hedge in the early 1970s,' the Citibank letter says. 'But money is now a gold-price hedge.'" New York Times, August 29.

Wow, were they kidding?! This reminds me of those dimwits journalists who said in 2011 to not invest in gold because it isn't "backed by anything."

[9] "Private American purchases of gold, once this was legalized at the end of 1974, never materialized on a large scale. If the gold bugs have indeed been routed, special responsibilities fall on the victorious dollar." New York Times, August 29.

The USD's purchasing power has declined by 80% since this article declared the dollar "victorious."

[10] "Some experts, with good records in gold trading, declare it is still too early to buy bullion." New York Times, September 12.

Too bad; they could've cleaned up.

[11] "Wall Street's biggest brokerage houses, after having scorned gold investments during the bargain days of the late 1960s and early 1970s, made a great display of arriving late at the party." New York Times, September 12.

No comment necessary.

[12] "He believes the price of bullion is headed below $100 an ounce. 'Who wants to put money over there now?'" As stated by Lawrence Helm in the New York Times, September 12.

The price of gold had bottomed two weeks before, making the timing of this advice about the worst it could possibly be.

[13] Author Elliot Janeway, whose book jacket states, "Presidents listen to him," was asked by a book reviewer about his preferred investments. He writes: "Then, gold and silver? He likes neither. In fact he writes: 'Any argument against putting your trust in gold, and backing it up with money, goes double for silver: silver is fool's gold.'" New York Times, November 21.

Mr. Janeway ate his words big-time: from the date of his comments to silver's peak of $50 on January 21, 1980, silver rose 1,055%!

[14] "Mr. Holt admits that 'in 1974, intense speculation caused the gold price to get too far ahead of itself.'" New York Times, December 19.

So, anything sound familiar here? Yes, it was a brutal time for gold investors, but what's obvious is that those who looked only at the price and ignored the fundamentals ended up eating their words and dispensing horrible advice. Investors who followed the "wisdom of the day" missed out on one of the greatest opportunities for profit in their lifetimes.

I was pleased to learn, though, that not all comments were negative in 1976. In fact, in the middle of the "great selloff," there were those who remained stanchly bullish. These investors must've been viewed as outliers – they, much like some of us now, were the contrarians of the day.

Also from 1976…

- "Many gold issues, in fact, are down 40 percent or more from their highs. Investors who overstayed the market are apparently making their disenchantment known. The current issue of the Lowe Investment and Financial Letter says, 'We are showing losses on our gold mining share recommended list… but keep in mind that these shares are for the long-term as investments.'" New York Times, March 26.

Sounds like what you might read in an issue of a Casey Research metals newsletter..

- "The time to buy gold shares," [James Dines] declares, "is when there is blood in the streets." New York Times, September 12.

If you glance at the chart above, Jim's comments were made within two weeks of the absolute low.

- "We're recommending to clients that they hold gold and gold shares," [C. Austin Barker, consulting economist] says. "The low-production-cost mines in South Africa might be interesting to buy for the longer term because I see further inflation ahead." New York Times, September 12.

Investors who listened to Mr. Barker ended up seeing massive gains in their gold and gold equity holdings.

- "The probability of runaway inflation by 1980 is 50%... In light of this, the only safe investments are gold, silver, and Swiss francs,'" said the late Harry Browne on November 21 in the New York Times.

- "In the longer run, [Jeffrey Nichols of Argus Research] believes gold's price trend 'is much more likely to be upward than downward.'" New York Times, December 19.

The "longer run" won.

- "'I think the intermediate outlook for gold is a period of consolidation and a bit of dullness,' says Mr. Werden. 'However, six or nine months from now, we could see renewed interest in gold.'" New York Times, December 19.

He was right; within nine months gold had risen 13.5%.

- "Mr. Holt offers some advice to investors who are taking tax losses on their South African gold shares – some of which are selling at just 30 to 35 percent of their peak prices in 1974. 'If leverage has worked against you on the way down,' he reasons, 'why not take advantage of it on the way up?'" New York Times, December 19.

Solid advice for investors today, too.

