US Treasury Bonds vs. the CRB Point to Bond Market Collapse

Interest-Rates / US Bonds Mar 05, 2008 - 07:22 PM GMTBy: Michael_Pento

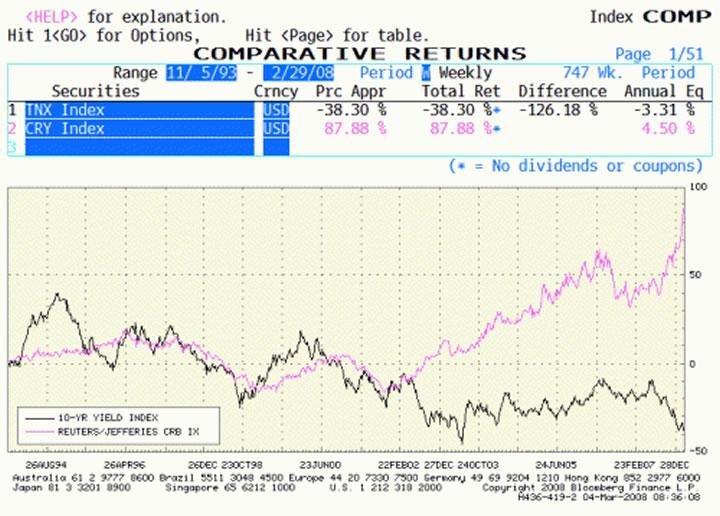

From 1980 until the spring of 2002, 10-year Treasury note yields held a positive correlation with the CRB index. Since 2002, however, there has been a dramatic divergence between Treasury yields and commodity prices. This trend is unsustainable in the long term because bond yields must eventually reflect rising inflationary pressures and at some point offer a positive real after-tax return.

From 1980 until the spring of 2002, 10-year Treasury note yields held a positive correlation with the CRB index. Since 2002, however, there has been a dramatic divergence between Treasury yields and commodity prices. This trend is unsustainable in the long term because bond yields must eventually reflect rising inflationary pressures and at some point offer a positive real after-tax return.

There can be only two possible conclusions reached when viewing this disparity, shown in the chart below. One is that commodity prices are no longer an indication of inflationary pressures, a ridiculous contention that cannot be taken seriously. After all, the CRB Index contains 19 commodities that include precious metals, base metals, agriculture and energy, broad measures of the pricing pressures that exist in today's economy.

The other conclusion-the right one, in my estimation-is that Treasury securities are grossly overvalued.

Source: Bloomberg

[The 15-year chart above shows the close relationship that existed between 10-year yields (shown above in white) and the CRB index (green) from November 1993 into 2002. The decoupling since that time can clearly be seen here.]

Today's disparity between rising bond prices and inflation are likely the result of bondholders' fears of holding any debt not backed by the full faith and credit of the U.S. Government, but this is a not a disparity that should be able to continue indefinitely. After all, even according to the "official" inflation measure-the Consumer Price Index, which likely understates inflation-buyers of 10-year treasuries are currently getting a negative real return to the tune of nearly a full 1%!

History is clear that we should look for a reversion to the mean, either via a dramatic downward break in commodity prices, a sharp increase in Treasury bond yields or some combination of the two. It is my belief that the continued actions undertaken by the Fed to re-liquefy the banking sector will engender a further increase in inflation pressures and send commodity prices higher still.

As a result, the most likely outcome in this scenario is for a collapse in bond prices as opposed to a dramatic retrenchment in commodities.

In the current economic environment, rising interest rates would exacerbate the decline in home prices and restrict credit availability even further, thus the Fed will be unable to hike rates until any economic recovery is well underway. So, despite the incessant claims over the last few days that commodities are "in a bubble," the risk of falling bond prices far outweighs the risk of falling commodity prices.

While it may be true that commodities are a little overbought on a short-term basis, today's real bubble exists in the bond market.

I discuss this rate cutting nonsense and more in my new podcast, the Mid-Week Reality Check . Five minutes of sanity in an insane financial world!

Michael Pento

Senior Market Strategist

Delta Global Advisors

800-485-1220

mpento@deltaga.com

www.deltaga.com

With more than 16 years of industry experience, Michael Pento acts as senior market strategist for Delta Global Advisors and is a contributing writer for GreenFaucet.com . He is a well-established specialist in the Austrian School of economic theory and a regular guest on CNBC and other national media outlets. Mr. Pento has worked on the floor of the N.Y.S.E. as well as serving as vice president of investments for GunnAllen Financial immediately prior to joining Delta Global.

Michael Pento Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.