Financial Markets Vulnerable Due to Credit and Energy Crisis

Stock-Markets / Credit Crisis 2008 Mar 09, 2008 - 09:09 PM GMTBy: Brian_Bloom

Society at a crossroads - On February 12th 2008, this analyst took a decision that prevarication was no longer an option. A judgement call was needed and the judgement call was made, as follows: “Despite many conflicting signals from many different quarters, this analyst believes we have entered a Primary Bear Market for Industrial Equities.”. On that day the Dow Jones Industrial Index stood at 12,240.01.

Society at a crossroads - On February 12th 2008, this analyst took a decision that prevarication was no longer an option. A judgement call was needed and the judgement call was made, as follows: “Despite many conflicting signals from many different quarters, this analyst believes we have entered a Primary Bear Market for Industrial Equities.”. On that day the Dow Jones Industrial Index stood at 12,240.01.

Of course, it was to be expected that the authorities would fight the Bear with everything at their disposal, but the core issue seemed to be that the state of mind of the investing public had turned negative.

Let's look at this concept of “mindset” a bit more closely. There were many times, for example, when I watched my then teenage kids on the morning after a party. There were many times when I asked myself when they would finally make the connection that too much booze makes you sick; and that too much booze for too long makes you chronically sick. Eventually, the penny dropped for all three of them. When they finally made the connection, they stopped binge drinking. They started to turn down invitations to parties - even though the drinks were free. They became responsible adults. They stopped living only for today. One even became a professional youth outreach worker specialising in drug and alcohol problems.

The analogy is not difficult to follow. A point is finally reached where the actions of the Federal Reserve Board become irrelevant. A bank cannot hope to lend money – even at zero interest – to someone who has taken a decision to stop consuming beyond his or her means. When enough people across a society arrive at the conclusion that their expenditure is chronically in excess of their income, and that they cannot continue to live a life of unbridled hedonism, the economy goes into recession. Under those circumstances, even if the monetary punch-bowl runneth over, it will remain untouched.

So, if the industrial markets are going to head south, what do ordinary people like you and me do?

First, it is clear from the following chart (courtesy stockcharts.com ) that hard assets in the form of commodities have for some time been favoured over Industrial Equities.

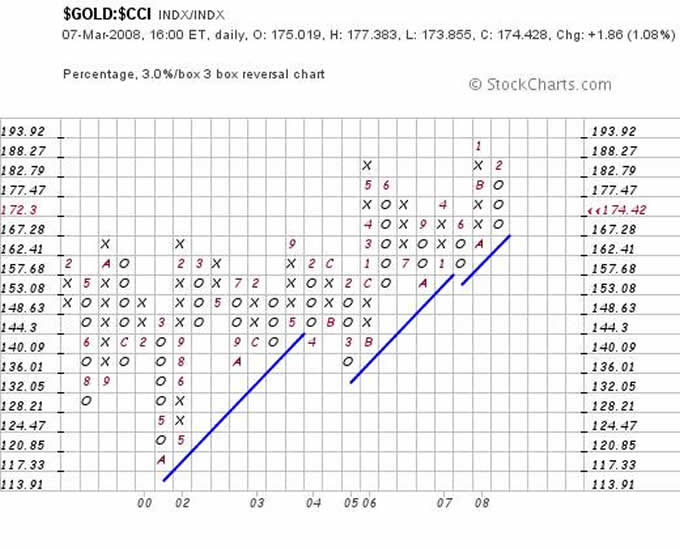

Next, it is clear from the following chart that Gold has been in a bull market relative to commodities for some time, and that a “buy signal” was given when the ratio rose to 188.27. The ratio subsequently pulled back, but did not violate the rising blue trendline.

Next, it is clear from the chart below that gold recently gave a buy signal relative to the oil price, and is now in a relative bull trend even though it has pulled back somewhat.

