US Home Owners Debts Exceed Equity

Stock-Markets / Credit Crisis 2008 Mar 08, 2008 - 02:12 AM GMT

The pace of expansion of all forms of debt is decelerating in the fourth quarter of 2007. Domestic non-financial debt rose 8% as a whole over 2007, .75% lower than in 2006. That may not seem like a slowdown, but consumers are changing course at the fastest pace, slowing from a pace of 6.75% annualized growth of debt in the third quarter to 5.5% in the fourth quarter. For the year, household debt rose at 6.75% compared to 10.25% in 2006. State and local government debt expanded at a rate of 9.75% for the entire year, while the Federal Government claims to have expanded its debt burden by 5%. I don't believe that last figure, since much of the Federal Government spending is “off the books.” Read the report and weep. We're all a bunch of debt junkies. Kicking the habit will be very hard.

The pace of expansion of all forms of debt is decelerating in the fourth quarter of 2007. Domestic non-financial debt rose 8% as a whole over 2007, .75% lower than in 2006. That may not seem like a slowdown, but consumers are changing course at the fastest pace, slowing from a pace of 6.75% annualized growth of debt in the third quarter to 5.5% in the fourth quarter. For the year, household debt rose at 6.75% compared to 10.25% in 2006. State and local government debt expanded at a rate of 9.75% for the entire year, while the Federal Government claims to have expanded its debt burden by 5%. I don't believe that last figure, since much of the Federal Government spending is “off the books.” Read the report and weep. We're all a bunch of debt junkies. Kicking the habit will be very hard.

Homeowner equity dips below 50%.

Homeowner's equity dropped to 47.9% in the fourth quarter and the second quarter number was revised downward to 49.6%, making this the third quarter in a row that homeowner's equity fell below 50%. This is the first time that homeowner's debt exceeds their equity since the Feds kept track in 1945. Moody's Economy.com estimates that 8.8 million homeowners, or about 10.3 percent of homes, will have zero or negative equity by the end of the month. Even more disturbing, about 13.8 million households, or 15.9 percent, will be "upside down" if prices fall 20 percent from their peak.

The latest Standard & Poor's/Case-Shiller index showed U.S. home prices plunging 8.9 percent in the final quarter of 2007 compared with a year ago, the steepest decline in the 20-year history of the index.

Bernanke wants to share your pain...

In a speech given at the Independent Community Bankers of America annual convention, Mr. Bernanke outlines his plan to mitigate the losses of foreclosure through a write-down program.

“Reducing the rate of preventable foreclosures would promote economic stability for households, neighborhoods, and the nation as a whole. Although lenders and servicers have scaled up their efforts and adopted a wider variety of loss-mitigation techniques, more can, and should, be done. The fact that many troubled borrowers have little or no equity suggests that greater use of principal writedowns or short payoffs, perhaps with shared appreciation features, would be in the best interest of both borrowers and lenders. This approach would be facilitated by allowing the FHA the flexibility to offer refinancing products to more borrowers.”

…and it's getting worse.

|

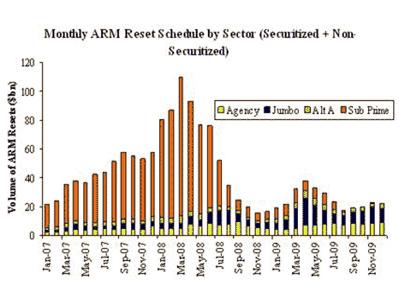

The graph to the left shows that we are only halfway through the mortgage resets (3% or higher) that are causing all the problems in the mortgage market. The housing market is in free-fall. The values of homes fell 9.1% in 2007, according to the Case-Schiller Index . That only tells half of the story. Home values nationally fell at an annualized rate of 18% in the fourth quarter and are gathering speed. What this is telling us is that the Federal Reserve rescue has failed. |

Are we now in a RECESSION?

|

March 7 ( Bloomberg ) -- The U.S. unexpectedly lost jobs in February for the second consecutive month, adding to evidence the economy is in a recession. Payrolls fell by 63,000 jobs, the most in five years, after a revised decline of 22,000 jobs in January, the Labor Department said today in Washington . The jobless rate dropped to 4.8 percent, reflecting a shrinking labor force as some people gave up looking for work, or simply weren't counted. |

Credit Markets scorched by margin calls.

|

March 7 ( Bloomberg ) -- The collapse of the subprime- mortgage market has engulfed Carlyle Group, the world's second- biggest leveraged-buyout firm by assets. The odd thing about this announcement is that Carlyle only trades in quality bonds and mortgages issued by Fannie Mae and Freddie Mac. The unfortunate thing is that the management had leveraged its funds 32-to-1. This turned a hiccup into pneumonia as Wall Street de-leveraged this month. It may also be the reason why there was massive selling in quality bonds, recently. |

The “R” word may not be good for gold.

|

NEW YORK ( MarketWatch ) -- Gold futures swung between gains and losses Friday after the government reported the biggest drop in nonfarm payrolls since March 2003, signaling the U.S. economy might already be in a recession. The jobs numbers have fallen short of expectations for a “moderate growth” economy. A recession may cause speculators to rethink their position. |