- "What's his [Thomas J. Holt] prediction for the future price of gold? 'A new high, reaching above $200 an ounce, within the next couple years.'" New York Times, December 19.

His prediction was conservative; gold reached $200 nineteen months later, by July 1978.

It's clear that there were positive "voices in the wilderness" during that big correction, and as we all know, those who listened profited mightily.

There were other interesting tidbits, too. For example, gold stocks had been performing so poorly for so long that some advisors suggested a strategy we also hear today…

- "It is probably too late to sell gold shares, the stock market's worst-acting group these days, except for one possible strategy: selling to take a tax loss and switching into a comparable gold security to retain a position in the group." New York Times, September 12.

Even back then, it was widely known that gold often bucks the trend of the broader markets…

- "You might put a small portion of your money into gold shares and pray like the dickens that you lose half of it. In that way, chances are that if gold shares go down, the rest of your stock portfolio will go up." New York Times, September 12.

Gold miners provided critical revenue and jobs, just like today. From the August 2 issue of Time magazine…

- "South Africa, the world's largest gold producer, is being hurt the most. The price drop will cost it at least $200 million in potential export earnings this year."

- "Layoffs at the gold mines would make it even worse – the joblessness could intensify South Africa's explosive racial unrest."

- The Soviet Union, the world's second-largest gold producer, is feeling the price drop, too. The Soviets depend on gold sales to get hard currency needed to buy US grain and other imports."

Gold was also used as collateral…

- "The international gold market was also roiled yesterday by a report by the Commodity News Service that Iran was negotiating to lend South Africa roughly $600 million, predicated on a collateral of 6.25 million ounces of gold."

And just like today, there were plenty of stupid misguided US politicians: From the New York Times on August 27:

- "The drop in gold bullion prices from $126, which was the average at the first IMF auction June 2, provoked the Swiss National Bank to attack Washington's attitude toward the metal as 'childish.' Aside from the estimated $4.8 billion of gold reserves held by Switzerland, bankers there advocate some role for the metal as a form of discipline against unrestricted printing of paper money."

That last statement from the Swiss bankers is hauntingly just as true today.

Last, you know how the government in India has been tinkering with the precious-metals market in its country? And how it's led to smuggling? From the New York Times on August 27:

- "India announced it was resuming its ban on the export of silver. India is believed to have the largest silver hoard and the government there freed exports earlier this year as a means of earning taxes levied on overseas sales. However, most silver dealers minimized the significance of India's move yesterday. As one dealer explained, 'Smuggling silver out of India is so ingrained there that the ban will have no effect on the flow. It never has. Indian silver will continue to ebb and flow into the world market according to price.'"

So what's the difference in mood today vs. the mid-1970s? Nothing! This shows that the same concerns, fears, and confusion we have now existed at a similar point in the gold market then. There were also those who saw the big picture and stayed vigilant. Virtually every comment made in 1976 could apply to today. Keep in mind that most of the statements above are from two publications only; there are undoubtedly many more similar comments from that year.

The obvious lesson here is that patience won out in the end. It took the gold price three years and seven months to return to its December 1974 high. It only took another 18 months to soar to $850. Today, that would be the equivalent of gold falling until June this year, and not returning to its $1,921 high until April, 2015. It would also mean we climb to $6,227 and get there in November, 2016. Could you wait that long for a fourfold return?

This review of history gives us the confidence to know that our gold investments are on the right track. I hope you'll join me and everyone else at Casey Research in accepting this message from history and staying the course.

So, what will your kids or grandkids read in a few decades?

- "Buy gold. It's going a lot higher." Jeff Clark, Casey Research, March 24, 2013.

Gold is going higher, but gold producers are going to go higher still. Now, junior gold explorers… if you select the right ones, you'll experience life-changing gains. Identifying junior gold miners with the right stuff is how contrarian investing legends Doug Casey, Rick Rule, and Bill Bonner have made millions – and right now you have the opportunity to hear them reveal exactly how they did it, and how you can, too. It's all happening during the upcoming Downturn Millionaires web video event, which is free. To learn more, click here.

© 2013 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Casey Research Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.