Argentina Turns To Gold As Inflation Tops 26%

Commodities / Gold and Silver 2013 Mar 20, 2013 - 12:50 PM GMTBy: GoldCore

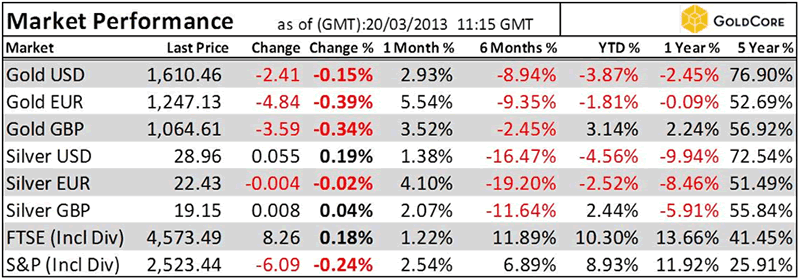

Today’s AM fix was USD 1,611.50, EUR 1,247.10 and GBP 1,064.12 per ounce.

Today’s AM fix was USD 1,611.50, EUR 1,247.10 and GBP 1,064.12 per ounce.

Yesterday’s AM fix was USD 1,602.50, EUR 1,238.41 and GBP 1,059.78 per ounce.

Silver is trading at $28.95/oz, €22.52/oz and £19.23/oz. Platinum is trading at $1,558.50/oz, palladium at $737.00/oz and rhodium at $1,250/oz.

Gold rose $7.30 or 0.45% and closed yesterday at $1,612.60/oz. Silver rose to $29.10, and then finished down 0.03%.

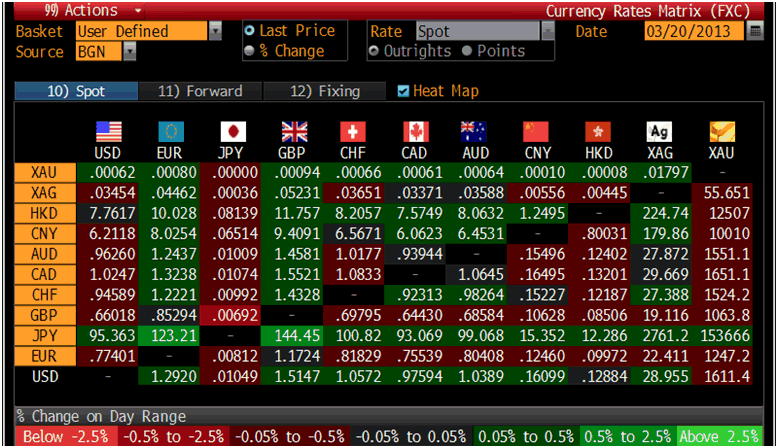

Cross Currency Table – (Bloomberg)

Despite an increase in risk appetite in recent months, systemic risk remains. As Reuters' Pedro da Costa noted the "global impact of events in Cyprus casts doubt on the notion that the financial system has gotten a lot stronger since the crisis." The Cypriot deposit levy is creating jitters among some investors who are increasing their gold positions.

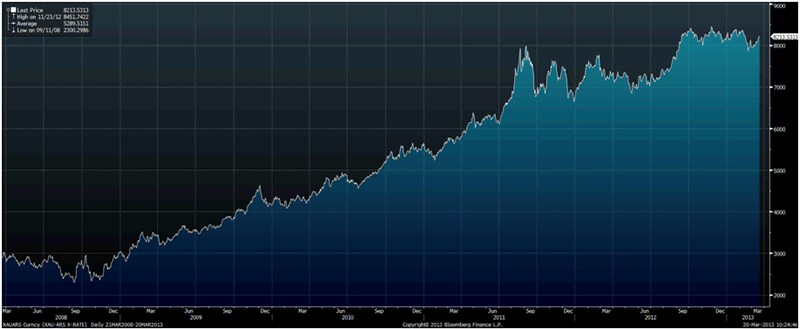

Argentines are buying more gold than ever to protect their savings from the Western Hemisphere’s fastest inflation reported Bloomberg.

Banco de la Ciudad de Buenos Aires, Argentina’s only bank offering gold bullion coins and bars to investors and savers is negotiating with mining companies to purchase gold direct as surging demand depletes the scrap supply.

The bank began marketing gold to clients after Argentina tightened currency controls in October 2011, selling 280 kilos in year one for 102.6 million pesos ($20 million).

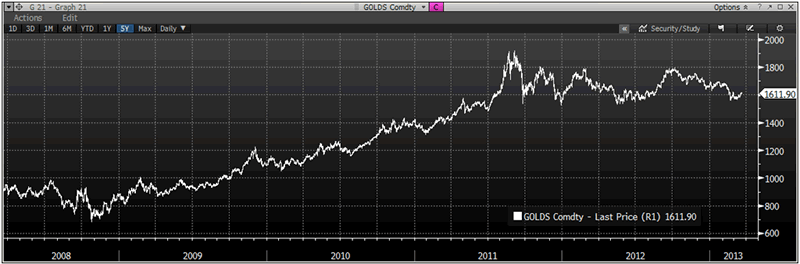

Gold, 5 Years – (Bloomberg)

Argentines are utilizing gold to hedge their savings as economists forecast the peso will lose more value than any currency in the world, and President Cristina Fernandez de Kirchner forbids dollar purchases.

The nation’s inflation rate of 26% is also eroding Argentina’s peso- denominated bonds to fall 5.5% ytd.

“I’m buying gold every chance I get,” Guillermo Acosta, a 27-year-old security guard, said inside a branch of Banco Ciudad in downtown Buenos Aires. “With this inflation, I feel like my savings will evaporate if I keep them in pesos.”

Acosta’s initial investment of 10 grams of gold in February last year has returned 47% as the price per gram rose to 381.5 pesos from 260 pesos.

Gold in Argentine Pesos – 5 Years – (Bloomberg)

With Argentina printing pesos to finance itself, the growth of pesos in the economy has rose 38% in the past year, leading analysts to predict that the currency will depreciate 12.9% through year-end, the highest of currencies tracked by Bloomberg.

Banco Ciudad is the only bank left that trades in gold after Fernandez banned the purchase of certified 99.99% pure gold for savings in July. The bank sells it at 99.96% purity, according to Carlos Leiza, who oversees the lender’s gold trading.

There is a 35% gap in the prices to buy and sell physical gold at Banco Ciudad, while there’s no premium to sell the country’s benchmark 2017 dollar bond in the local market, according to the Buenos Aires-based Open Electronic Market, known as MAE.

Gold sold by Banco Ciudad also isn’t recognized internationally, making it more difficult to determine its value, he said.

The cost of 100 grams of gold in Argentina as of last week was 36,646 pesos. In New York, the same amount based on the benchmark troy ounce (31 grams) sold for about $5,126.

The bank multiplies that price by 0.95 to account for the lower quality of the gold to get a dollar price of $4,870.

“Historically, gold has been seen as a store of value, so as long as options for doing that in Argentina are limited, people are going to keep buying it,” Banco Ciudad’s Leiza told Bloomberg.

Bloomberg’s Alix Steel covered the story and a short video about record gold demand in Argentina can be watched here http://www.bloomberg.com/video/argentina-desperate-for-gold-to-fight-inflation-rKV6PNKXSAGkYzA2GaeNfg.html.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.