The sagging Nikkei; blame it on the politicians.

|

It's the politics, stupid , The mantra for Japan's sickly stock market is getting louder. Foreign and local economists, brokers, investors, restaurant owners, barmen and taxi drivers, Peter Douglas, head of GFIA, a hedge fund consultancy, reels off the list after a recent trip to Tokyo. “They are all spitting blood in a very un-Japanese fashion.” “The consensus right now is that the reason why the market is falling and Japan appears to be stuck is down to Japanese politicians.” |

Shanghai Composite shows increasing worry over U.S.

|

SHANGHAI , China — Chinese stocks fell Friday amid mounting worries over a weakening U.S. economy and inflation-fighting credit controls at home. The benchmark Shanghai Composite Index fell 60.47 points, or 1.4%, to 4,300.52. The Shenzhen Composite Index slipped 1.3 % to 1,369.84. What a topsy-turvy market! While we are loosening the purse strings (lower interest rates) China is tightening to curb inflation. |

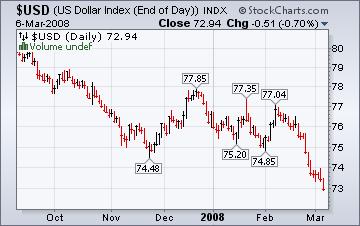

Everyone is hopping off this one!

|

Investors are abandoning the U.S. dollar and speculating in commodities, instead. For example, crude oil prices shot up a stunning $5 ( U.S. ) to a new closing record of $104.52 a barrel yesterday as investors dumped U.S. dollars and fuelled a broad commodity market frenzy. Just when it seem obvious to everyone, the trend can change, so be on the alert! |

Late payments getting later.

|

The share of all home loans with payments more than 30 days late , both prime and fixed-rate loans, rose to a seasonally adjusted 5.82 percent, the highest since 1985, the bankers' group said in today's report. ``We're seeing people give up even before they get to the reset because they couldn't afford the home in the first place,'' said Jay Brinkmann , vice president of research and economics for the Washington-based trade group. |

Is the Midwest getting preferential treatment?

|

The Energy Information Administration's This Week In Petroleum asserts that the Midwest is the only region where gasoline prices did not increase this week. It remained unchanged at $3.08 per gallon. The West Coast, on the other hand, is getting socked by the highest gasoline prices in history. The price of diesel also surged over 10 cents to $3.658 per gallon. |

In like a Lion…Out like a lamb?

|

The Natural Gas Weekly Update reports, “Boosted by record-high crude oil prices and declining working gas in storage, the prices of natural gas futures contracts increased on the week, reaching levels not seen in the market in more than 2 years. The price of the futures contract for April 2008 delivery increased 68 cents per MMBtu to $9.741.” Cold weather that blanketed much of the country, with the exception of the Northeast, as well as the high crude oil prices, led to price increases at nearly all natural gas spot market locations. Spot price increases in the Lower 48 States ranged mostly between 20 and 50 cents per MMBtu. Well, folks, Spring is just around the corner. |

Mish does it again.

In his latest article entitled, “ An Unmitigated Disaster in Jobs ,” Mish handles the details of today's jobs report. It never ceases to amaze me that these government reports have such damning evidence hidden in full view. I suspect that they don't think most people will read the details and figure out for themselves that it's worse than the smiley face report says.

From the BLS: "Both the civilian labor force, at 153.4 million, and the labor force participation rate, at 65.9 percent, declined in February."

Here is the same sentence in plain English. "The unemployment rate dropped because we stopped counting everyone who is unemployed." Expect to see more of this kind of nonsense from the BLS and you will not be disappointed.

We're on the air every Friday.

Tim Wood of www.cyclesman.com , John Grant and I are back in our weekly session on the markets. This week should be fascinating. You will be able to access the interview by clicking here .

New IPTV program starting in March.

I will be a regular guest on www.yorba.tv starting on Thursday, March 6 th at 4:00 pm EDT . Stay tuned for news and views!

Please make an appointment to discuss our investment strategies by calling Claire or Tony at (517) 699-1554, ext 10 or 11. Or e-mail us at tpi@thepracticalinvestor.com .

Regards,

Anthony M. Cherniawski,

President and CIO

http://www.thepracticalinvestor.com

As a State Registered Investment Advisor, The Practical Investor (TPI) manages private client investment portfolios using a proprietary investment strategy created by Chief Investment Officer Tony Cherniawski. Throughout 2000-01, when many investors felt the pain of double digit market losses, TPI successfully navigated the choppy investment waters, creating a profit for our private investment clients. With a focus on preserving assets and capitalizing on opportunities, TPI clients benefited greatly from the TPI strategies, allowing them to stay on track with their life goals

Disclaimer: The content in this article is written for educational and informational purposes only. There is no offer or recommendation to buy or sell any security and no information contained here should be interpreted or construed as investment advice. Do you own due diligence as the information in this article is the opinion of Anthony M. Cherniawski and subject to change without notice.

Anthony M. Cherniawski Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.