Cyprus in Focus, Stock Market Gap Down

Stock-Markets / Stock Markets 2013 Mar 18, 2013 - 03:56 PM GMT SPX is set to gap down for the frist time since October 6, 2008. It is currently hovering between 1530 (ES) and 1543 (ES). This is roughly between 1536.00 and 1550.00 in the cash index. It appears to have made a wave 1 low and wave 2 bounce that may already be finished.

SPX is set to gap down for the frist time since October 6, 2008. It is currently hovering between 1530 (ES) and 1543 (ES). This is roughly between 1536.00 and 1550.00 in the cash index. It appears to have made a wave 1 low and wave 2 bounce that may already be finished.

There’s no telling how this will look once the market opens, but it is sure that the market will be in decline from here, dependent on how quickly sellers overwhelm the liquidity provided by today’s POMO, which is scheduled to be a large one.

This morning’s NDX/NQ100 is also in a solid gap down. It made an overnight low near its Intermediate-term support at 2753.16 and bounced back to its mid-Cycle support/resistance at 2767.90. All things considered, the QE and POMO injections may not be capable of overcoming heavy selling if the big hedge funds get serious about exiting their positions. They have been 100%+ long for the past month, so any jolt such as this may send them scurrying for cash.

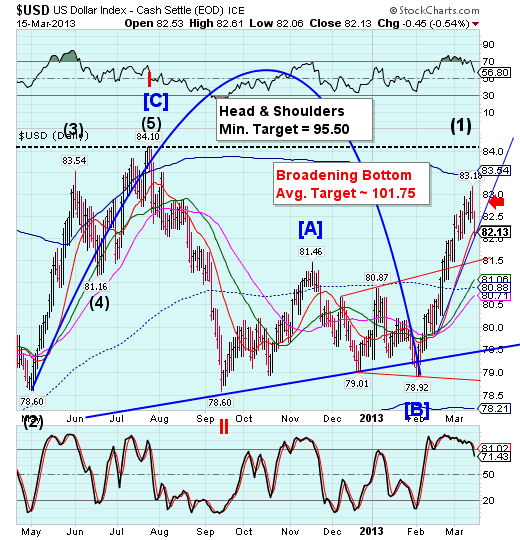

The US Dollar vaulted out of its 4the wave low at 82.13 and is currently at 82.89 in the futures. It appears that the impetus of the move may vault the dollar to its Head & Shoulders neckline at 84.10 or even above it. Remember, the entire structure from June 4 is the right shoulder, so there’s no reason why the dollar cannot exceed neckline resistance this time.

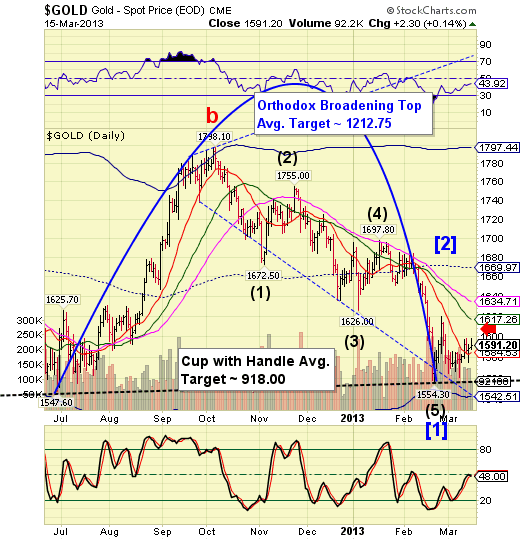

Gold is also gapping higher this morning, but is still beneath Intermediate-term resistance at 1617.26. It has hit a high of 1608.00 and is currently hovering at 1605.00 in the futures. There are some structures that could take gold higher, but I would stay on the cautious side for now in gold. The reason is that the action in Cyprus is signaling a major policy shift in Europe that has global repercussions. This is highly deflationary, so ultimately this move has the capability of taking gold much further down.

Regards,

Tony

Our Investment Advisor Registration is on the Web

We are in the process of updating our website at www.thepracticalinvestor.com to have more information on our services. Log on and click on Advisor Registration to get more details.

If you are a client or wish to become one, please make an appointment to discuss our investment strategies by calling Connie or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Anthony M. Cherniawski, President and CIO http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.