Exponentially Accelerating Money Supply

Economics / Money Supply Mar 25, 2013 - 06:48 PM GMTBy: Alasdair_Macleod

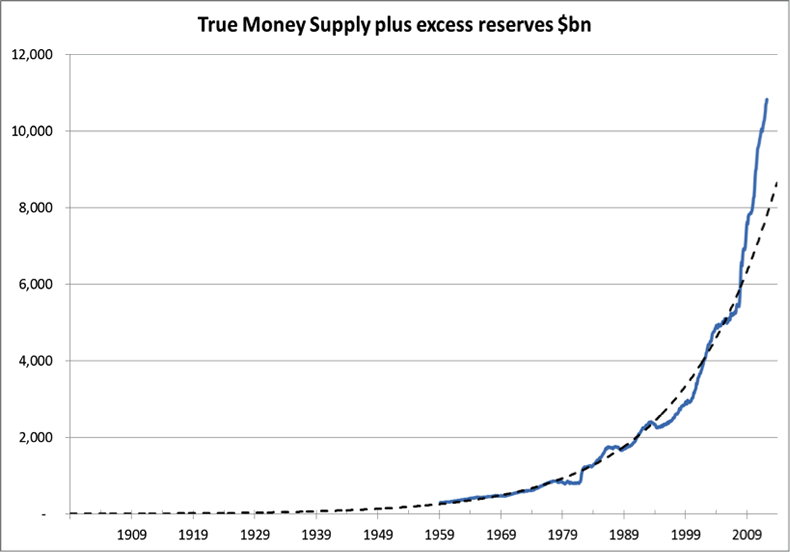

The monthly figures for the US dollar components of Austrian, or True Money Supply, for February are now in. TMS plus excess reserves amount to the quantity of money that can be drawn down without notice, including time deposits that in practice can be instantly drawn down without notice, only foregoing interest. This is shown in the long-term chart below.

The black dotted line is the exponential track, which it followed closely until the US government abandoned all gold convertibility in 1971, and continued to do so with a few wobbles until 2008, when TMS took off and became hyperbolic; that is to say it began expanding at a greater rate than exponential. This chart is the clearest way to illustrate the accelerating debasement of the dollar.

It also serves as proxy for the yen, pound and euro, which are also being issued at ever-increasing rates. The move into hyper-drive was sparked by the central banks responding to the banking crisis, but today there are four reasons why money issuance will probably continue on this hyperbolic path.

• The US economy is in a slump. The statistics suggesting it is stable are misleading, because the deflator severely understates inflation. A more correct assessment, in line with the inflation figures calculated by Shadowstats.com, is that the economy is contracting by perhaps 5% annually. The imperative for central banks to continue to pump new money into the economy is therefore strong.

• While the hoped-for economic recovery remains in abeyance the commercial banks will pile up bad debts. The Fed will have to create new money in increasing quantities to keep them in business and to keep loan collateral values from falling and making the situation worse. For this reason alone, interest rates cannot be permitted to rise.

• The government’s deficit will continue to increase because tax revenues, which depend on economic recovery, will fail to keep up with government spending. Furthermore, quantitative easing is required to keep the interest cost of government borrowing down, and to enable the Fed to fund the deficit through purchases of Treasury bonds.

• Mandated welfare spending, including pensions, healthcare and unemployment benefits are accelerating. This will ensure US government spending continues to increase, dashing any hopes that eventually economic recovery will allow the government to balance its books. Put another way, these future liabilities can only be met by monetary creation.

Therefore the path of least resistance is simply to continue to issue more and more money (so long as it has any purchasing power). The alternative, permitting the collapse of the banking system, businesses and even government itself, is unpalatable. Meanwhile, the dollar has a brief window of zero interest rates before the effect of excessive increases in money quantities on prices graduates from inflating asset values to inflating prices for food, energy and other consumables.

These four separate problems apply to all major currencies, as well as the dollar. At some point confidence in fiat currencies will begin to slide, to be reflected in a surprise fall in their purchasing powers, evidenced by a jump in prices. This should be in the back of everyone’s mind as we navigate through the increasing economic and financial difficulties of 2013.

Alasdair Macleod runs FinanceAndEconomics.org, a website dedicated to sound money and demystifying finance and economics. Alasdair has a background as a stockbroker, banker and economist. He is also a contributor to GoldMoney - The best way to buy gold online.

© 2013 Copyright Alasdair Macleod - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Alasdair Macleod Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.