The bottom line is that Gold seems (from a technical perspective) to be an eminently sensible investment at this time. However, there is an oddity in that – conventionally – if the gold price was about to roar upwards, one would expect the prices of leveraged gold mining shares to outperform gold. This has not happened, as can be seen from the chart below.

Indeed, the mystery deepens when we see that the speculative $HUI has not (yet?) started to outperform the $XAU – as can be seen from the chart below:

Interim conclusion #1

Whilst it appears that industrial shares have entered a Primary Bear Market, and whilst commodities have been outperforming Industrials, and whilst gold has been outperforming commodities, the gold mining shares have not been outperforming the gold price. At face value, this is counterintuitive. In a normal world, this would make no sense at all.

But the situation gets even curiouser.

One would imagine that in an environment where the US Dollar is falling out of bed, and where the US economy is driven by consumers (66% - 70% of GDP) and where the US trading account is chronically in deficit because imports exceed exports, the US would be experiencing rising inflation. Indeed, it probably is.

But one would also imagine that in a situation of building inflation, interest rates would be rising.

At face value they have not been rising, as “might” be concluded from the following chart of 30 year bond yields. (Chart courtesy decisionpoint.com )

But, caution is warranted. Even though the Fed has been slashing the short rates, and even though the longer dated yields also seems to be in bear trends, the ratio of longer dated yields to shorter dated yields has been rising – as can be seen from the following chart (courtesy stockcharts.com )

Interestingly, whilst the ratio of 30 year yield to ten year yield has not yet broken into bull territory, the ratio of 10 year yield to five year yield has, as can be seen from the chart below:

Similar patterns exist for the 10/5 year yield chart and the 5/2 year yield chart.

Questions:

- If we are facing “inflation”, why are the long dated yields not rising in absolute terms?

- Alternatively, if we are facing “deflation” why are the longer dated yields rising relative to the shorter dated yields when they should be falling?

Well, maybe there is more to all this than meets the eye.

Let's take another closer look at the DecisionPoint 30 year yield chart.

Note how, since 1999, there has been a series of rising bottoms in the PMO oscillator even as the yield itself has been in a bear trend.

Interim Conclusion #2

It seems reasonable to conclude (hypothesise?) from the behaviour of the bond yields relative to each other that the “credit crunch” is manifesting differently in different parts of the economy. Those whom the Fed would like to have borrowing in the short term (the public) appear to have little interest in borrowing, whilst those who would like to be borrowing in the longer term (leveraged or undercapitalised people or organisations) cannot get access to capital. This might explain why, behind the scenes, the relative price of funds has been rising subtly on a time scale basis.

Questions:

- Could this strange behaviour of the bond yields explain why the gold mines' share prices are not rising relative to gold? If the mines' access to capital is waning, then the risks associated with getting the gold out of the ground may be rising.

But surely this can't be correct? If the Fed is making money relatively freely available, and if the gold price is rising, surely the gold mines represent sound credit risks? Why wouldn't the capital markets make capital available to the mines under such circumstances – even at raised lending margins?

- Could it be that the risks associated with getting the gold out of the ground are rising for reasons unrelated to capital availability? Is it possible that the energy/transport markets are trending towards dysfunctionality? For example, look at what happened in South Africa – where gold mine production was under extreme pressure because of rolling electricity brownouts.

In previous articles I have drawn the reader's attention to the fact that Dow Theory requires the direction of travel of both the Transports and the Industrials to confirm the Primary Direction of the equity markets. They both need to fall to lower lows in a Primary bear market and they both need to rise to higher highs in a Primary bull market. Right now, the Transports are not confirming a sell signal by the Industrial index. However, it is my view that – this time around – things are really different. They are different because the world is running out of oil; and it was precisely for this reason that I was prepared to stick my neck out and call a Primary Bear Market; notwithstanding the non-confirmation.

