Venezuela: On the Death of Chávez and the Ailing Bolivar

Politics / Fiat Currency Mar 13, 2013 - 11:03 AM GMTBy: Steve_H_Hanke

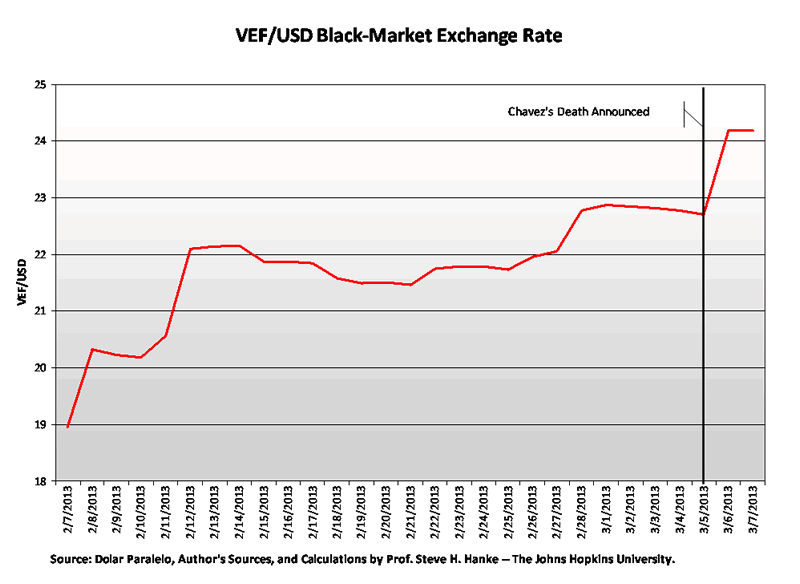

Although Hugo Chávez, the socialist presidente of Venezuela, has finally met his maker, the grim reaper is still lingering in Caracas. As it turns out, Chávez was not the only important Venezuelan whose health began to fail in recent weeks. The country's currency, the Venezuelan bolivar fuerte (VEF) may soon need to be put on life support. Indeed, in the past month the bolivar has lost 21.72 percent of its value against the greenback on the black market (read: free market).

Although Hugo Chávez, the socialist presidente of Venezuela, has finally met his maker, the grim reaper is still lingering in Caracas. As it turns out, Chávez was not the only important Venezuelan whose health began to fail in recent weeks. The country's currency, the Venezuelan bolivar fuerte (VEF) may soon need to be put on life support. Indeed, in the past month the bolivar has lost 21.72 percent of its value against the greenback on the black market (read: free market).

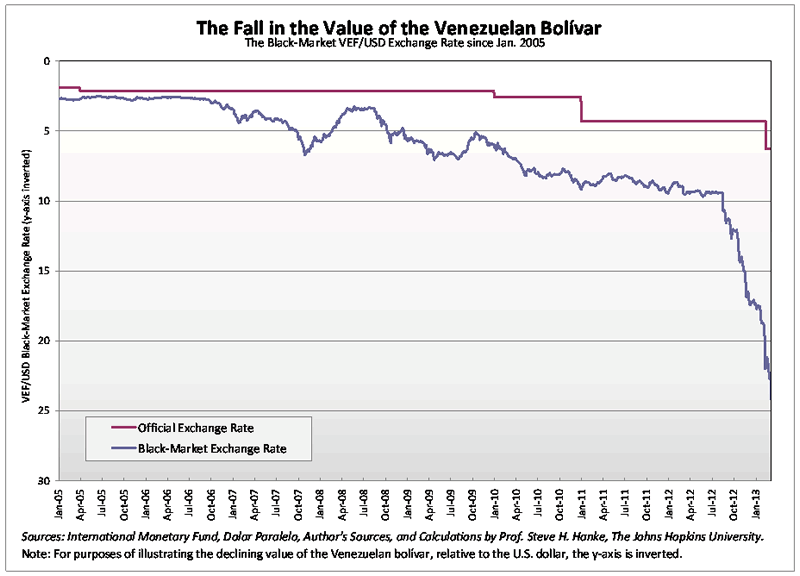

As the accompanying chart shows, the bolivar has entered what could be a death spiral, which has only accelerated with news of Chávez's death.

Shortly before his death, Chávez's administration acknowledged that the bolivar was in trouble and devalued the currency by 32 percent, bringing the official VEF/USD rate to 6.29 (up from 4.29). But, at the official exchange rate, the bolivar is still "overvalued" by 74 percent versus the free-market exchange rate.

So, how can Venezuela stave off a currency crisis and place its economy back on a solid monetary foundation? The solution is simple: replace the bolivar with the U.S. dollar. This option, known as dollarization, was one I presented to President Caldera, when I was his adviser back in 1995. And, it's a model that has been wildly successful in Ecuador, where I was an adviser to the Minister of Economy and Finance and early advocate of dollarization.

Ecuador's president, Rafael Correa, has wisely retained the U.S. dollar as the country's currency. Yes, the dollar has provided a strong anchor for the Ecuadorian economy (and the Correa regime), and it has insulated Ecuador from the economic ills that have plagued many of its neighbors.

Venezuelans, are you listening?

By Steve H. Hanke

www.cato.org/people/hanke.html

Steve H. Hanke is a Professor of Applied Economics and Co-Director of the Institute for Applied Economics, Global Health, and the Study of Business Enterprise at The Johns Hopkins University in Baltimore. Prof. Hanke is also a Senior Fellow at the Cato Institute in Washington, D.C.; a Distinguished Professor at the Universitas Pelita Harapan in Jakarta, Indonesia; a Senior Advisor at the Renmin University of China’s International Monetary Research Institute in Beijing; a Special Counselor to the Center for Financial Stability in New York; a member of the National Bank of Kuwait’s International Advisory Board (chaired by Sir John Major); a member of the Financial Advisory Council of the United Arab Emirates; and a contributing editor at Globe Asia Magazine.

Copyright © 2013 Steve H. Hanke - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Steve H. Hanke Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.