Stock and Bond Market Shock Waves!

Stock-Markets / Stock Markets 2013 Feb 22, 2013 - 03:36 PM GMT Yesterday around 2 pm EST a small tremor shook Wall Street. Minutes of the Federal Reserve’s January meeting released reveal that many Fed officials are worried about the costs and risks arising from the $85 billion–per–month asset-purchase program. And they all seem to have their own ideas on how to proceed. Several Fed officials said the central bank should be prepared to vary the pace of the asset-purchase plan depending on the outlook or how the program was working. One wanted to vary it on a meeting-by-meeting basis. One new idea backed by a “number” of Fed officials would have the central bank promising markets that it will take its time when selling its massive holdings of Treasuries and mortgage-backed securities.

Yesterday around 2 pm EST a small tremor shook Wall Street. Minutes of the Federal Reserve’s January meeting released reveal that many Fed officials are worried about the costs and risks arising from the $85 billion–per–month asset-purchase program. And they all seem to have their own ideas on how to proceed. Several Fed officials said the central bank should be prepared to vary the pace of the asset-purchase plan depending on the outlook or how the program was working. One wanted to vary it on a meeting-by-meeting basis. One new idea backed by a “number” of Fed officials would have the central bank promising markets that it will take its time when selling its massive holdings of Treasuries and mortgage-backed securities.

This was only one possible scenario discussed as the minutes show a committee that is far less unified than at any other time in the past few years. The Fed said a review of the program had been set for March. Fed Chairman Ben Bernanke will hold a press conference at the end of the two-day meeting on March 20. Without the Fed’s unconventional program, the 10-year Treasury would yield 3% or more, according to research published by Goldman Sachs. A number of Fed officials said the central bank may have to taper off or end the purchases before reaching the stated goal of a substantial improvement in the labor-market outlook. On the other hand, several Fed officials warned that ending the asset purchases too soon would damage the economy. They stressed that it was important to communicate that the Fed would hold to an ultra-easy policy stance as long as warranted by the weak economy.

One Fed official said that the central bank could adjust the size of the asset-purchase program every meeting. Some officials said they were worried about the effects of more asset purchases on the functioning of particular financial markets. As it stands right now the bond, dollar and stock market are all greatly affected, some would say corrupted, by the Fed interference. Some far all of this is just talk, and it might be designed to slow the markets down a bit. Stocks are close to all-time highs so this may be nothing more than “jawboning” in an effort to slow the car down a bit. There has been a lot of commentary directed toward the Fed pressuring it to come out with a plan to move out of QE.

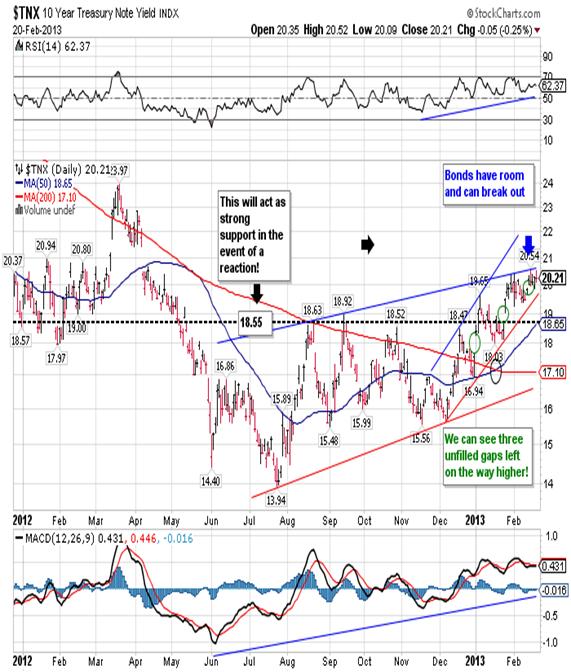

Whenever you hear comments like this the first thing you have to do is ask yourself if it’s probable. Right now the Fed is acting as a buyer of last resort for a government that is running trillion dollar plus deficits. This way it can

keep the government funded, prevent defaults, and keep rates lower. Even with all the QE the interest rate has still been climbing over the last seven months!

Here’s the trillion dollar question: if the Fed stops QE here, who will buy the trillions of dollars of new debt issued by a fiscally irresponsible administration? Who will pay off the bondholders when the old debt comes due? The answer is that no one will be standing in that line so that means the government will have to become fiscally responsible almost overnight. For those of you pay attention to what goes on in Washington, you know that almost no one is willing to sit down and have an intelligent discussion regarding debt, and there is absolutely no political will to resolve the issue. So an intelligent man will look at all of this and come to the conclusion that we’ll see business continue as usual.

