Global Economy and Financial System - Let’s be Honest …

Stock-Markets / Financial Markets 2013 Mar 18, 2013 - 07:00 PM GMTBy: Brian_Bloom

The current situation within the world economy may be summarised as follows:

The current situation within the world economy may be summarised as follows:

- USA:

- There are 47 million people (>15% of the entire US population) who rely on Food Stamps to make ends meet.

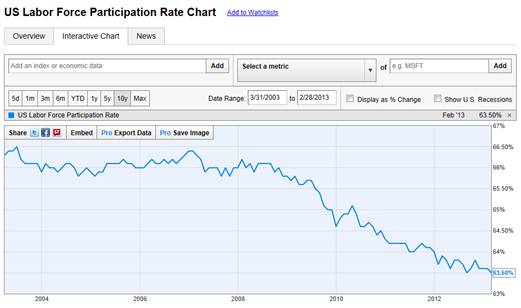

- The participation rate (percentage of working age people who are looking for work) has fallen by 2.5% from 66% in 2008 (when the Global Financial Crisis manifested) to 63.5%

Source: http://ycharts.com/indicators/labor... )

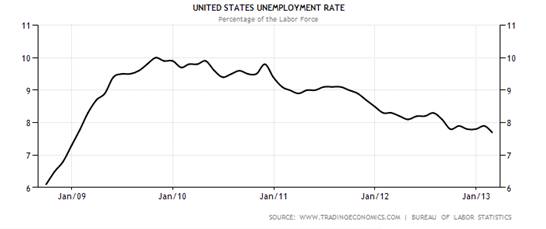

- The US unemployment rate is “officially” 7.7% as per Chart #2 below, having fallen from 10% in late 2009, roughly a year after the GFC emerged.

(Source: http://www.tradingeconomics.com/united-states/unemployment-rate )

Of course, if one adds the 2.5% reduction in participation to the 7.7%, then one sees that the effective unemployment rate is still above the 2009 peak. Arguably emphasising one statistic, whilst ignoring the other, is both misleading and unethical. As mentioned in my most recent article, “One consequence of this generalised deterioration in the level of ethical behaviour across all levels of society is that the so-called “Rule of Law” has become separated from the foundation of ethics on which it was originally constructed.” The above is one example. It is becoming ever more attractive to take the stance that, if the government can lie and cheat, then why shouldn’t I?

All this needs to be seen against a background of the $SPX index having been flirting with all time highs.

Chart #3

(Source: decisionpoint.com)

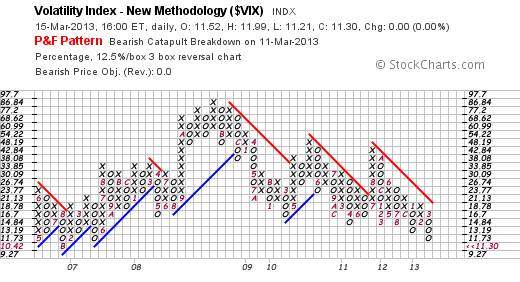

Finally, the next chart is of the $VIX, which reflects investor sentiment of fear. At extremes of high fear and low fear there is potential for exaggerated price movements in the opposite direction. High fear leads to strongly rising prices and vice versa

Chart #4 – 12.5% X 3 box Point & Figure chart of the Volatility Index

This chart shows that fear in the markets has reached its lowest point since immediately prior to the GFC, and fear is still falling. This reflects amazing complacency and is a strong contra-indicator.

Interim Conclusion #1

Even if the US economy is improving (which is difficult to validate from charts 1-3) the stock market should be bouncing up from a trough, not threatening to break up through “Triple Top” resistance dating back 13 years. In any event, this latter outcomes looks highly unlikely in context of exceptionally low $VIX.

Author comment: As explained in last week’s article, the reason the markets have been rising is more likely related to rising liquidity in the financial bathtub than to improving economic fundamentals. This rising liquidity has underpinned demand (funded by continuing credit) and has allowed corporations to fatten their margins – in turn, allowing profits to continue rising, regardless of underlying volumes. Given the virtual absence of fear, the US equity market may be extraordinarily vulnerable to a “black swan” shock, if sentiment should turn negative.

- Europe:

The EU 27 unemployment rate was 10.7% and rising as at November 2012, with Greece and Spain hovering around 26% and Portugal at 16.3%. Cyprus, where an unbelievably draconian proposal relating to to savings “confiscation” has just been announced, had an unemployment rate of 14% (source: http://www.guardian.co.uk/news/datablog/2012/oct/31/europe-unemployment-rate-by-country-eurozone#data )

