Warning Stock and Bond Market Crash

Stock-Markets / Financial Crash Mar 22, 2013 - 04:06 PM GMTBy: Dr_Martenson

After the shot across the bow in 2008, you might have expected that regulators and market participants would use the experience to change for the better, to become more prudent, and to reduce the sorts of risky behaviors that almost crashed the entire system.

After the shot across the bow in 2008, you might have expected that regulators and market participants would use the experience to change for the better, to become more prudent, and to reduce the sorts of risky behaviors that almost crashed the entire system.

Unfortunately, you'd be wrong.

LTCM and Moral Hazard

In 1998, there was a firm called Long-Term Capital Management (LTCM, as it is commonly referred to today), staffed by the best of the best, including one of the very top bond traders that Wall Street ever produced as well as two future Nobel laureates.

LTCM boasted of its use of complex models that were supposed to generate outsized returns while operating with a risk-minimizing profile that, mathematically, was only supposed to experience severe losses so infrequently that the periods between them would be measured in the thousands of years.

Unfortunately for LTCM, their models badly underestimated real risks, and their leverage was such that their original $1 billion in capital turned into total losses of $4.6 billion in a little over four years, nearly dragging down the entire financial system in the process.

While this experience has much to teach us in the way of market risk, hubris, and the dangers of leverage, it really needs to be understood in terms of the rise of moral hazard on Wall Street. The main lesson that Wall Street seems to have learned from the LTCM disaster is that if the wipe-out was big enough, the Federal Reserve would swoop in and rescue things.

Message received: Go big or go home. Take on as much risk as possible, secure in the knowledge that if things got bad enough, the Fed would simply print up what was necessary to make all the players whole again, with perhaps one core player or institution thrown under the bus for the sake of appearances.

Fast forward to 2008, and that exact experience was replicated perfectly, thereby reinforcing Wall Street's perception that it is best rewarded by chasing big risks and big returns. And if things didn't go as hoped, the good ol' Fed would always be there to push the Reset button.

Since nobody of consequence went to prison after the overt fraud and excesses of the housing bubble were revealed, and no bank had to give back a single penny of their ill-gotten and outlandish profits related to such behaviors, one does not have to be a genius to guess what happened next.

Banks took the taxpayer funds, paid themselves gigantic bonuses, and immediately began taking on huge new risks. I mean, why not? If you had a rich uncle that promised to let you keep any gains from your trading portfolio but would absorb any losses you might incur, you'd soon be swinging for the fences like a pro.

Back to the Future

This is why today, instead of having been reduced, financial risks loom larger than ever. It's why the next downturn will be just as bad – if not worse – than the last one. Nothing has been learned, and nothing has been changed. The most basic of human behaviors, the tendency towards moral hazard (so well understood by the insurance industry) has been completely overlooked by the Fed. Once again, that institution, entrusted with so much, has been exposed as being rather intellectually shallow, or at least devoid of common sense.

I'll leave you with this: The very same Fed that could not and did not see that a housing bubble was forming is now equally complacent about corporate bond yields touching all-time record lows across the entire spectrum, right down to CCC junk that sits one skinny notch above default. Stocks are for show, but bonds are for dough – and with bonds now priced for perfection if not for something even better, there's no room for error.

Even the slightest hiccup – say, one brought about by a renewed global slump as is already underway in Europe and Japan – will cause massive losses to bond portfolios, and we will, yet one more time, be reminded that indeed there is nothing new under the sun. Central banks cannot print us all back to prosperity, and insolvency cannot be cured with liquidity.

All that remains is to assign the losses to someone. And right now there are plenty of very well-connected and powerful individuals working feverishly to assure that those losses do not fall upon them.

That leaves you and me, otherwise known as 'taxpayers'. And 'bank account holders'. Oh, yeah – and 'Muppets.'

Big Trouble Brewing

What the Fed, in cahoots with other central banks, has managed to engineer is a spectacular rise in the price of financial assets. Stocks, bonds, and all of their associated brethren such as options, futures, and derivatives have all been magically elevated.

To put this into context, not only are stocks at nominal all-time highs, but bonds are too. Bonds, however, are very different from stocks, and the fact that they are also at all-time highs should really be viewed with much more concern.

