Gold Price Correction Separating the Men from the Boys

Commodities / Gold and Silver 2013 Feb 22, 2013 - 03:41 PM GMT Is gold bullion becoming the commodity the mainstream media and analysts love to hate?

Is gold bullion becoming the commodity the mainstream media and analysts love to hate?

After all, views of the metal are becoming increasingly bearish. But I believe the most important factor as to why gold bullion is actually attractive at this point is being ignored; gold bullion becomes more valuable as the paper money created by central banks increases in circulation.

How negative have investors become on gold bullion? Since October 2012, hedge funds have cut their holdings of gold bullion by 56%. (Source: Bloomberg, February 15, 2013.) Hence, you can see why some are calling the recent price decline in gold bullion prices the end of the bull market in the metal.

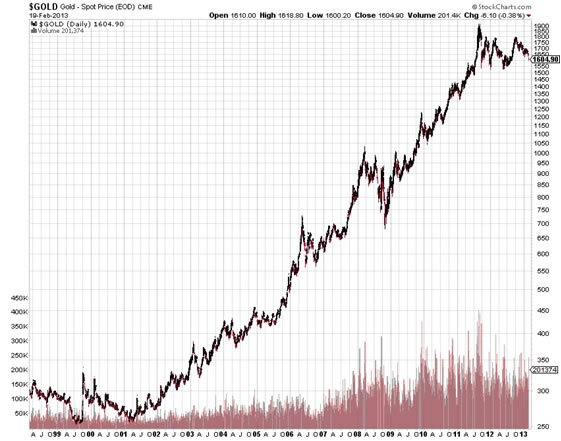

Here’s a long-term chart of gold bullion prices. I see a sideways pattern developing, but I don’t see a bust of the bull market that started 12 years ago in gold bullion.

Chart courtesy of www.StockCharts.com

As my loyal readers know, I’m still bullish on gold bullion. My main reason for staying bullish is very simple; so long as the central banks continue to devalue their currencies, I believe the precious metal will shine.

And right now, wherever I look, I see central banks looking to “fight” their strengthening currencies by outright devaluing them. Their attitude of “do whatever it takes to get our exports going” is going to create trouble in the future.

The Federal Reserve alone has printed trillions of dollars to improve the economy. And unfortunately, other central banks are taking the exact same actions—not just major central banks, but the smaller ones too, like the Philippine, Taiwan, Indonesia, South Korea, Colombia, Peru, Costa Rica, and Brazil central banks.

Dear reader, what holds true is that the list of central banks committing to print more money is increasing, and those that were already printing are promising to print more. For example, the central bank of Switzerland, is working hard to keep the value of the Swiss franc lower so its currency doesn’t rise in value against the euro. (The eurozone is its major trading partner.)

As more central banks join in on printing more money, I become more bullish on gold bullion. Looking at the long-term picture, gold bullion is standing at a bright spot. Remember: No investment goes straight up or straight down. And in true bull markets, pullbacks are needed to weed out the speculators.

Michael’s Personal Notes:

A slight rise in U.S. home prices has the financial news reporters believing there is real growth in the U.S. housing market. Unfortunately, the fact is: the housing market in the U.S. economy hasn’t improved, and the most important aspect of real growth—first-time homebuyers—is still missing.

Consider this, if the price of a stock goes down by 30%, and then the next day it rises by 10%, would you say the stock has recovered? The answer is, “no.”

The S&P/Case-Shiller 20-City Home Price index, the most quoted index to observe the pulse of U.S. housing market, is still close to the same point it was at in August of 2010, and it’s down almost 30% since the end of 2006. (Source: Federal Reserve Bank of St. Louis, January 29, 2013.)

If you judge the housing market by looking at home prices, then clearly, it is deep underwater. Average home prices in the U.S. housing markets will have to increase more than 40% to get to the same level as 2006.

Now, if you look at the first-time homebuyers—the pulse of the housing market—they are not getting involved.

How bleak is the demand for first-time homebuyers in the U.S. housing market? At the very best, it is dismal.

Look at the sales of new one-family homes. They have been continuously declining. In 2011, on average, 168,000 units of new one-family homes were sold in the U.S. housing market. In 2012, the average was 146,000—a decline of more than 13% over a one-year period. (Source: Federal Reserve Bank of St. Louis, January 25, 2013.)

And according to the National Association of Home Builders/Wells Fargo Housing Index (HMI), the confidence of new single-family home builders is falling. It fell to 46 in February from 47 in January. (Source: National Association of Home Builders, February 19, 2013.) Any number below 50 means that the builders perceive housing market conditions to be poor, not good.

Keep in mind that new home builders closely follow the demand of the housing market. If their confidence turns negative, it is definitely not a good sign.

Dear reader, consumers in the U.S. economy are still working hard to make ends meet. After the financial crisis, those who were lucky enough to find a job are earning less than they did before, while others are still unemployed.

It is truly not a surprise for me to see the absence of first-time homebuyers from the housing market. They simply don’t have money right now to afford houses. I will consider the U.S. housing market to be in a rebound when I see first-time homebuyers pouring in—right now, that’s not the case.

NEWSFLASH: Highflier Toll Brothers, Inc. (NYSE/TOL), the largest U.S. luxury home builder, saw its stock fall by just under 10% on Wednesday after the company reported earnings that significantly trailed analysts’ estimates. My opinion: investors have pushed the stocks of new home builders up too far. The rebound in the housing market will be much slower than analysts and investors currently predict.

Where the Market Stands; Where it’s Headed:

My indicators point to the stock market being severely overbought. I don’t think stocks have much more room to move higher, and I continue to believe we are getting close to a top for the market.

What He Said:

“I see a deal when it’s a deal. And right now there’s a good ‘for sale’ sign flashing on gold bullion and gold producer shares. In fact, after peaking at the $690 an ounce level earlier this year, gold could be a bargain at its current price of around $650 per ounce. As a reader, you are undoubtedly aware of my negative stance on the general stock market and the U.S. economy. As the economic problems that continue to brew in the U.S., as these problems develop into others, and as they are finally exposed, what other investment but gold will worldwide investors turn to?” Michael Lombardi in PROFIT CONFIDENTIAL, March 14, 2007. Gold bullion was trading under $300.00 an ounce when Michael first started recommending gold-related investments.

Source - http://www.profitconfidential.com/gold-investments/golds-price-correcti...

By Mitchell Clark, B.Comm. for Profit Confidential

http://www.profitconfidential.com

We publish Profit Confidential daily for our Lombardi Financial customers because we believe many of those reporting today’s financial news simply don’t know what they are telling you! Reporters are trained to tell you the news—not what it can mean for you! What you read in the popular news services, be it the daily newspapers, on the internet or TV, is the news from a “reporter’s opinion.” And there’s the big difference.

With Profit Confidential you are receiving the news with the opinions, commentaries and interpretations of seasoned financial analysts and economists. We analyze the actions of the stock market, precious metals, interest rates, real estate and other investments so we can tell you what we believe today’s financial news will mean for you tomorrow!

© 2013 Copyright Profit Confidential - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.