Commodity Super Cycle Good and Bad News

Commodities / Commodities Trading Mar 23, 2013 - 01:04 PM GMTBy: Richard_Mills

Commodity super-cycles are defined as decades long price movements in a wide range of commodities. Super-cycles differ from shorter term fluctuations in three ways:

Commodity super-cycles are defined as decades long price movements in a wide range of commodities. Super-cycles differ from shorter term fluctuations in three ways:

- Super-cycles are demand driven because they follow world GDP

- Super-cycles span a much longer period of time with upswings of 10-35 years, taking 20-70 years to generate complete cycles

- Super-cycles are observed over a broad range of commodities. These commodities are mostly inputs for industrial production and for the urban development of an emerging economy

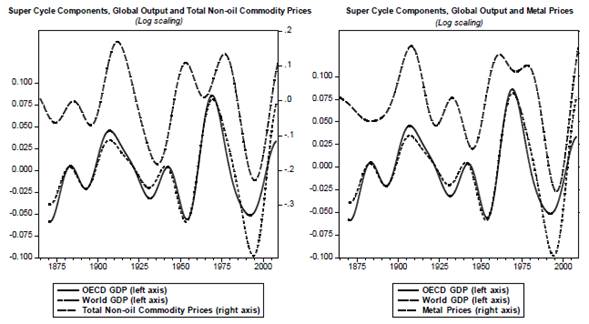

According to DESA Working Paper No. 110 'Super-cycles of commodity prices since the mid-nineteenth century' published February 2012 by Bilge Erten and José Antonio Ocampo there have been 3.5 non-fuel commodity super-cycles from 1894 to 2009:

(1) from 1894 to 1932, peaking in 1917. The first long cycle begins in the late 1890s, peaks around World War I, and ends in the early 1930s, the cycle shows strong upward and downward phases.

(2) from 1932 to 1971, peaking in 1951. The second cycle takes off in the 1930s, peaks during the post-war reconstruction of Europe but doesn't fade away till the mid 1960s. This cycle shows a strong upward phase but a weak downward one.

(3) from 1971 to 1999. The early 1970s marks the beginning of the third cycle which turns downward during the mid 1970s and ends in the late 1990s. This cycle shows a weak upward phase and a strong downward one.

(3) 2001 still ongoing. The post-2000 episode is the beginning of the latest cycle. This super-cycle shows a continuing strong upward phase.

(3) 2001 still ongoing. The post-2000 episode is the beginning of the latest cycle. This super-cycle shows a continuing strong upward phase.

The most recent boom (from 2001) in global economic growth or GDP, is unprecedented.

"Global growth performance has been attributed as the single most important driver of commodity markets, being most pronounced for metals.

The basic premise is that commodity prices and world GDP have a long-term relationship over time because the robust growth episodes in the world economy are accompanied by a rapid pace of industrialization and urbanization, which in turn require an increasing supply of primary commodities as inputs of production. However, there is often a lag between the investment in further commodity production and the actual results, which leads to price hikes in periods of strong world economic growth. As growth slows down and investment generates with a lag an increase in commodity supplies, the pressure on commodity prices eases. This hypothesis implies that the super-cycles in world output fluctuations generate corresponding super-cycles in real commodity prices." ~ DESA Working Paper No. 110

The real prices of energy and metals more than doubled from the lows of 1999

and late 2001/2002 to the high in 2008.After suffering a severe correction in late 2008 (because of the global economic slowdown) and bottoming in early 2009 commodity prices started to recover - from the low in early 2009 commodity prices have been putting in higher highs and higher lows.

By comparing the charts above it's obvious metals and agricultural have a long running integrated relationship with global GDP.

The phases and durations of previous super-cycles lead us to expect an upswing phase of between ten and thirty years. Being that we're twelve years into this super-cycle is there more to come, or has supply caught up to a cooling global economy?

First let's recap, commodity prices are dependent on:

- Demand side factors - the rapid pace of industrial development and urbanization in China, India, and other emerging economies

- Supply side factors - resource depletion, resource nationalization, geo-political risk, lack of investment