I have been arguing that the Transport index is artificially high at present. In turn, in an earlier article, I demonstrated that this is likely so because the underlying transport companies have been able to pass on the rising cost of energy plus the profit margin thereon because of price inelasticity. i.e. Their profits have been artificially stimulated by rising energy prices. If so – because of falling volumes being masked – we should recognise this as a temporary phenomenon, and we would be better advised not to wait for confirmation by the Transports, which is probably inevitable even though it will be delayed.

But, if the above is true, there is a much more serious matter on which we need to focus: In an environment where the world is running out of oil, there is no way the world economy can keep growing unless/until new energy paradigms have been embraced that can have an economically stimulative impact.

The possibility that gold price might outperform the oil price is very worrying. Arguably, the markets are edging towards some sort of crisis of confidence.

What might be the catalyst to this crisis of confidence? To get a handle on the possibilities here, the reader's attention is drawn to the charts below, which reflect sunspot cycles since before the beginning of the Industrial Revolution. (Source: http://sidc.oma.be/sunspot -index-graphics/sidc_graphics .php )

The alert reader will note that the most recent sunspot cycle is bottoming as these words are being written.

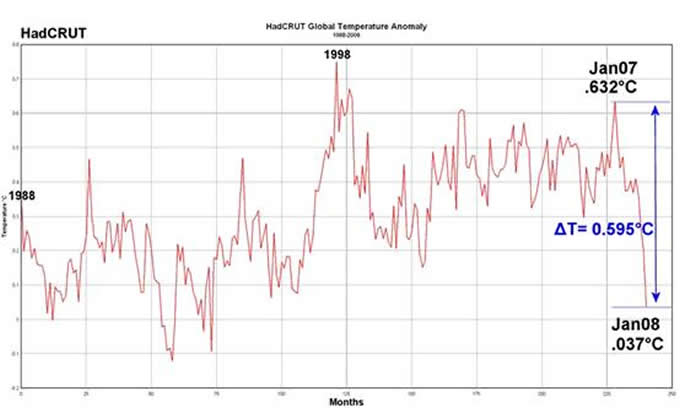

But the reader's attention is also drawn to the chart below, which shows that, globally, average ambient temperature has been falling in recent months. ( Source: http://wattsupwiththat.wordpres s.com/2008/02/19/january-2008 -4-sources-say-globally-cooler -in-the-past-12-months/ )

UK's Hadley Climate Research Unit Temperature anomaly (HadCRUT) Dr. Phil Jones:

Is it merely a coincidence that global temperatures have fallen in January/February/March 2008 just as the latest sunspot cycle has been bottoming? In my view, one would either have to be extremely obtuse or extremely dogmatic to argue “coincidence”. Common sense is screaming that it has been our sun which has been the ultimate driver of global warming. The reader is guided to examine the number of sunspots that have been manifesting within the cycles since around 1950. He/she will see that this number has been higher, on average, than during the cycles in the preceding one hundred odd years. Based on this evidence it follows that whilst CO 2 emissions and greenhouse gases may be exacerbating global warming, greenhouse gases have not been causing global warming.

Why is this relevant to what's happening in the world economy?

It is relevant because of the following two charts:

The first chart – source, http://www.ucar.edu/news /releases/2006/sunspot.shtml clearly shows that cycle #23 is ending, and that #24 is expected to be more active than all but one of the cycles within the past 130 years.

In this analyst's view, a more active cycle #24 is going to give rise to a last burst of global warming, which will “sucker” a lot of people into embracing solar power as the most logical alternative to fossil fuels. They will be comfortable with this decision because the politicians are going to argue in the coming years that the rising temperatures are screaming for urgent action to move towards clean fuels, of which solar power is the most obvious because it is the most readily available.

But there is a problem: The following chart shows that this unusually virulent cycle of sunspot activity (#24) is likely to be the last one for some time. It is likely to be a “final” spike leading to a prolonged period of lower solar activity.

