Stock, Commodity and Euro Market Cycles

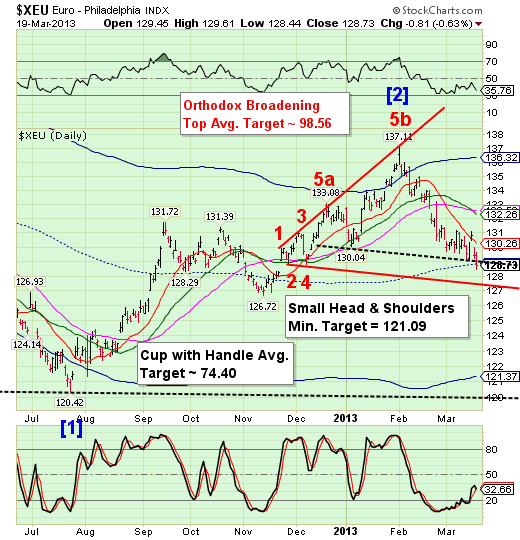

Stock-Markets / Financial Markets 2013 Mar 20, 2013 - 09:44 AM GMT The Euro is losing its battle with its Head & Shoulders neckline and mid-Cycle support which temporarily slowed its decline. It appears that gravity may take over at any time now, since both supports appear to have been violated. The real surprise is that it has held on for so long despite the erosion in the pattern. It is time for a steeper decline to follow.

The Euro is losing its battle with its Head & Shoulders neckline and mid-Cycle support which temporarily slowed its decline. It appears that gravity may take over at any time now, since both supports appear to have been violated. The real surprise is that it has held on for so long despite the erosion in the pattern. It is time for a steeper decline to follow.

I’m using daily charts this afternoon to give the bigger picture of what is going on. You can see that SPX has bounced from its Short-term support and upper Diagonal trendline at 1536.66. It still has several support levels to venture through, but we may see overnight selling pressure rising, especially from Europe. The probability of an overnight gap through the trendline and possibly even intermediate-term support at 1524.75 is rising. The 50-day moving average and 3-month trend channel are at 1510.83 and may provide the next level of support for the SPX. That area must be broken through before the decline begins in earnest.

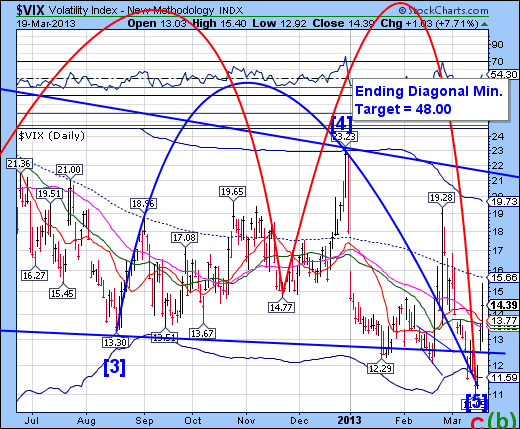

I have decided to add another Cycle Dimension to the chart of the VIX. I hope that it adds clarity and not confusion. You may recall that I have mentioned multiple cycles on each index. I am now illustrating that concept with Cycle A in blue and Cycle B in red. These cycles tend to “leapfrog” one another in such a way that Cycle B generally lands at the midpoint of Cycle A and vice-versa. This happened on November 21.

But Cycle B took a half-cycle leap where the two cycles landed together on the same spot. This occurred on March 14 to form a much deeper-than-expected low. The result is that both cycles will be rising from that low without counter-acting one another. So the new cycle emerging from this low has the potential of being extremely powerful…The upper limit of this cycle may be reached in about four months where we may see the combined cycle peak. That’s right. I am anticipating possibly an all-time high in the VIX in mid-July.

The NDX is set up for a potential gap down overnight. It appears that a potential gap may decline through mid-Cycle support at 2708.00. This is not a guarantee, but the potential is certainly there. It is still too early to tell by looking at the futures, but that is what I’d be watching overnight.

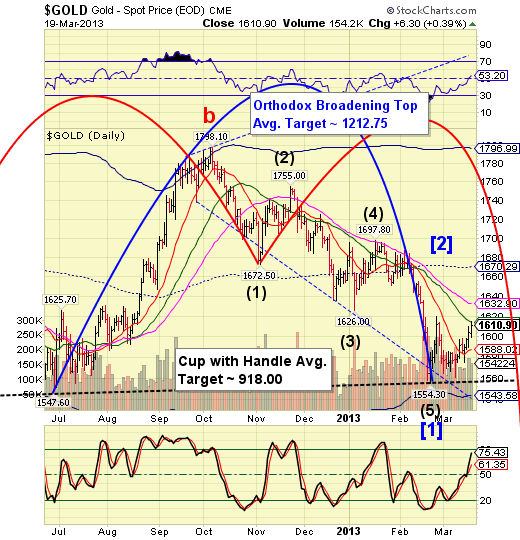

Gold still has one more probe higher left in its arsenal. The likely target appears to be the 50-day moving average at 1632.91. From there I expect to see a total collapse in this precious metal. Cycle B will become the dominant cycle and “pull” Cycle A with it into a very deep bottom in late June, just as we have seen in the VIX in mid-March.

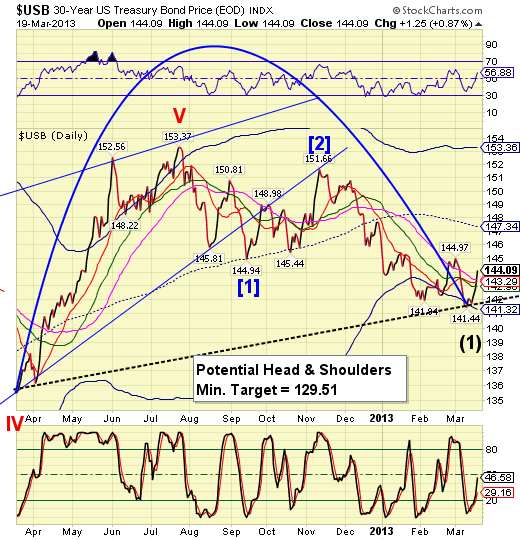

I am revising the bottom of Master Cycle A in USB to March 8. There are two reasons. The first is that wave (1) then has 9 clear sub-waves, which is impulsive. The second reason is that the rally in USB has exceeded its 50-day moving average, which is bullish. This is still conditional, but if correct, the rally in USB could last at least another two weeks, which makes USB a candidate for those who are long-only investors while stocks take their shellacking. The target for USB appears to be mid-Cycle resistance at 147.34.

More analysis in the morning. I have more commitments to make this evening.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.