Bernanke the Comedian Addicted to Asset Bubbles

Politics / US Federal Reserve Bank Mar 02, 2013 - 06:42 PM GMTBy: Joseph_T_Salerno

Ben Bernanke confided on January 14 that he is unaware of any new method of stimulating economic growth. Bernanke said: “As far as I’m aware, there’s no completely new method that we haven’t [already tapped].” So Helicopter Ben has run out of innovative and unconventional ways to create new money. Lest you be tempted to breathe a bit easier, however, rest assured that the now conventional method of quantitative easing, involving the Fed’s monthly purchase of $85 billion worth of mortgage-backed and U.S. government securities, seems to be working just fine according to Bernanke and he foresees its continuation. Noting the stubbornly high unemployment rate combined with the low inflation rate in the U.S. economy, Bernanke stated, “That is the case for being aggressive, which we are trying to do.” Although he is “cautiously optimistic,” he does promise to closely monitor the risks, efficacy, costs, and benefits of this inflationary policy.

Ben Bernanke confided on January 14 that he is unaware of any new method of stimulating economic growth. Bernanke said: “As far as I’m aware, there’s no completely new method that we haven’t [already tapped].” So Helicopter Ben has run out of innovative and unconventional ways to create new money. Lest you be tempted to breathe a bit easier, however, rest assured that the now conventional method of quantitative easing, involving the Fed’s monthly purchase of $85 billion worth of mortgage-backed and U.S. government securities, seems to be working just fine according to Bernanke and he foresees its continuation. Noting the stubbornly high unemployment rate combined with the low inflation rate in the U.S. economy, Bernanke stated, “That is the case for being aggressive, which we are trying to do.” Although he is “cautiously optimistic,” he does promise to closely monitor the risks, efficacy, costs, and benefits of this inflationary policy.

I guess the rapid asset price run-up in stock and commodities markets, which are nearly back to financial bubble levels, and booming farmland prices do not count in Bernanke’s benefit-cost calculus. More likely, Bernanke accounts them as a benefit, which, via the “wealth effect,” will induce another debt-driven consumption spree on the part of the American public that will stimulate economic growth, i.e., create another bubble economy.

Recreating the Asset Bubble: The Fed’s Plan for Economic Recovery

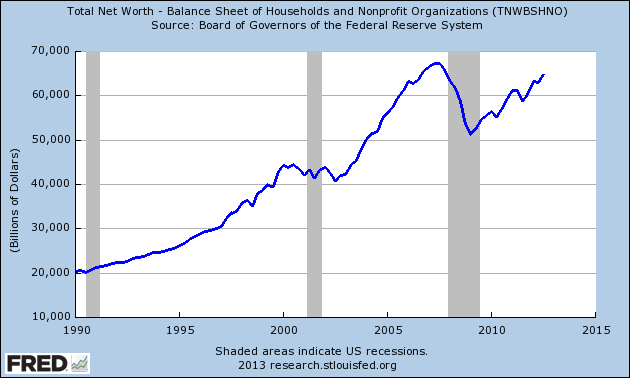

Circle Bastiat, February 11, 2013While Keynesians continue to sing that lame old song about insufficient aggregate demand stimulus and the horrors of austerity and “market” monetarists prattle on about deficient growth in nominal GDP, the signs of an incipient asset bubble become more evident every day. In fact, it would not be overstating the case to say that the Fed is deliberately aiming at recreating an asset bubble as a means of rekindling the historically unprecedented consumption booms of the latter half of the 1990s and the first part of the last decade. These consumption manias were driven by the “wealth” or “net worth” effect, pithily described in the metaphor “using one’s home as an ATM machine.” As the following graphs show, Fed monetary policy is succeeding in pumping up total net worth, which consists mainly of financial assets plus real estate owned by households (and nonprofit organizations) minus household debt.

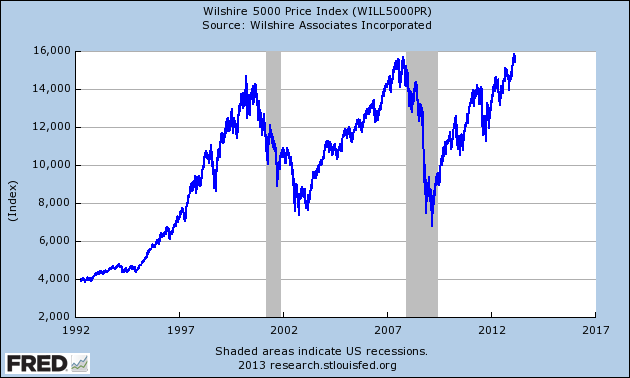

What the above graph shows is that total net worth peaked at $67.3 trillion in Q3 2007 and fell precipitously to $51.1 trillion in Q1 2009. This $16.1 trillion decline in U.S. household wealth exceeded the combined annual GDP of Great Britain, Germany, and Japan. The Fed has since succeeded in pumping up net worth, to $64.8 trillion by Q3 2012, which is only $2.5 trillion below its level at the peak of the bubble. Although the value of household real estate remained $5.5 trillion below its bubble peak for Q3 2012 and has been slowly increasing, the Fed has been wildly successful in pushing up the value of U.S. financial assets. This is revealed in the the Wilshire 5000 Total Market Index. This index tracks the total dollar value of all U.S.-headquartered equity securities with readily available price data and includes more than 6,000 firms.