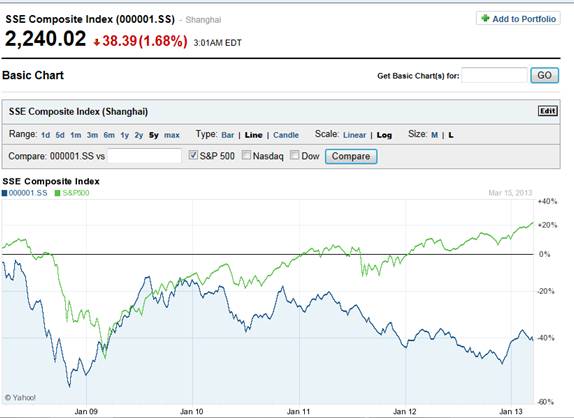

- China, which was reported in March 2011 by SBS TV in Australia to have 64 million apartments (worth close to 90% of the Chinese annual GDP in 2011 has a stock market that has been showing signs of softening since March 2011. It is now 40% below is 2008 high compared to the $SPX which has risen 20%. Readers can watch the SBS documentary via the link on my website at http://www.beyondneanderthal.com/research-links/economicsfinance/

Chart # 5 Shanghai Index Relative to $SPX

Source: http://finance.yahoo.com/q/bc?t=5y&s=000001.SS&l=on&z=l&q=l&c=&ql=1&c=%5EGSPC

- Japan

The Japanese stock market is trading at roughly 70% of its 1989 high and, whilst there are some who believe that this export-oriented economy is starting to stir from the doldrums, the sharp rise in the yen seems likely to create significant headwinds to further growth in a country that has an ageing population.

Chart #6 – Yen:US$ Exchange Rate

(Source: http://www.indexmundi.com/xrates/graph.aspx?c1=JPY&c2=USD&days=1825 )

Interim Conclusion #2

The optimistic behaviour of the stock markets of the world’s major economies belies the historical lack of vitality in their underlying economies

Author Comment: Arguably, the seemingly robust markets are more likely a reflection of liquidity than of economic vibrancy. Of course, one could also argue that if the economies are bottoming then the markets have room to rise further and that “labour” will not be a constraint. But this latter argument ignores the fact that the markets are not taking into account the headwinds that will flow from sovereign debt.

One “black swan” that was referred to in Interim Conclusion #1 above, might well be the development in Cyprus and its potential impact on consumer confidence in the financial/economic system. It is recommended that the reader study carefully what is being contemplated, and links to three articles on the subject are provided in my website at http://www.beyondneanderthal.com/..... In short, the concept of ethical behaviour has been ravaged by the recent Central Bank proposal. Rather than subject the depositors in Cypress to an impost that will be used to protect the depositors of the two banks that are expected to fail if the E10 billion sovereign debt is not refinanced, what these amoral (unethical) bankers are proposing is that it is the debts of the two banks in question – and also the loans of the sovereign lenders – that should be partially backstopped by the imposts without consultation with or agreement of the depositors.

Let’s continue be honest ….

Now I want to turn my attention to a set of facts that you will not read about anywhere else because they are unique to me personally, and they are also representative of what is happening in the market as a whole.

I have been submitting blogs to various websites over several years (since 2002) and, one by one, the publishers have fallen by the wayside because I have been writing about what people “need” to hear as opposed to what they “want” to hear. Without naming names, the business models of the financial/economics oriented websites are based on low costs (authors are not paid to submit their articles) and high readership. What’s in it for the author is that he/she gets broad coverage and thousands of readers get to hear about him/her. What’s in it for the website owner is that large traffic flows can command reasonably robust advertising fees and/or attract fee paying clients for professional services to be rendered. This arrangement has the potential to have a genuine win/win outcome, provided the website owner does not pick and choose what he publishes. Of course, by picking and choosing that which the website owners think their readers “want” to hear, what happens is that the credibility of the author may be undermined because the thread of his thought processes is interrupted. There are a few website owners who have been of sufficiently high integrity to publish all my articles, and one of these has been The Market Oracle. I am reporting this not only because I want to throw a bouquet at Nadeem Walayat, the editor, but because that fact has facilitated the following analysis:

If the reader will navigate to the following page on The Market Oracle (http://www.marketoracle.co.uk/UserInfo-Brian_Bloom.html ) – the one that lists all the articles I have published there over the years, and the numbers of people who have read these articles – the reader will see that the particular article of mine that was read by maximum number of people was the one published on May 3rd 2009. It was read by 49,244 people. By contrast, last week’s article was read by 2,135 people.

Cynics will argue that the former article got it wrong, and that’s why readership has dropped off. However, one reason for the sharp drop has been that I have been writing about what I believe people “need” to hear, when what most people “want” to hear is: “How can I improve or maintain my personal financial situation?”.

The fact is that the most-read article last week was read by around 5,000 readers and so one might argue that – if the 49,244 readers article was top in its week, and given that the 5,000+ readers article was the top article last week, then the number of people who are reading these articles has fallen by around 90% from the peak. Yes, I got it wrong in that particular article, but it appears that readers are generally more fair-minded than the cynics.