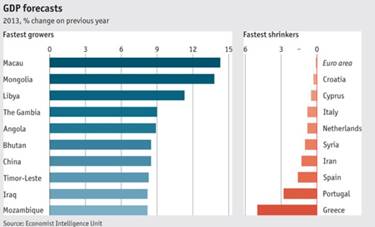

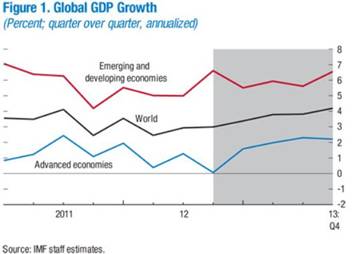

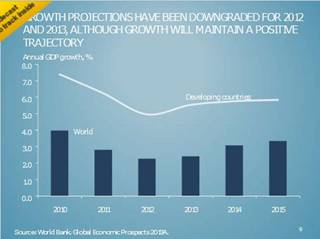

To help us answer whether or not commodity price strength will continue we first turn to global growth predictions:

Conference Board

No one it seems is predicting a global no growth scenario. In fact, the prediction seems to be a call for average future global GDP to be at four percent with developing countries clocking in at a six percent average.

That's a lot of continuing forward demand for commodities. Global demand seems to be well supported, economic growth in emerging economies will continue because of:

- Industrialization

- Urbanization

- Population growth

- Higher reserve price

"There is also the issue of the so-called reserve price (the highest price a buyer is willing to pay for a good or service). The reserve price places a cap on how high commodity prices will go, as it is the price at which demand destruction occurs (consumers are no longer willing or able to purchase the good or service).

For many commodities, such as oil, the reserve price is higher in emerging countries than in developed economies. One explanation for the difference is accelerating wage growth across developing regions, which is raising commodity demand, whereas stagnating wages in developed markets are causing the reserve price to decline. By implication, if nothing else, global energy, food , and mineral prices will continue to be buoyed by seemingly insatiable emerging-market demand, which commands much higher reserve prices.

Ultimately, emerging economies' absolute size and rate of growth both matter in charting commodity demand and the future trajectory of global commodity prices, with per capita income clearly linked to consumers' wealth. If people feel rich and enjoy growing wages and appreciating assets, they are less inclined to cannibalize other spending when commodity consumption becomes more expensive. They just pay more and carry on."

- Dambisa Moyo, Commodities on the Rise

The facts are:

- Global economic growth is going to continue

- As long as developing countries commodity demand grows at a higher rate than global supply, prices will rise

- There will be no demand destruction in developing economies as prices rise

"Although it is perhaps difficult to believe at present, the third great economic super-cycle is underway. Since 2000, emerging market countries have been unlocking their growth potential and facilitating the catch up process. This will last until 2030 and will be commodity intensive throughout."

- Neil Gregson, fund manager, JPM Natural Resources Fund,

Supply-side challenges

There is a concern on the supply side, from the DESA Working Paper referenced above comes this cautionary note...

"As growth slows down and investment generates with a lag an increase in commodity supplies, the pressure on commodity prices eases."

Now we get to the nut-crunching, the 'rub' as they say. Will the investments into ramping up commodity supply over the last ten or so years fill the gap, has supply caught up to demand?

As we've seen both demand and prices dropped temporarily but both demand and prices are quickly rebounding. That's because, in addition to a continuing growing demand there are real deep seated structural issues on the supply side.

There are many serious concerns in regards to global metals extraction that we need to consider:

- Resource nationalism/Country risk, political instability of supplier

- A looming skills shortage

- Competition with Chinese mining investment , smaller areas open for exploration

- Low hanging fruit - the high quality large deposits have already been found, lower economic attractiveness of new projects, cost inflation

- Supply bottlenecks for much needed and scarce equipment

- The manipulation of supplies ie speculation and concentrated ownership of LME stocks

- Rising capex/opex , lack of financing options, capital project execution

- Lack of innovation and technological advancements

- Declining open pit production, ongoing operational issues, declining grades at older mines, more complicated metallurgy

- Lack of recognition for population growth, growing middle class w/disposable incomes and urbanization as on-going demand growth factors

- Environmental group and labor risks, mining unrest - lack of a social license to operate, incredibly difficult and lengthy permitting processes

- Climate change , accidents and natural disasters

- Lack of infrastructure or poor infrastructure access, attacks on supply infrastructure

- Price and currency volatility

- Fraud and corruption

A Few Rising cost and Resource Nationalism Examples

Brazilian mining giant Vale SA is likely to cancel a $5.9 billion potash project, has put mining projects around the world on review and took a $5.66 billion write down on assets.

Chile's Copper Commission (COCHILCO) stated that the country will be delaying 11 out of 45 copper and gold mining projects or US$38.9 billion out of the total US$104.3 billion worth of projects.