Note in the graph above that the index reached its peak of 15,244 in December 2007, then went crashing to its trough of 6,800 by March 2009. By January 2013 the Fed’s inflationary policies drove it past its previous peak, reflating the index by 2,000 points in 2012 alone. But perhaps the most telling graph is the ratio of household net worth to GDP.

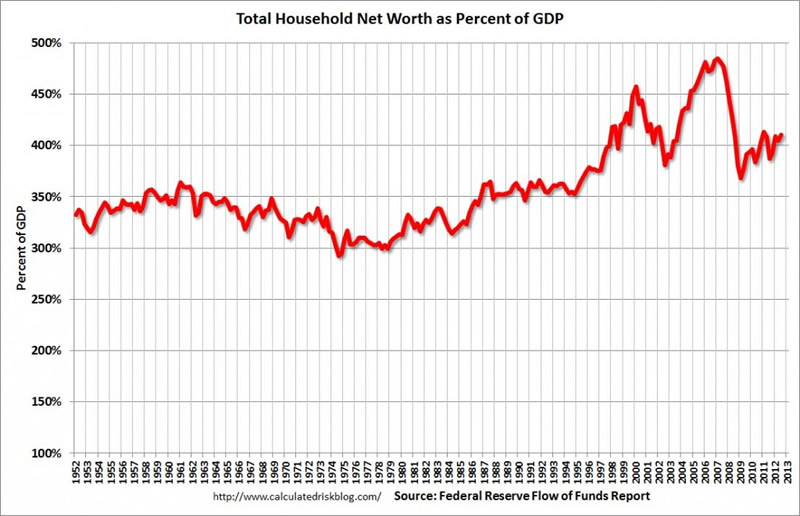

This graph shows that for over 40 years, from 1952 until the dot-com boom began in the mid-1990s, the household net worth to GDP ratio fluctuated in a band between 300 percent and 350 percent. After falling back toward this range after the recession of 2001, the Fed’s monetary expansion interrupted the correction and sharply drove the ratio up by 100 percentage points in a matter of three years. The financial crisis set another needed asset price readjustment in train, but it was once again reversed by the Fed, which was desperate to re-inflate asset prices in order to first prevent a financial collapse and then to start another consumption boom. The ratio now sits at 400 percent—a level it first reached midway through the dot-com bubble—and is headed inexorably upward. Once housing markets in general begin to follow the lead of New York City’s and Washington, D.C.’s overheated residential real estate markets, we will be well on our way to another unsustainable asset bubble.

