Let’s Get Cyprused!

Politics / Credit Crisis 2013 Mar 27, 2013 - 05:11 PM GMTBy: Andy_Sutton

There is little doubt that the past two weeks have brought about dramatic changes in most circles regarding the way people look at banks, bank deposits, and the monetary situation in general. This year’s ‘Ides of March’ will no doubt go down in history as a pivotal period where once again our world changed forever. One would be right in stating that there have been many such watershed events in the past decade and a half and that alone should be even more persuasive to those who believe we still live in the bull market of the 1980s. This is not your father’s market, nor his country, nor his world.

There is little doubt that the past two weeks have brought about dramatic changes in most circles regarding the way people look at banks, bank deposits, and the monetary situation in general. This year’s ‘Ides of March’ will no doubt go down in history as a pivotal period where once again our world changed forever. One would be right in stating that there have been many such watershed events in the past decade and a half and that alone should be even more persuasive to those who believe we still live in the bull market of the 1980s. This is not your father’s market, nor his country, nor his world.

So what exactly happened in Cyprus that changed everything? The goal here is to provide something of a post mortem on the situation – with the recognition that it is still ongoing. However, some of the major decisions have been made and, fallout notwithstanding, are somewhat set in stone.

The Parallels with 2008 (And Before)

Make no mistake about it; ‘The Great Cypriot Train Robbery’ adhered closely to the now accepted methodology of conquest by fear used successfully in America in 2008 when the banksters wanted their $750 billion bailout from Congress.

While the purpose of this piece is not to relive that experience, it is critical that people see the progression in place just over the past 5 years. I must point out that all of these situations are able to happen because banks have outlived their usefulness in our society – at least in their present form. The whole purpose of having banks (of the Savings & Loan variety) in the first place was to solve one of the primary challenges facing a direct exchange economy – that of coincidence of wants. Or, to use more commonly accepted vernacular, to bring together those with savings and those with a demand for that savings. It allowed the saver to indirectly ‘invest’ in the commercial activities of the borrower. The bank acted as a conduit, charging interest to the borrower and paying interest to the saver – all at rates that made it economically feasible for all parties to engage in the transaction.

Today we have a system that is half-baked at best, born half improvised and half compromised. The improvisation created the moral hazards and the compromise allowed these institutions not only to leverage themselves into insolvency, but to attach the economies of entire nations to their activities as well. The main firewall preventing this, the Glass-Steagall Act, was torn down over a decade ago. The morphing that has taken place since then set the stage for the rampage of financial crises we’ve witnessed over the past half dozen years. The factor that should be most concerning regarding this aspect is the consolidated nature of the global banking system and the fact that nearly every nation of consequence allows the same types of risky activities that are permitted (and even encouraged) both in America and the Eurozone. There is no longer such a thing as an isolated incident. Everyone has exposure to everyone else’s bad bets.

What About Depositor Guarantees?

Obviously the Cypriots learned the hard way a lesson that should have been learned from Argentina circa 2000: when the chips are down, hold onto your wallet. If the rest of the world has learned nothing else from this ordeal, it should be that nothing in the economic/financial world is sacrosanct, especially when it comes to assets.

We’ve now watched an entire first-world continent succumb in large part to the demands of the banker-elites, in that they’ve pledged the economic efforts of the people ad infinitum to support ‘bailouts’ that have zero chance of working. Yes, zero chance. As long as governments continue to overspend and incur new debt while the piranhas in the trading pits make all manner of insane bets on said debt, this will continue to devolve into a persistent crisis state. Double that for the consumer whether it is through mortgages (which various institutions love to bet on), credit cards or other kinds of debt. Think about it. When in the last half decade hasn’t there been a crisis going on somewhere?

