Gold Short-term Giving Worrying Technical Signals

Commodities / Gold & Silver Mar 09, 2008 - 03:41 PM GMTBy: Merv_Burak

Despite some volatile daily moves, on a chart this past week it looked like a sideways trend, even possibly a topping action. Let's see.

Despite some volatile daily moves, on a chart this past week it looked like a sideways trend, even possibly a topping action. Let's see.

GOLD : LONG TERM

Taking away most of the trend, support and resistance lines from the P&F chart and leaving only a few primary lines gives an interesting view of the bull market since 2001. With the present units and reversals used in the chart the original primary up trend line, if extended, shows the action of the past several months just hugging the line, slightly above at times and slightly below at other times.

With the new primary up trend line from the 2006 low we seem to get a wide trading channel with the upper boundary being the original resistance line. These boundaries appear to be almost equal spaced above and below the original up trend line. Hmmm! I wonder if this means anything relative to future action? Oh well, it may be interesting but I don't thing I'll lose any sleep trying to decipher its meaning.

Back to reality. Gold continues to trade in new high territory but not too enthusiastically. It is well above its long term positive sloping moving average line with no worries for some time, at least not from the long term view. Momentum is also comfortably in its positive zone having made new highs this past week. The volume indicator has also been reaching into new high territory above its positive sloping trigger line. There are weaknesses to be concerned about but these will be mentioned in the analysis for the next time periods.

All in all there is no reason to be concerned from a long term perspective. The price may move higher or it most likely could move lower but from a long term perspective these would just be minor fluctuations. The long term rating remains BULLISH .

INTERMEDIATE TERM

As with the long term the intermediate term is still well fixed on the bullish side so that there is no immediate danger of going bearish, as far as a confirmation of trend is concerned. However, we should not get too complacent as there are some signs of potential danger ahead. At this point they are just the initial stirrings of caution and may end up to be nothing to worry about but they are there. The momentum indicator, which in the long term has made new highs, has not yet done so in the intermediate term. While the price of gold, and its moving average, continues to move in an upward direction the momentum indicator appears to have gone in a lateral direction since the beginning of the year. I wouldn't go so far as to call this a negative divergence (because of the serious implication that would have) but it is a divergence of trend that must be respected and watched for its potential implication on price. However, all this is still taking place well inside the momentum positive zone so I see no immediate reversal of trend that would be confirmed by the indicators.

As with the long term, the intermediate term rating remains BULLISH .

SHORT TERM

The short term chart and indicators are giving us a much more worrisome picture than had the other charts. Here we see the potential topping more clearly. Despite some very volatile days, this past week was basically a sideways move for gold. All week it really didn't go anywhere. This sideways motion becomes more worrisome when we look at the short term momentum indicator. Despite a new high in the price of gold on Wednesday the momentum indicator barely rallied. The higher lows on Thursday and Friday, versus the low of Tuesday, showed up as lower lows in the momentum indicator. This is showing some serious short term weakness in the price action and has the potential of turning the trend for gold downward.

We have a short term up trending channel nestled inside an intermediate term up trending channel. With the weakness shown by the momentum indicator I would not be surprised if the price broke below the lower support line of the short term channel and made a run at the lower line of the intermediate term channel.

Another indication that this week may not be positive for gold is the turning of the very short term moving average line, presently to the horizontal just short of fully negative. In addition the Stochastic Oscillator had moved decisively below its overbought line and is almost ready to go negative. The short term momentum has also moved below its overbought line and is below its negative sloping trigger line. All in all, this coming week looks like it might be a rough week, barring any major flare-up in the Middle East .

Should the price close above $995 I would be inclined to take all this commentary back and start fresh.

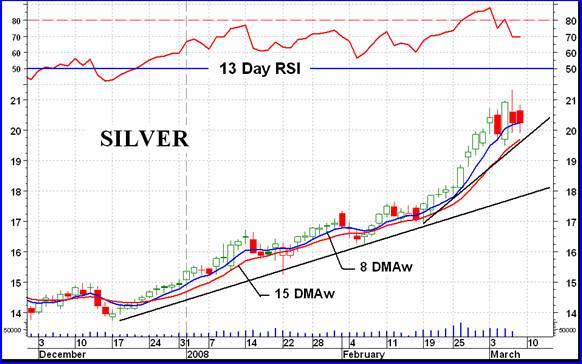

SILVER

As with gold, silver also seems to be in a possible topping activity. The momentum indicator is showing a sudden decline in strength over the past few days. This can't continue for long. Last week I mentioned the possibility of a blow-off activity as I had a FAN PRINCIPLE third stage trend line which is often a warning of a blow-off. Shown in the chart are the second and third FAN trend lines. I would not be surprised if silver tried to take off again but unless that momentum starts to confirm such move, it may not last long. Most probably the direction silver may take, at least on the short term, is towards that second trend line and possibly lower, although not much lower. Should the momentum indicator move into its negative zone then we could have a somewhat more serious situation.