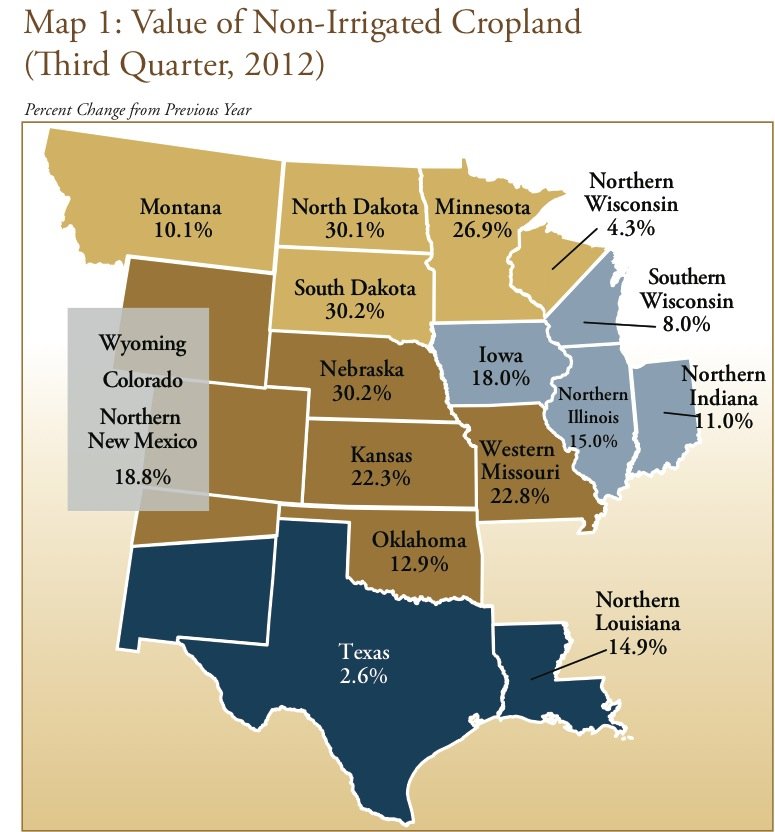

The Fed is Blowing More Bubbles

Circle Bastiat, February 15, 2013As if any more evidence were needed that the Fed has succeeded, either through ignorance or design, in igniting new asset bubbles throughout the economy, the Federal Reserve Bank of Kansas City just released a survey of bankers that confirms a continuing rise in U.S. farmland prices. The following chart shows the stratospheric year-over-year rise in non-irrigated cropland prices for 3Q 2012.

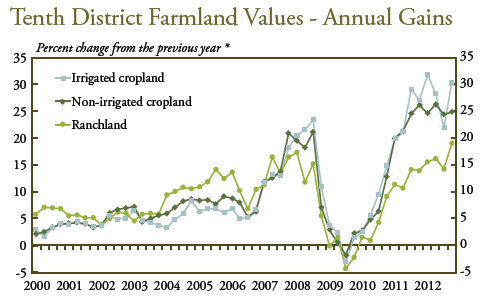

As reported by TheBlaze, one analyst noted, “If this trend continues . . . these agricultural areas may very well become ‘New Manhattans’ (as far as wealth is concerned).” The chart below from the report by the Kansas City Fed puts this stunning trend in temporal perspective and reveals that it extends across all farmland, including irrigated cropland and ranchland.

Bernanke the Comedian

Circle Bastiat, February 27, 2013Dr. Brendan Brown is an eminent financial economist in the City of London and the author of The Global Curse of the Federal Reserve,initially published in 2011 and just released in its second revised edition. In his book, Brown is critical of Milton Friedman and the monetarists for ignoring the effects of monetary expansion on interest rates and asset prices and for assuming that a stable price level indicates an absence of inflation. Brown adopts Rothbard’s view that the 1920s were an inflationary decade, because, despite the rough price-level stability that obtained, asset and commodities markets were “overheated.” Brown also rejects the monetarist argument that price-level stabilization is the sine qua non of economic stability. He argues that price stabilization policy is one of the “dangerous features of Friedmanite monetarism” which “Austrian critics have long highlighted” and “which in hindsight may have played a role in the growth in Bernanke-ism.” Finally, and most insightfully, Brown also maintains that deflation is effective—and indeed, necessary—to extricate an economy from the depths of a recession or depression.

Needless to say, Dr. Brown is no fan of Chairman Bernanke. In fact, in a memo today, Brown perceptively identifies the comedic aspect of Bernanke’s testimony on the first day of his semiannual monetary policy report to Congress. Writes Brown:

Comedy according to the theorists of drama is based on inflexibility of character. The lead role cannot in any way bend his stereotyped behaviour even when this would avoid an accident or disaster which is looming. And so “Don Juan” of Molière is a comedy. Even when the ghostly statue of his slain victim threatens to take Don Juan on a fiery descent into hell, the lead character cannot show remorse and desist from his life of debauchery. Chekhov listed his “Cherry Orchard” as a comedy because the lead characters could not shake themselves out of their nonchalance and avoid bankruptcy by selling the cherry orchard of their villa to a property developer on which he would build bungalows.

And so we come to the monetary comedy which played out in Washington yesterday. Professor Bernanke, adamant as always that the road to economic prosperity and stability takes the form of a rigorous targeting of inflation and supremely confident in a good outcome to his massive monetary experimentation tells his Congressional questioners that he sees no signs of asset price inflation which would justify changing his present policies. This is the same professor who largely repudiates any concept of asset price inflation and believes totally that any such dangers can be avoided well ahead of time by skilful action on the part of an army of regulators following the recently expanded book of rules. And this is the same professor who denies that monetary disequilibrium played any role in the giant asset and credit market inflations of the last two decades.

There is another element in the monetary comedy under the title of “Fed chair’s semi-annual testimony to Congress.” This is the failure of congressional questioners to hold the professor to account. When he declared that there is no asset price inflation, there was no follow on question such as “but professor you still say there was no asset price inflation in the last great bubble and bust and deny that the Fed of which you were a leading policy maker was in any way responsible: why should we believe you now?” That there should be no such question is part of the comedy, in its literal sense.

Dr. Brown will deliver the Murray N. Rothbard Memorial Lecture at the Austrian Economics Research Conference in March 2013.

Joseph Salerno is academic vice president of the Mises Institute, professor of economics at Pace University, and editor of the Quarterly Journal of Austrian Economics. He has been interviewed in the Austrian Economics Newsletter and on Mises.org. Send him mail. See Joseph T. Salerno's article archives. Comment on the blog.

© 2013 Copyright Joseph Salerno - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.