Advertisers should recognise that this comparison has the potential to be statistically misleading because one should be comparing moving average mean or median readership rather than peak readership. I sincerely believe that this fall in readers is less a reflection of the quality of the articles being submitted, and more a reflection of the percentage of private investors (maybe as high as 90% but very likely smaller) who have fallen by the wayside.

Interim Conclusion #3

The trading activity that has pushed the stock market from its 2008 low to its current peak has been primarily driven by professional managers of “Other People’s Money”.

Author Comment: The above is an extremely important concept to grasp because, of course, those who manage Other People’s Money, will be less fearful of incurring losses than the owners of that money – which has likely been a contributory reason for the sharply falling $VIX index. Of course there will likely be little fear amongst participants in a market when all the managers of OPM have to do to keep their jobs is to match or beat the indices – whether the indices are rising or falling.

Now let’s cut to the chase: The above is not necessarily something the reader “wanted” to hear, but – as the Late Steve Irwin (Australian wild animal handler) used to put it: By Crikey, in my view, the reader absolutely “needed” to hear it – and The Market Oracle’s propensity to behave with integrity is what has facilitated this understanding. Three Cheers for Nadeem Walayat (and others like him); may his (and their) businesses grow from strength to strength.

So, if rising liquidity and a more cavalier attitude to risk have been driving both corporate profits and stock market prices, then what are the risks?

The main risks revolve around the low propensity of managers of OPM to appropriately assess risks in general and, also, rising consumer price inflation and rising consumer propensity to pay down debt rather than spend. Both of these latter phenomena – if they should manifest – will place a downward pressure on volumes of goods and services sold – which is something that the managers of OPM seem likely to overlook because the published statistics to which many refer are not volume oriented. More importantly, a continuing consumer propensity to spend will require a continuing confidence in the system – which confidence will clearly be eroded if the Central Banks make another outrageous move like they did in Cypress.

Interim Conclusion #4

Because the economic/financial system is becoming increasingly unstable, it is becoming increasingly non-productive for individuals to think in terms of planning for a “better” future. The most sensible attitude investors can adopt relates to how he/she can protect what they have.

There are three approaches to achieving this outcome:

- Balance your budget by focusing on cost cutting rather than increased income (sound familiar?). If appropriate, downsize your home and car/s and use the surplus equity to pay down your debts. And treat this as an urgent priority. The window of opportunity may be closing.

- Become conscious of the risk that volumes of goods and services changing hands in the economy might contract, and of the propensity of professional managers to be focussing on price indices rather than on volume indices. In short, do not allow professional managers the unfettered opportunity to lose your life savings because of their congenital predisposition to be optimistic. It’s your money. Second guess the managers and hold them accountable.

- Start focussing on what you “need” to know rather than what you “want” to know.

In today’s environment what people “need” to know is: What are the threats to the system as a whole”? And “What might we collectively do to minimise those threats?” This will require a different mindset from the self-centred mindset to survive and prosper in a “naked” capitalist environment.

Overall Conclusion

Flowing from all of the above, it is this analyst’s intention to focus more on investor needs than on investor wants.

Author Comment: My future articles will attempt to identify possible modifications to the social systems, which modifications will have the objective of minimising the risks of systemic collapse. My most recent article summarises the areas on which I will be focusing and you can access it at http://www.beyondneanderthal.com/....

Also, my two fact-based novels already summarise some of the key opportunities, and the quality of these books might be assessed by checking reader reviews to date at:

Book sales have been growing nicely and doubtless, over time, the number of these reviews will grow. Perhaps you can add yours.

In my forthcoming articles I will be providing links to interesting articles and facts that I will analyse in context of “systemic” risk. The reader will not necessarily get rich from acting on what is contained in these articles but you might protect yourself from losses, and you might also contribute your voice to the growing wave of pressure to keep the world’s decision makers honest as they move to shore up the system. The last thing we want is for the system to be shored up in a way that furthers the interests of the powerful at the expense of the ordinary people like you and me. (For example, one way of their achieving this will be to declare war on some supposedly heinous country and send your sons and daughters out to be killed – and/or limit your democratic rights – in the process of stimulating a war-footing economy). The second last thing we want is to rob Peter to give hand-outs to Paul – whether Paul is amongst the world’s very rich or the world’s very poor. Economics is all about adding value. To earn a subsistence reward, you have to add subsistence value – even if all you do is sweep the streets or clean public toilets. To earn super rewards you need add super value. Executive remuneration needs to be carefully scrutinised in terms of value-add. The time has come to get real.

Author, Beyond Neanderthal and The Last Finesse

Beyond Neanderthal and The Last Finesse are now available to purchase in e-book format, at under US$10 a copy, via almost 60 web based book retailers across the globe. In addition to Kindle, the entertaining, easy-to-read fact based adventure novels may also be downloaded on Kindle for PC, iPhone, iPod Touch, Blackberry, Nook, iPad and Adobe Digital Editions. Together, these two books offer a holistic right brain/left brain view of the current human condition, and of possibilities for a more positive future for humanity.

Copyright © 2013 Brian Bloom - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.