Gold, Crude Oil and Stock Market SPX Trade Setups

Stock-Markets / Financial Markets 2013 Mar 03, 2013 - 05:32 PM GMTBy: Chris_Vermeulen

Over the past year my long term trends and outlooks have not changed for gold, oil or the SP500. Though there has been a lot of sideways price action to keep everyone one their toes and focused on the short term charts.

Over the past year my long term trends and outlooks have not changed for gold, oil or the SP500. Though there has been a lot of sideways price action to keep everyone one their toes and focused on the short term charts.

We all know that if the market does not shake you out, it will wait you out, and sometimes it will even do both at the same time. So stepping back to review the bigger picture each week is crucial in keeping a level trading/investing strategy in motion.

The key to investing success is to always trade with the long term trend and stick with it until price and volume clearly signals change of trend. Doing this means you truly never catch the market top nor do you catch market bottoms. But the important thing is that you do catch the low risk trending stage of an investment (stage 2 – Bull Market, Stage 4 Bear Market).

Let’s take a look at the charts and see where prices stand in the grand scheme of things for gold, oil, energy and stocks…

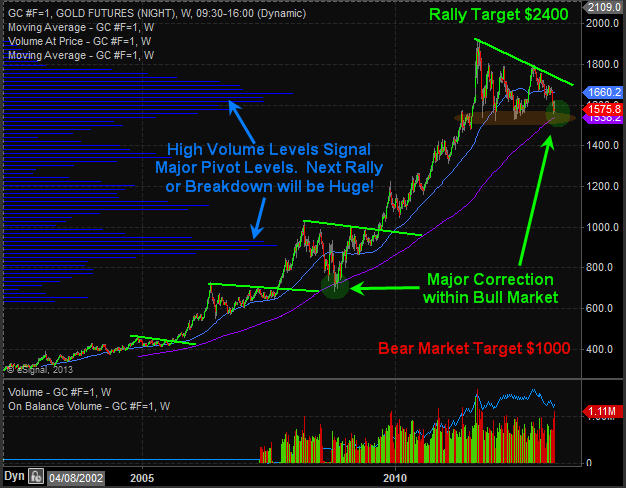

Gold Weekly Futures Trading Chart:

Last week I talked about how precious metals were nearing a major tipping point and to be aware of those levels because the next move is likely to be huge and you do not want to miss it or even worse be on the wrong side of it.

Overall gold and silver remain in a secular bull market and hav gone through many similar pauses to what we are watching unfold with them over the past year. As mentioned above the gold market looks to be trying to not only shake investors out but to wait them out also with this 18 month volatile sideways trend.

A lot of gold bugs, and gold investors of mining stocks are starting to give up which can been seen on the charts when reviewing the price and selling volume for these investments. I am a contrarian in nature so when I see the masses running for the door I start to become interested in what everyone is unloading at bargain prices.

Gold is now entering an oversold panic selling phase which happens to be at major long term support. This bodes well for a strong bounce or start of a new bull market leg higher for this shiny metal. If gold breaks below $1500 – 1530 levels it could trigger a bear market for precious metals but until then I am bullish at the current price. I do think we could see another spike lower in gold to test the $1500- $1530 level this week but after that it could be off to the races to new highs.

Crude Oil Weekly Trading Chart:

Oil had a huge bull market from 2009 until 2011 but since then has been trading sideways in a narrowing bullish range. I expect some big moves this year for oil and technical analysis puts the odds in favor for a higher price. If we do get a breakout and rally then $130 will likely be reached. But if price breaks down then a sharp drop to $50 per barrel looks like the next stop.

Utility & Energy Stocks – XLU - XLE – Weekly Investing Chart

The utility sector has done well and continues to look very bullish for 2013. This high dividend paying sector is liked by many and the price action speaks for its self… If the overall financial market starts to peak then these sectors should hold up well because they are services, dividend and a commodity play wrapped in one.

SP500 Trend Daily Chart:

The SP500 continues to be in an uptrend which I am trading with until price and volume tell me otherwise. But there are some early warning signs that another correction or a full blown bear market may be just around the corner (Selloff in May??).

Again, sticking with the uptrend is key, but knowing what could happen in the coming months gives you some time to start looking for some great shorting opportunities for when the trend changes. Your transition from long positions to short positions should be a simple measured move in your portfolios and not a panic reaction.

Weekend Trend Conclusion:

In short, I remain bullish on stocks and commodity until I see a trend change in the SP500.

The energy sector is doing well and looks bullish for the next month or so.

Gold and gold miners, I feel they are entering a low risk entry point to start building a new long position. Risk is low compared to potential reward so depending on how things unfold this week I may start to get active in this sector.

Keep in mind that when the price of a commodity or index trades near the apex of a narrowing range or long term support/resistance level volatility typically increases as fear and greed become heightened. This creates larger daily price swings so be prepared for some turbulence in the coming weeks while the market shakes things up.

If you would like to keep up to date on market trends and trade ideas be sure to join my newsletter at http://www.thegoldandoilguy.com

By Chris Vermeulen

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 7 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

Chris Vermeulen Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.