One thing that happens when sunspot activity wanes, is that cloud cover rises. (See Henrik Svensmark's work at http://en.wikipedia.org/wiki /Henrik_Svensmark )

When cloud cover rises, less of the sun's rays get through to the earth's surface. Therefore, by embracing solar power, we might very well be zigging when we should be zagging. From the year 2012 onwards, after the coming sunspot cycle has peaked and cloud cover begins to increase once again, the world's industrial infrastructure might find itself chronically short of electrical power (because fossil fuels will be less readily available and incoming solar energy will not be as powerful as previously thought), and the world economy might become terminally damaged as a result.

The above logic is one reason I decided to write Beyond Neanderthal – which is a novel that introduces at least three alternative energy technologies that hold out the hope of:

- Remaining functional in an environment of global cooling (ie They are not reliant on any of the sun, the wind, or the integrity of freezing cold overhead power cables)

- Stimulating downstream economic activity – which might have the capacity to “drive” the world economy

- Facilitating an increased utilisation of apparently infertile land for farming purposes – which might contribute to feeding the world's population during a period when more of the world's surface will become inhospitable to farming due to declining ambient temperatures.

The technologies need validation, but are certainly worthy of far more serious investigation than heretofore. I chose the format of a novel because, whilst much of the evidence cannot (yet) be regarded as scientifically defensible, we do not have the luxury of being so precious about the politically correct, box-ticking mentality that has emerged across society over the past few decades. Arguably, decision makers have come to value style over substance and process over outcome. In an environment where time is the enemy, prevarication is inappropriate. Wisdom needs to prevail, and decision-making needs to be fast-tracked. In simple terms, we need to take decisions which will stand up to either/both global warming or global cooling. Hopefully, given that the information in Beyond Neanderthal is communicated by means of an entertaining storyline (possibly one of the most fascinating detective stories ever written) the message will be disseminated across a broad front in a relatively short time frame. Some of the clues in this particular detective story date back over 5,000 years!

Gold's role

Following (layman) investigation over a prolonged period, it is this analyst's conclusion that gold will have a critically important role to play in the years ahead; and that this role will be unrelated to currencies. Gold as a substance has some unique physical properties which have only relatively recently begun to be understood. Circumstantial evidence suggests that Sir Isaac Newton may have gotten an intuitive glimpse of gold's real value when he was experimenting with alchemy. If so, this would explain why he moved to become Master of the Mint and why he moved to put Great Britain onto a gold standard. Beyond Neanderthal discusses gold's potential role in some depth. Gold may indeed be the most valuable substance on earth.

Overall Conclusion

Society is at a crossroads. The industrial equity markets are shaky, the world economy is vulnerable, Peak Oil has passed, and we might be facing an emerging (and prolonged) period of global cooling which will only begin to emerge post 2012, after one last intense burst of warming. There is little evidence to suggest that the world's political leaders even understand the true nature of the problems, let alone what to do about them.

On a personal (you and me) level, both the technicals and fundamentals are pointing to the wisdom of investing a modest proportion of one's assets in gold and/or gold related assets. (Between 10% and 25%)

On a society-wide level, every “problem” presents an opportunity for advancement. In this case, humanity might be facing the opportunity to make an evolutionary leap forward – provided we move to embrace alternative energy paradigms which appear to be far more powerful than fossil fuels. Amongst these alternative paradigms, gold will have a critically important role to play.

Brian Bloom

Author, Beyond Neanderthal

Author's note: We (the publisher and author) are entering the “home stretch” of the highly complex task of editing Beyond Neanderthal to make it as easily readable and as entertaining as possible. Attractive cover designs have been received from an award winning designer, and we will hopefully send the finally edited manuscript to the printers within the next few weeks. Our initial print order will be guided by the number of people who have registered interest to acquire a copy. To avoid disappointment, if you are interested to acquire a copy, please register that interest now at www.beyondneanderthal.com . Within the next 4-6 weeks I will be personally emailing all interested parties and will provide a hotlink to our book distributor's website where your orders can be placed.

Copyright © 2008 Brian Bloom - All Rights Reserved

Brian Bloom Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.