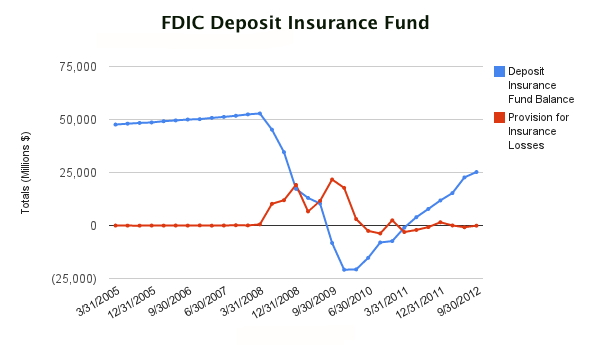

The bottom line is there is no such thing as a depositor guarantee. Not anymore. You’re on your own. I don’t care if you’re in Albuquerque, NM or Auckland, New Zealand. There is no guarantee. What about FDIC? What about it? First of all it doesn’t apply in a Cyprus-like situation. FDIC is specifically for bank failures. And if the government taxes you to make your bank non-failing, then it is a tax and taxes just aren’t covered by FDIC. If you want to see who is going to guarantee your funds, look in the nearest mirror. Secondly, even if the FDIC wanted to, there is no way it could cover the kinds of losses depositors would suffer even under a modest ‘haircut’ type situation. Take a look at the FDIC’s pitiful reserves as of 9/30/12 for dealing with any type of bank failure:

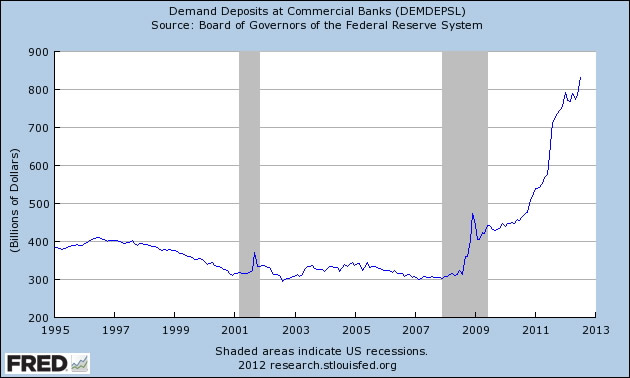

The ‘Fund’ has a mere $25 billion available and there are many questions about how much of that money is even ‘free and clear’ that it could be used to bail out anything. To put it in perspective, $25 billion is about 4.75 days of government borrowing at the current rate, about 0.1% of US GDP, or (and most importantly), about 3% of all US demand deposits as of the end of 2012. This alone should demonstrate that even if the FDIC were so inclined or obligated, it would prove to be completely impotent at backstopping any type of Cyprus-style bank confiscation.

The Rest of the EU Has Been Warned

Earlier this week, the UK Telegraph ran an article in which senior EU official Jeroen Dijsselbloem said that the folks in Italy and Spain in particular ought to be ready to fund a bailout should any of their banks require it. Gee, I wonder how long it’ll be until one of those banks hits the mat? Don’t forget who is running these countries and WHERE they came from. Just think of Hank “I never saw a bailout I didn’t like” Paulson.

From The Telegraph:

The euro fell on global markets after Jeroen Dijsselbloem, the Dutch chairman of the Eurozone, announced that the heavy losses inflicted on depositors in Cyprus would be the template for future banking crises across Europe.

“If there is a risk in a bank, our first question should be ‘Okay, what are you in the bank going to do about that? What can you do to recapitalize yourself?’,” he said.

“If the bank can’t do it, then we’ll talk to the shareholders and the bondholders, we’ll ask them to contribute in recapitalizing the bank, and if necessary the uninsured deposit holders.”

Seriously, if Dijsselbloem gets anymore radical someone might suggest that he run for the mayor of Chicago – or maybe even New York City. I wonder what his stance on 16oz sodas happens to be? Come on Jeroen, enquiring minds want to know!

All levity aside, however, the warning has been given. The think tank position papers on these topics are so old that the edges are starting to yellow. Theory and policy desire have become practice and the practice is spreading.

America’s Next Crisis?

Obviously the bulk of readers of this periodical reside in the United States and as such are seeking input on the likelihood of such a scenario taking place here. I will quickly grant that the EU has been in turmoil for the better part of three years now and it has finally come to forfeiture of deposits. Why did they wait for little Cyprus instead of pulling a similar stunt in Greece, Italy, Spain, or even Portugal or Ireland? Simple. First of all it was a nice way to extend the state ornithological symbol to the Russians.

