How the Fed Will Crash the U.S. Bond Market

Interest-Rates / US Bonds Feb 25, 2013 - 07:00 AM GMTBy: Submissions

Richard Moyer writes: When you or I buy bonds, we pay a certain amount of money to buy someone elses debt. In return, they pay us a certain amount of interest for a fixed period of time.

Richard Moyer writes: When you or I buy bonds, we pay a certain amount of money to buy someone elses debt. In return, they pay us a certain amount of interest for a fixed period of time.

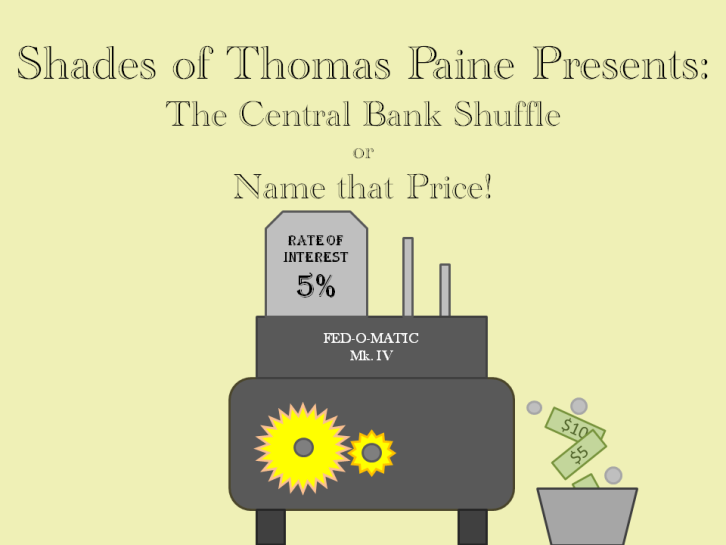

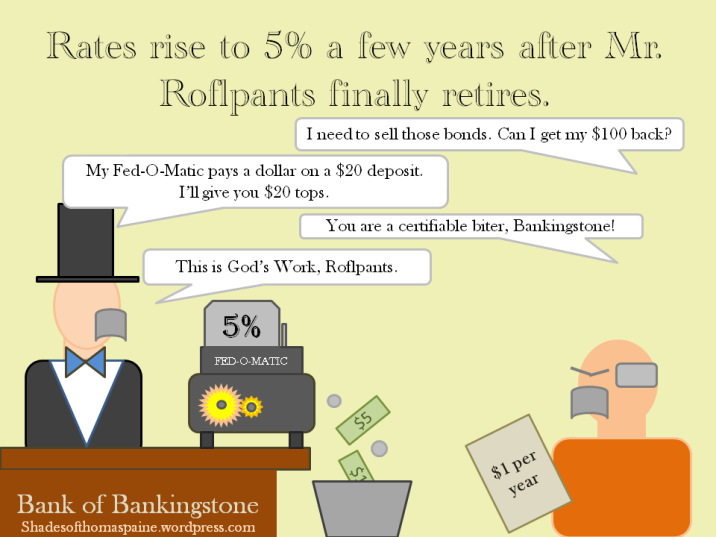

The Federal Reserve can influence prices of debt by offering a certain risk-free interest rate. In this article, this risk-free rate is pictured as the Fed-O-Matic, a money-printing machine sitting on the desk of Lord Bankingstone, respresenting big finance. You put money in, it dumps more money into the bucket according to the rate of interest.

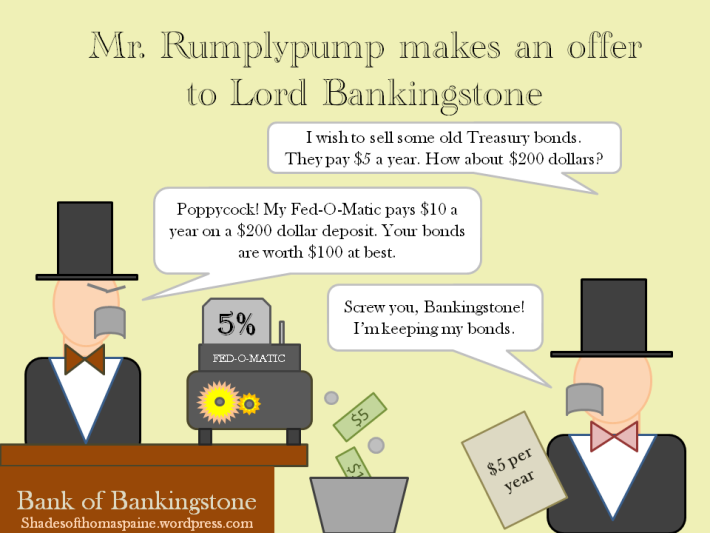

While the Fed-O-Matic pays good rates of interest, Mr. Rumplypump’s bonds aren’t worth so much. At the same time, anyone wishing to issue bonds is going to have to beat the Fed-O-Matic rate pretty handsomely, seeing as how the machine has absolutely zero risk.