I guess silver will continue to act in the basically same direction as gold although, as always, one or the other will provide a better performance. For now it looks like silver just might continue with the better performance.

MERV'S PRECIOUS METALS INDICES

I'm often asked why the Merv's Indices so often differ in their performance as opposed to the major North American Indices. This question must come from continuing new readers to these commentaries but I guess it's instructive to remind readers of the differences from time to time. As mentioned here on many occasions the major Indices calculate their Index values based upon some variation of the market value of the component stocks. From this we get the situation where the major portion of such Indices are calculated based upon the market value of only a few of the largest component stocks while the lower market value components have basically no contribution to the Index value. My Indices are based upon the AVERAGE weekly performance of each component stock. No stock has an inherent advantage towards the Index calculation just because it is a large company with a high market value. Which method is better? That's a subjective question where each individual will find one or the other method more to their liking as a personal thing. I like my method because it is the simpler method and I guess I'm basically a lazy guy going for the simple.

The other difference between the two sets of Indices is that the component stocks of the majors are mostly the same stocks while the component stocks of the Merv's Indices are different stocks. Only the Merv's Qual-Gold Index could be thought as being equivalent to the majors as far as component stocks are concerned. The other Merv's Indices have far more of the speculative stocks as component stocks and this gives rise to significant differences in Index performance, up or down.

This week we see the major North American Indices basically on the up side while the majority of the Merv's Indices are on the down side. The Qual-Gold Index did gain 0.3% which was in line with the performance of the majors. The Gamb-Gold Index lost 4.5% indicating that the major hits during the week fell on the more speculative or gambling stocks.

The average overall performance of the universe of 160 component stocks of the Merv's Gold & Silver 160 Index was a loss of 2.1%. There were 48 winners (30%) in the bunch and 109 losers (68%). Three stocks closed the week unchanged. The top five weekly performers were Stratagold, Romios, Kimber, Carmax and Anaconda while the bottom five were Eaglecrest, NFX, Apex Silver, Sage and Miranda. As for the summation of individual stock ratings, they all moved a little towards the negative. On the short term we are at BULL 58% and BEAR 29%, on the intermediate term we are at BULL 61% and BEAR 29% and finally on the long term we are at BULL 52% and BEAR 37%. As we see one week of poor markets does not a trend reversal make.

Looking at the charts and indicators everything is still positive for the intermediate and long term. The ratings stay at BULLISH for both time periods.

As for the three sector Indices the indicators are still all in the positive. For the intermediate and long term the ratings remain BULLISH for the three sectors.

Merv's Precious Metals Indices Table

That's it for this week.

By Merv Burak, CMT

Hudson Aero/Systems Inc.

Technical Information Group

for Merv's Precious Metals Central

Web: www.themarkettraders.com

e-mail: merv@themarkettraders.com

Before you invest, Always check your market tirming with a Qualified Professional Market Technician

For DAILY Uranium stock commentary and WEEKLY Uranium market update check out my new Technically Uranium with Merv blog at www.techuranium.blogspot.com .

During the day Merv practices his engineering profession as a Consulting Aerospace Engineer. Once the sun goes down and night descends upon the earth Merv dons his other hat as a Chartered Market Technician ( CMT ) and tries to decipher what's going on in the securities markets. As an underground surveyor in the gold mines of Canada 's Northwest Territories in his youth, Merv has a soft spot for the gold industry and has developed several Gold Indices reflecting different aspects of the industry. As a basically lazy individual Merv's driving focus is to KEEP IT SIMPLE .

To find out more about Merv's various Gold Indices and component stocks, please visit www.themarkettraders.com and click on Merv's Precious Metals Central . There you will find samples of the Indices and their component stocks plus other publications of interest to gold investors. While at the themarkettraders.com web site please take the time to check out the Energy Central site and the various Merv's Energy Tables for the most comprehensive survey of energy stocks on the internet. Before you invest, Always check your market timing with a Qualified Professional Market Technician

Merv Burak Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.