Gold And Silver Traders Reduce Long Positions Again

Commodities / Gold and Silver 2013 Mar 11, 2013 - 03:41 PM GMTBy: GoldCore

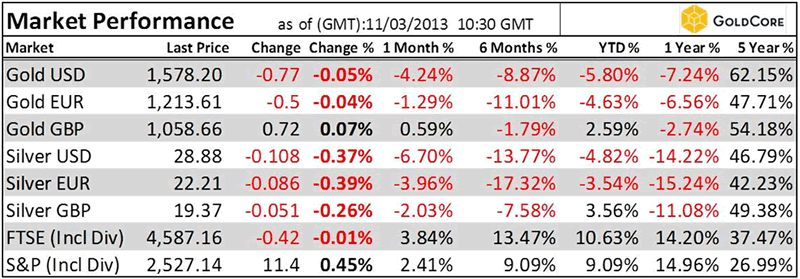

Today’s AM fix was USD 1,577.50, EUR 1,213.28 and GBP 1,058.37 per ounce.

Today’s AM fix was USD 1,577.50, EUR 1,213.28 and GBP 1,058.37 per ounce.

Friday’s AM fix was USD 1,577.00, EUR 1,204.18 and GBP 1,049.10per ounce.

Silver is trading at $28.91/oz, €22.32/oz and £19.50/oz. Platinum is trading at $1,600.75/oz, palladium at $772.00/oz and rhodium at $1,200/oz.

Gold was up $0.40 or 0.03% and closed Friday at $1,578.10/oz. Silver hit a high of $29.25 and finished +0.31%. For the week gold was up 0.16% and silver 1.33%.

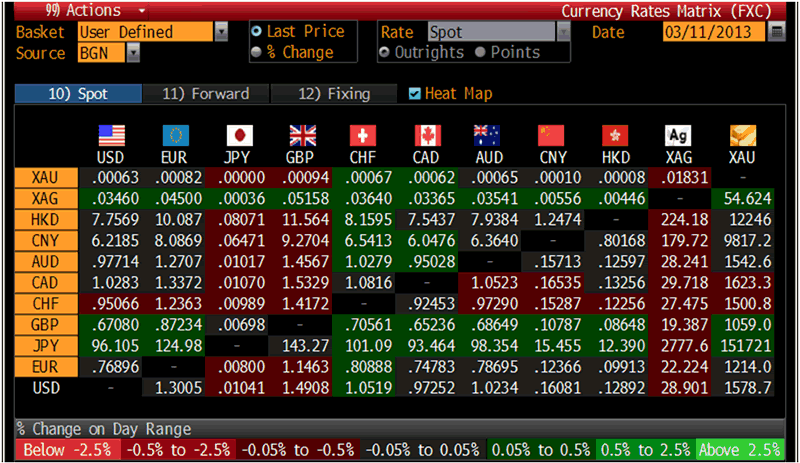

Cross Currency Table – (Bloomberg)

Hedge-fund managers and other large speculators decreased their net-long position in New York gold and silver futures last week (week ended March 5), according to U.S. Commodity Futures Trading Commission (CFTC) data.

Gold, 5 Years – (Bloomberg)

Speculative long gold positions, or bets prices will rise, outnumbered short positions by 107,587 contracts on the Comex division of the New York Mercantile Exchange, the CFTC said. Net-long positions fell by 9,012 contracts, or 8%, from a week earlier.

Gold futures rose last week, gaining 0.3%to $1,576.90 a troy ounce at Friday's close.

Miners, producers, jewelers and other commercial users were net-short 133,798 contracts, down 3,822 contracts, or 3%, from the previous week.

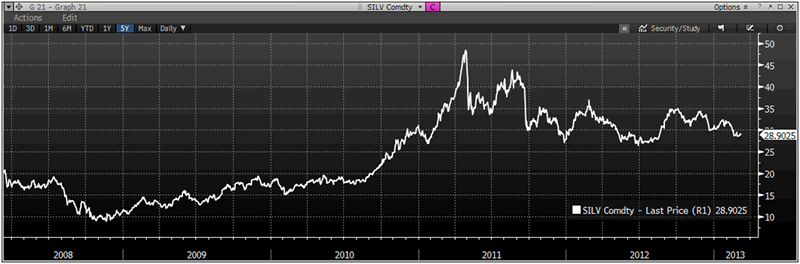

Silver, 5 Years – (Bloomberg)

Speculative long silver positions, or bets prices will rise, outnumbered short positions by 18,603 contracts on the Comex division of the New York Mercantile Exchange, the CFTC reported. Net-long positions fell by 3,134 contracts, or 14%, from a week earlier.

Silver futures rose last week, gaining 1.6% to $28.95 a troy ounce at Friday's close.

Miners, producers, jewelers and other commercial users were net-short 29,183 contracts, down 1,703 contracts, or 6%, from the previous week.

The poor sentiment in the gold and silver market and the continuing decline in net long positions on the COMEX is bullish from a contrarian perspective.

Webinar: Everything you need to know about Silver in 60 minutes.

Date: 13th March, 2013, 1900 - 2000 GMT

Speakers: David Morgan publisher of the Morgan Report and GoldCore Research Director Mark O'Byrne

Do you want answers on why silver should be part of your investment portfolio and why silver is a form of saving and financial insurance? Do you want to know the safest way to own silver? Do you want the opportunity to put your own questions to two leading world authorities on silver? We'll help you in this complimentary webinar, "Everything you need to know about Silver in 60 minutes."

To register click here!

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.