Stock Market Healthy Pullback or THE END OF THE WORLD?

Stock-Markets / Stock Markets 2013 Feb 21, 2013 - 05:12 PM GMTBy: PhilStockWorld

Wheeeeeee on oil!

Congrats to all who played that game with us as oil bottoms out BELOW $94 this morning (and still hasn't gotten back over the line). We took 1/2 the money and ran on our doubled-down trades on USO and SCO but $92.50 may be bust for this drop so we'll hang in and see how low we can go this week. Meanwhile, we got a short, sharp shock thanks to the Fed yesterday but it's perfect for the way we've been playing as we had a few short callers (GOOG, FAS, TSLA) that were getting away from us and Members were getting tired of my calling for patience as we've been waiting for this little correction for over a week now.

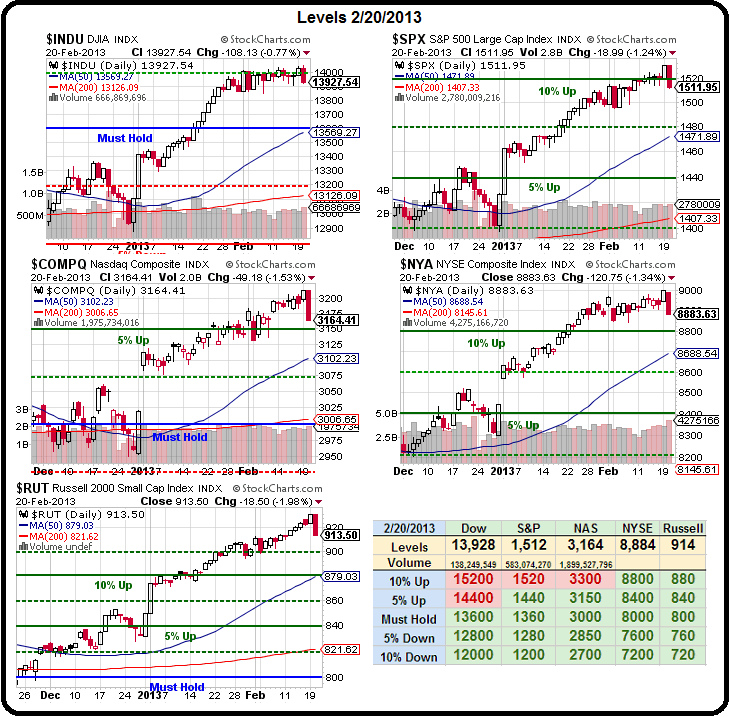

Using the Big Chart and, of course, our famous 5% Rule to tell us what's going to happen, we can see we had a 1,000-point run in the Dow from 13,000 (we don't count spikes) to 14,000 and that means we expect a 20% pullback (of the run) of 200 points to the 13,800 line as a HEALTY correction. Another 200 points would take us to 13,600 and – lo and behold – it's our Must Hold line and guess what – it MUST HOLD or the markets are truly turning bearish.

Of course we predicted the Must Hold line way back in 2009 so not to surprising that, overall, we end up consolidating there in the bigger picture (see bigger chart). We are NOT expecting to test 13,600 though, that's just the worst-case, where we would be BUYBUYBUYing on the dip but we HOPE to see 13,800 tested so we can get over it and consolidate for a real move (not a spike) over 14,000, as well as our 10% lines on the Nasdaq (3,300) and the S&P (1,520), which came so close to making us up our levels but failed – right on schedule!

We already went long on /NKD Futures in Member Chat this morning (over the 11,300 line) but, for a pullback in US indexes, we're looking for the following 20 and 40% pullback levels to hold (at worst):

- Dow 13,800 (weak retrace) and 13,600 (strong retrace and confirmed with Must Hold)

- S&P had a 120 point run to 1,520 so giving 24 back is 1,496 and another 24 hits 1,472

- Nasdaq (AAPLdaq) had a 200-point run

- Phil

Philip R. Davis is a founder of Phil's Stock World (www.philstockworld.com), a stock and options trading site that teaches the art of options trading to newcomers and devises advanced strategies for expert traders. Mr. Davis is a serial entrepreneur, having founded software company Accu-Title, a real estate title insurance software solution, and is also the President of the Delphi Consulting Corp., an M&A consulting firm that helps large and small companies obtain funding and close deals. He was also the founder of Accu-Search, a property data corporation that was sold to DataTrace in 2004 and Personality Plus, a precursor to eHarmony.com. Phil was a former editor of a UMass/Amherst humor magazine and it shows in his writing -- which is filled with colorful commentary along with very specific ideas on stock option purchases (Phil rarely holds actual stocks). Visit: Phil's Stock World (www.philstockworld.com)

© 2013 Copyright PhilStockWorld - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

PhilStockWorld Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.