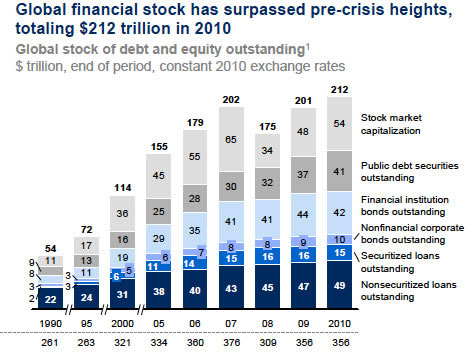

The bond market is enormous and dwarfs the equity markets by over 2 to 1, or 3 to 1 if you include non-securitized loans in the mix:

(Source)

But just looking at traditional bonds, what we have here is a situation where over $100 trillion in bonds are now historically badly overpriced. That's what “record territory” means to me, at any rate. For every 1% loss on that portfolio, more than a trillion dollars will be lost.

While the value of stocks has to be carefully adjusted for inflation to determine if all-time highs have been reached (not yet, by the way), bonds are priced according to the yield they offer. The higher the price, the lower the yield. The yield of a bond is supposed to compensate you for the risks involved, which include inflation, default, and time.

The worse the prospect, the higher inflation, and the longer the time to maturity the higher the yield will be. So how important is it that bonds are now yielding record lows? This is perhaps the single most important factor in the financial landscape right now, because it means either one of two things: (1) the risks of default and inflation are at all time lows, or (2) bond buyers are not being adequately compensated for risk.

Here's the data for corporate bonds, but sovereign bonds are just as lofty, and the lack of yield in those securities explains the grasping for yield in corporate bonds:

Yield-to-worst in junk bond market hits record low

Mar 13, 2013

March 13 (IFR) - The yield-to-worst in the US high-yield bond market has fallen to a record low average of 5.56% this week, as investors flock to higher-yielding but riskier products.

With interest rates hovering around record lows, investors have found themselves rushing down the credit ladder in search of bonds offering more return - and more risk.

CCC rated bonds - the riskiest investments at the very bottom of the credit spectrum, just one notch above default level - have rallied the most.

"It's definitely risk-on behavior, where you are trying to get exposure to the most yield possible," said Drew Mogavero, head of US high-yield trading at Barclays.

"The safer segments of the market, BBs, have rallied to pretty low-yielding levels," he said. "So people are looking out to CCCs and other higher-yielding names."

Bond yields and prices move in opposite directions. As investor demand has driven up prices, yields have tumbled. Yield-to-worst indicates the lowest potential yield on a bond without the issuer defaulting.

Lower All Over

Broken down by ratings, the yield-to-worst on the Barclays Double B index is also at its lowest ever (4.24%), as is the level on the Triple C index (7.43%).

The only segment of the market that didn't close at a record low on Tuesday was the Single B index, which is 5.46% versus the record low of 5.39% set on January 24

Again, these are record lows as in never-before-in-all-of-time records. To think that the Fed has all of this under control, that it can steer the consequences of an entire world of investment and speculation decisions to a normal and graceful ending, requires far more faith than I can muster.

The very idea that the worst-of-the-worst credit risks in the corporate world are now yielding less than 6% is even more absurd than anything that I observed during the height of the housing bubbles. Even the tiniest hiccup will wipe out the holders of those bonds, leaving them with, at best, pennies on the dollar.

Let me be very clear here: What I see now in the bond market is at least an order of magnitude riskier than anything I saw in the housing bubble, and if/when it pops, the effects will be far, far worse.

In Part II: How to Survive the Mother of All Bubble Burstings: A Collapse of the Bond Market, we'll identify the most significant warning signals of market instability, including the growth in derivatives, the reemergence of synthetic CDOs, and the widespread overpricing of debt ranging from sovereign to junk securities. With these risks come huge implications for those with money in the financial markets. What should we be doing to protect ourselves? How do we avoid the next downturn? What strategies make sense given what we know and where we are in this story?

Click here to read Part II of this report (free executive summary; enrollment required for full access).

By Dr Martenson

© 2013 Copyright Dr Martenson - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.