Dow and Silver in Gold Terms

Commodities / Gold and Silver 2013 Mar 09, 2013 - 12:44 PM GMTBy: Richard_Mills

The Dow on Gold's terms:

The Dow on Gold's terms:

- During January 2000 gold traded at an average price of $284.32

- January 2000 the Dow was 10,900

- 10,900/$284.32 per ounce = 38.33 gold ounces to buy the Dow

Today gold is trading at $1570.90 while the Dow Jones (DJIA) continues to break records, up another 30 points as I write to 14,284.

14,284/1570.90 = 9.09 ozs of gold to buy the Dow today.

38.33/9.09 = 4.2

The Dow on Silver's terms:

- During January 2000 silver averaged $4.95 oz

- January 2000 the Dow was 10,900

- 10,900/$4.95 per ounce = 2202 silver ounces to buy the Dow

Today silver is trading at $28.62, the Dow is 14,284.

14,284/28.62 = 499 ozs silver to buy the Dow.

2202/499 = 4.4

The Dow has gone up roughly, and only, 3400 points since January 2000.

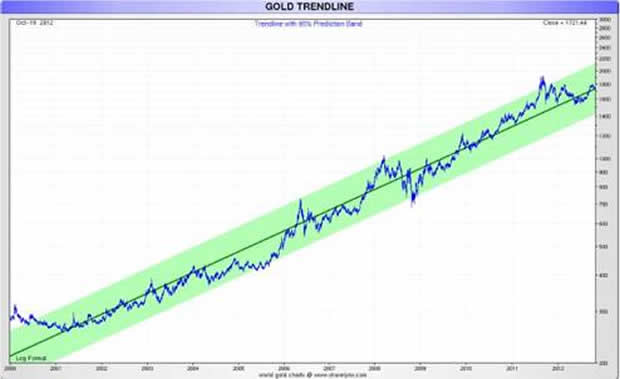

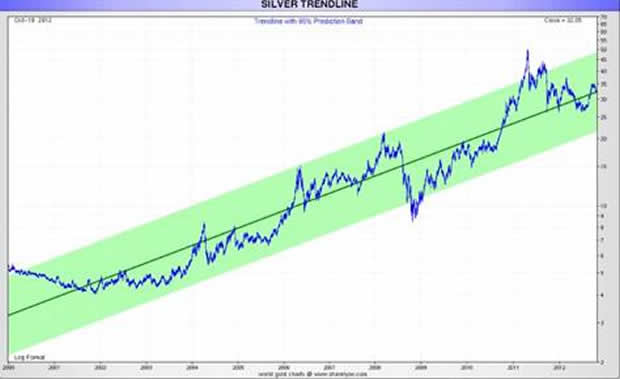

Gold, during the same period, has gone from an average of $284 to $1570.90 ($1570.90/$284 = 5.5x) while silver has gone from an average of $4.95 to $28.62 ($28.62/$4.95 = 5.7x) per oz.

In January 2000 the gold/silver ratio was $284.32/$4.95 = 57.43

Today, as I calculate these numbers, gold is $1570.90 oz while silver is $28.62 oz for a gold/silver ratio of 54.88.

Silver, a.k.a. 'poor man's gold' trades in lockstep with gold - from a ratio of 57.4 in 2000 to a ratio of 54.8 today some 13 years later who can argue?

Joe and Suzie on Gold's Terms

We've seen how gold and silver are doing relative to each other and the Dow. How is Joe & Suzie Average making out on gold's terms? Let's take a look at housing and wages...

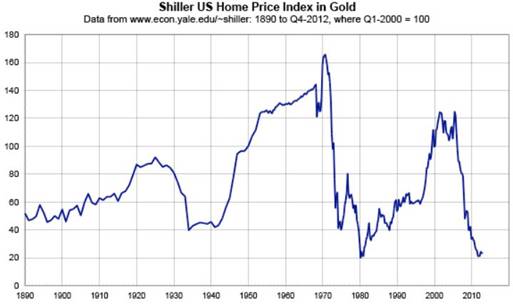

Today's home prices are lower than they were during the Great Depression and are approaching their all-time lows.

"At first, the drop in the dollar simply offset the apparent rise in home prices, and prices in gold worked sideways until 2006. But when home prices began to fall in dollar terms, and dollars were themselves falling in value, the double-whammy pushed true home prices down to levels not seen since the late 1980s. In fact, they set a new record, the lowest level since the index was first published. This means that most homes purchased in the last 20 years are now worth less than the original purchase price, even if they show gains of 100%, 200%, or more, in dollar terms." ~ pricedingold.com

The average U.S. worker earned $13.75 an hour in January of 2000. As we already know the price of an ounce of gold averaged $284.

The average worker would have had to work 20.65 hours ($284/$13.75) to buy an oz of gold in January, 2000.

Today the average U.S. workers wage is $19.77 and gold is $1570.90 oz - the average working Joe/Suzie would have to work 79.45 hours to buy an oz.

Consider:

- Global conflicts are intensifying and raising already considerable tension levels.

- Zero interest rates, global quantitative easing and escalating currency wars - an international race to worthless that ends with everyone a loser and leads to a rise in protectionism and future trade wars

After mulling over all that's happening in the world today ask yourself "what chance does Joe and Suzie have of buying gold and silver cheaper in the future than now?"

Conclusion

Buying some gold and silver should be on everyone's radar screens. Is it on your screen?

If not, maybe buying either, or a bit of both, should be.

By Richard (Rick) MillsIf you're interested in learning more about the junior resource and bio-med sectors please come and visit us at www.aheadoftheherd.com

Site membership is free. No credit card or personal information is asked for.

Richard is host of Aheadoftheherd.com and invests in the junior resource sector.

His articles have been published on over 400 websites, including:

Wall Street Journal, Market Oracle, SafeHaven , USAToday, National Post, Stockhouse, Lewrockwell, Pinnacledigest, Uranium Miner, Beforeitsnews, SeekingAlpha, MontrealGazette, Casey Research, 24hgold, Vancouver Sun, CBSnews, SilverBearCafe, Infomine, Huffington Post, Mineweb, 321Gold, Kitco, Gold-Eagle, The Gold/Energy Reports, Calgary Herald, Resource Investor, Mining.com, Forbes, FNArena, Uraniumseek, Financial Sense, Goldseek, Dallasnews, Vantagewire, Resourceclips and the Association of Mining Analysts.

Copyright © 2013 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

Richard (Rick) Mills Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.