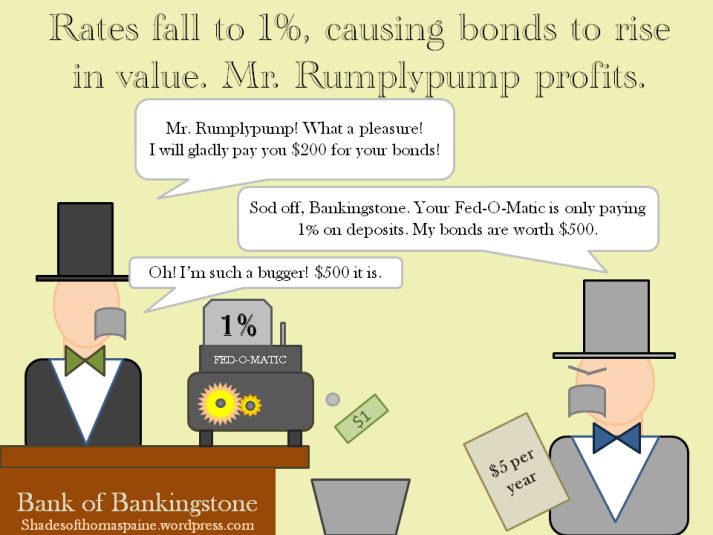

When the Fed-O-Matic pays crappy rates of interest, Mr. Rumplypump can command high prices for his high-paying bonds. At the same time, anyone issuing bonds doesn’t have to pay very much interest to beat the Fed-O-Matic.

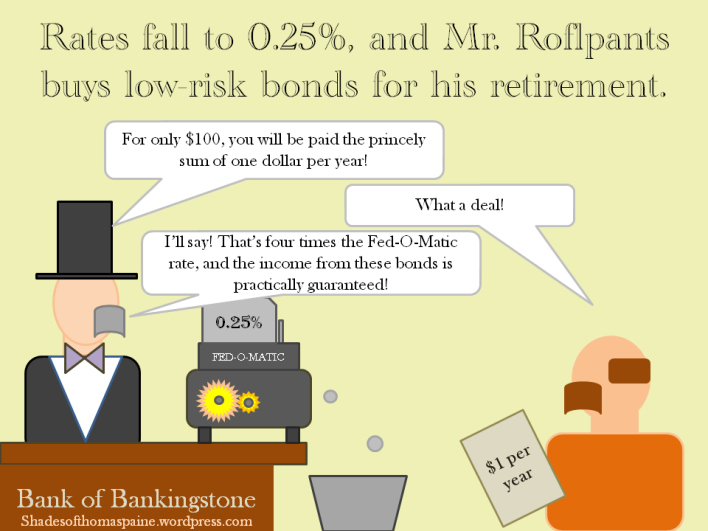

People saving for retirement, especially using 401(k)s, are routinely told to buy stocks early in their careers, and then as retirement gets closer, transition to safe, low-yielding bonds to guarantee income and avoid the possibility of a stock market crash. Assuming stable interest rates, this is a good strategy. However, wildly fluctuating interest rates resulting from an activist central bank can play havoc on the bond market.

Mr. Roflpants gets burned when he buys bonds during a zero-interest-rate policy (ZIRP), and then has to sell his bonds during a period of more typical interest rates. If prevailing interest rates double, the same bond is worth half as much. The recent news that the Fed is reconsidering its money-printing extravaganza bodes ill for the bond markets for several reasons.

Clearly, the value of existing bonds will crash. As the bond market crashes, the stock market won’t look as attractive. The low prices on existing debt and good rates of return on new debt will move money out of stocks and into bonds.

Imagine what will happen when Treasury bond rates are 6% instead of 1%. The United States would be forced to pay roughly a trillion dollars a year in interest on its $17 trillion debt. This would increase the deficit by roughly a trillion dollars, likely reducing trust in US debt. The US government, looking for buyers of yet more debt, without the Fed as its biggest customer, will be forced to raise interest rates further. Higher rates lead to bigger deficit. Bigger deficit leads to higher rates.

Higher interest rates will also cause mortgage rates to increase, meaning the mortgage payment for a given size of home loan will increase. Seeing as how the mortgage payment size is what decides whether someone can buy a house, home prices will necessarily have to come down, other things being equal.

At first, the end of the Fed’s money printing experiment will be read by investors as a sign of recovery, and commodity assets like gold and silver will probably suffer. Then, as interest rates rise and the Treasury bond market bubble deflates, those stores of value won’t look so bad and will likely rebound. Should things unfold in this way, there will be a good buying opportunity for gold and silver between the announcement that QE3 is ending and the inevitable increase of interest rates that will follow.

Richard Moyer

http://shadesofthomaspaine.wordpress.com

© 2013 Copyright Patrick Henningsen - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.