That means that the US Dollar Index, now at the key resistance level of 81.45, is something that should be sold rather than bought. In spite of the recent run-up the trend continues to be headed lower. Without a doubt we’ve seen efforts by Japan, Europe, China and Switzerland designed to cheapen their currency with respect to the US dollar, a sort of competitive printing war if you will, but the US is the debt king. Right now the greenback is coming up against a long-term trend line, so I would look for it to stall out and turn lower:

For months the dollar has been range bound, trading between 79.00 and 81.45, supported at the bottom by the printing coming from other nations. Sooner or later that will end.

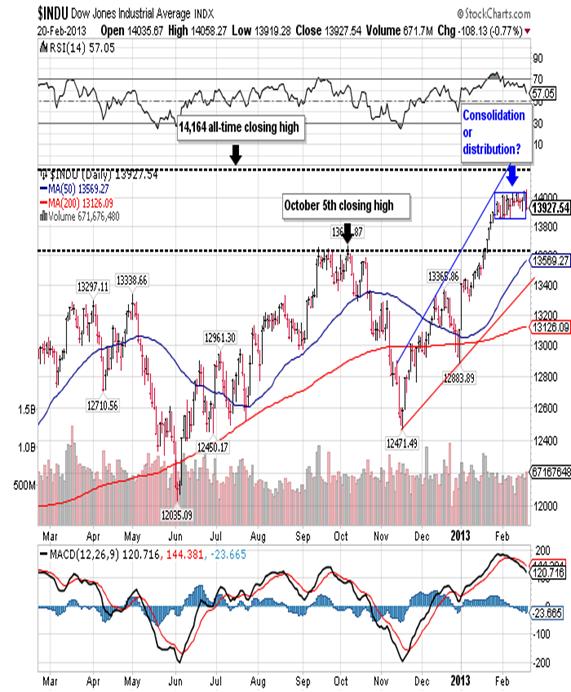

Finally, the Fed has taken great pains to ensure that the banks remain solvent and the stock market floats higher. The end of QE would undo all of that. Yesterday’s 100-point drop would be a grain of sand in the desert if QE comes to an end now:

Tuesday’s close at 14,035 was just 129 points shy of the all-time closing high. Since the Dow is the sign post everyone points to when they say that the recovery is here, they will do everything possible to support it. The Dow has been moving sideways for several weeks, trading between 13,850 and 14,025, and I still look for one last breakout to the upside and a new all-time high.

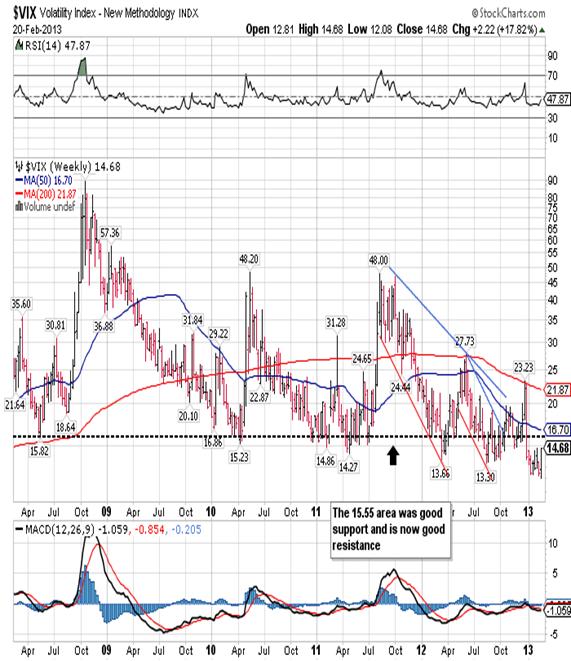

Finally, on Tuesday the VIX closed at 12.31, its lowest close since 1907. Even with yesterday’s spike the VIX is still at extremely low levels. The key to the VIX is the price of puts. If investors want insurance against a declining market, they buy puts. In general, the cheaper the puts, the lower the VIX! So why are investors so disinterested in protection against a declining market? The answer, according to Richard Russell, “is that the economy and the markets are floating on a veritable river of liquidity. Furthermore, investors are convinced that if anything unseemly occurs, Ben Bernanke and the Fed will turn the current river of liquidity into an ocean of liquidity”. That is reality and yesterday’s comments are just more smoke and mirrors.

Robert M. Williams

St. Andrews Investments, LLC

Nevada, USA

Copyright © 2013 Robert M. Williams - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.