Chile is the world's top copper producer but the country as a whole is woefully short of power. The country's power generation capacity currently stands at 17,000 megawatts. It is estimated that the country will need at least 30,000 megawatts of power by 2020 to keep up with the demand, the increased demand coming primarily from mining projects. Unfortunately the government only plans to add 8,000 megawatts between now and 2020 and there is serious opposition to these plans from environmental groups who have, so far, been wildly successful by suspending several key projects and more than $22 billion worth of power investment. The Chilean Supreme Court recently struck down the planned 2,100-megawatt, $5 billion Castilla thermoelectric power plant project, citing environmental concerns.

Codelco, the Chilean state owned copper company, and the world's largest copper miner with 20 percent of global copper reserves, said that their 2012 first half copper production fell 6.4 percent because of lower grades mined. Codelco's direct cash costs increased 27 percent year-on-year mostly because of paying higher prices for electricity from the drought stricken SIC grid.

"On the demand side, new reactor construction continues in China and there are strong indications that additional plants will be coming back on line in Japan. On the supply side, about 24 million pounds of annual uranium supply will be removed from the market after 2013 with the end of the Russian highly enriched uranium agreement. We are also seeing new mine projects delayed or cancelled due to the prevailing uncertainty in our markets."

- Tim Gitzel, Cameco president and CEO

Antofagasta announced in that it was dropping its Antucoya project because of a 20 percent jump in costs, primarily due to higher energy costs. Antucoya was to come online in 2014.

Labor costs jumped 54 percent on a per hour basis in Argentina in 2012.

Resource nationalism is increasing - Xstrata Plc's plans to create a $5.9 billion copper-gold project in the Philippines has been halted because of a mining reform bill. The almost $6 billion Tampakan mining project has had its start of operations delayed until 2019 because of the political cost of doing business in the Philippines.

Peru is the world's second biggest producer of copper and silver. At least 135 projects worth $7.5 billion have been delayed because of social unrest, mining investment in the country is expected to fall 33 percent in 2013 because of the unrest.

Antofagasta's Esperanza Sur project capex went from under US$3 billion to US$3.5 billion

Inmet's Cobre Panama project capex climbed to US$6.2 billion from US$4.8 billion, that's a capital intensity north of $15,000/t

Teck's Quebrada Blanca's capex is US$5.6 billion. The amount of money required to build Teck's new, and very large copper mine in a difficult environment, corresponds to a US$28,000/t capital intensity.

Barrick Gold, the world's biggest gold miner, says its capital costs to develop a giant gold mine high in the Andes could reach $8 billion dollars and has delayed production. Barrick has lowered its copper production outlook for 2013 due to permitting delays at its Jabal Sayid project in Saudi Arabia.

"In 2014, substantially all the mine production growth will come from new greenfield projects and these are subject to higher risk of production shortfall. New production from Africa, where infrastructure is less developed, also faces higher risk of shortfall particularly from power disruption."

- FitchRatings, Base Metals Update

Vale's New Caledonia (Goro) is many years behind schedule. The Goro nickel project in New Caledonia has become the bad boy poster child for the assortment of problems associated with HPAL technology. Minority partners Sumitomo and Mitsui have reduced their participation in the project.

Zambia is Africa's largest copper producer (and wants to directly market its copper), in second place is the DRC, the world's largest cobalt producer. The copper-belt which straddles Zambia's and the Democratic Republic of the Congo's borders is being tied up for internal development by the two countries. The DRC and Zambia are amending their mining codes to enable the government to raise taxes and implement a 35-percent minimum ownership threshold for state shareholding in projects.

"The spectre of resource insecurity has come back with a vengeance. The world is undergoing a period of intensified resource stress, driven in part by the scale and speed of demand growth from emerging economies and a decade of tight commodity markets. Poorly designed and short-sighted policies are also making things worse, not better. Whether or not resources are actually running out, the outlook is one of supply disruptions, volatile prices, accelerated environmental degradation and rising political tensions over resource access."

- Chatham House, Resources Futures

Conclusion

There's good news and bad news. First the bad news, consumers are going to be paying more for their very basics of survival because of a continuing price rise, across the board, in commodities.

The good news is you are being presented with an opportunity to get into commodity investing ahead of the herd. There are compelling reasons, and likely profitable ones, for an investment into commodities via junior resource companies at their current lows.

The two facts you need to have on your radar screen to be ahead of the herd are one, the world's developing economies still have a lot of commodity intensive growth ahead and two, the best leverage to rising commodity prices has historically been investments into quality junior resource companies.

Are these two facts on your radar screen? If not, maybe they should be.

If not, maybe they should be.

By Richard (Rick) Mills

If you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.