Russia has been dreadfully ornery lately and, even worse, has been acting awfully protectionist. That kind of independent thinking just isn’t welcome in a post NAFTA/GATT/WTO world. Make no mistake that there is at least an element of muscle-flexing between the world’s power brokers going on in this whole thing. Cyprus became their battleground. The tax haven status didn't’ help their cause either. If you happen to run a small island nation with a simple economy, it might be wise to think twice before trying to create a Club Med style resort for the global moneychangers. Seriously, it is bad for national health not to mention bank deposits.

Back to America and where we fit into all this. I have been asked at least a hundred times since this Cypriot situation boiled over what people could do about this. The answer stays the same. We remain one headline from being in the same boat as the Europeans. Our economic transgressions are even more grave than theirs and are several orders of magnitude deeper as well. Our currency is the foundation that the other houses of cards that are currently collapsing have been built on.

While the Dollar may be the last to go in terms of the monetary cycle, a quick look at history says that it will in fact fail. Paper currencies, by their very nature, are doomed to failure. The biggest mistake we could make in America is to assume that for whatever reason we get a free pass on this. We don’t, so forget about it. What is also true is that this could easily take a bit longer than many of the folks who are commonly referred to as ‘gloom and doomers’ would have us believe.

Many feel hyperinflation and bank runs are imminent. I will say right here that a hyperinflationary event at this point is impossible. Why? What about all the debt? What about all the unfunded liabilities, etc.? Yes, all that is true, but the biggest piece of the ‘immediate hyperinflation’ scenario is missing and that is a wage-price spiral. Prices are certainly rising, but wages are stagnant. If there is to be a Weimar-style monetary event in America, then wages are going to have to start increasing, slowly at first, then assuming a parabolic-type growth pattern. We’re just not there at this point.

Right now, wages are the limiting factor. I’ve heard the argument that credit could step in place of wages and to a certain extent that is true, but there is a specific point where the credit function as it relates to the ability to spend becomes exhausted. There is no mistaking the government’s efforts to induce people to borrow money. All these shenanigans aimed at restoring the housing bubble to 2005 status are clear evidence of that. Not only is it part of generating the wealth effect, the continual accumulation of debt is necessary to drive a fiat monetary system such as ours.

All this said, our banks are very susceptible. The safety nets to protect depositors just aren’t there and the sad reality is that such a small percentage of our money supply exists as cash that it would be patently impossible for everyone in the nation to pull even 10% of their funds from the banks without causing a serious dislocation. Think about it. Even in a paper system, the banks can’t produce deposits on demand. This demonstrates the functional insolvency of the savings/loan bank model. Their assets are spread out in time while their liabilities (your deposits) can be called at any time. This is why so many banks are putting limits on cash withdrawals and imposing waiting periods to receive such withdrawals and so forth. They just don’t have the ability to meet their obligations en masse.

In Conclusion – And a Forward Look

One part of the Cypriot situation that still boils on is that the banks remain closed and capital controls are now in place. Evidently the Cypriot government wants to make certain that their little island becomes a monetary ‘Hotel California’. You can pull your money out of the bank any time you like, but it can never leave the country. History has also demonstrated that capital controls tend to end very poorly. Wherever you happen to be, beware of such measures or even the talk thereof.

Finally, the biggest problem now in Cyprus is a social one. People have been cut off from their money for nearly 2 weeks. How many Americans could deal with that kind of reality? Will Cyprus be the next Greece where the middle class is picking through dumpsters looking for food and drug companies refuse to send medicine for fear they won’t be paid? Obviously these folks now know full well what it means to ‘Get Cyprused’. And as a logical extension, what would America look like after ‘Getting Cyprused’? As unappealing as the answer may be to some, the good news is that we have a bit more time to consider our options. Certainly more time than those million or so folks on that little previously obscure Mediterranean island got.

By Andy Sutton

http://www.my2centsonline.com

Andy Sutton holds a MBA with Honors in Economics from Moravian College and is a member of Omicron Delta Epsilon International Honor Society in Economics. His firm, Sutton & Associates, LLC currently provides financial planning services to a growing book of clients using a conservative approach aimed at accumulating high quality, income producing assets while providing protection against a falling dollar. For more information visit www.suttonfinance.net

Andy Sutton Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.