Gold Bull Market `Still Intact' Says HSBC's Respected Steel

Commodities / Gold and Silver 2013 Feb 20, 2013 - 04:41 PM GMTBy: GoldCore

Today’s AM fix was USD 1,602.00, EUR 1,195.34 and GBP 1,045.76per ounce.

Today’s AM fix was USD 1,602.00, EUR 1,195.34 and GBP 1,045.76per ounce.

Yesterday’s AM fix was USD 1,613.50, EUR 1,208.80 and GBP 1,041.57 per ounce.

Silver is trading at $29.07/oz, €21.83/oz and £19.9/oz. Platinum is trading at $1,664.50/oz, palladium at $753.00/oz and rhodium at $1,225/oz.

Gold fell $4.00 or 0.25% yesterday in New York and closed at $1,604.90/oz. Silver slipped to a low of $29.22 before it also rebounded, but it still finished with a loss of 1.31%.

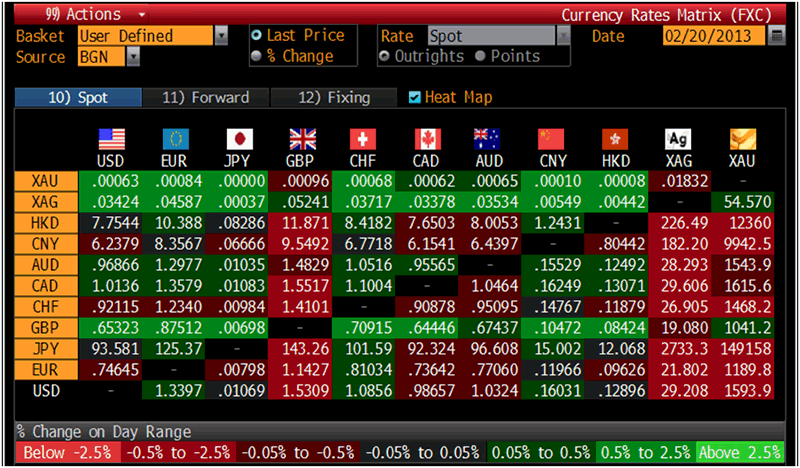

Cross Currency Table – (Bloomberg)

Gold fell to $1,591/oz today, as market digests data about a possible global recovery occurring which is sending investors to riskier assets. German business sentiment hit its greatest level in 3 years adding to the optimism.

The yellow metal is being bolstered by Asian bargain hunters and prices usually fall off when their markets close.

Shanghai Gold Exchange most active futures and spot gold contracts fell to their lowest levels in 7 months.

Chartists note the "death cross" formation on the spot gold chart, where the 50-day moving average is dropping below its 200-day moving average, which hints that a pullback could be on the way.

The RSI or Relative Strength Index which has fallen below 30 since late last week shows that the market has been oversold.

Investors will examine the wording in the minutes of the U.S. Federal Reserve's latest policy meeting, due at 1900 GMT.

Gold Spot $/oz, 23FEB11-20FEB13 – (Bloomberg)

James Steel, HSBC analyst, talks about the outlook for gold and silver markets. He speaks with Sara Eisen, Alix Steel and Adam Johnson of Bloomberg and recently just revised his silver forecast.

James Steel, HSBC analyst (USA Inc) interviewed by Bloomberg

Alix Steel : What triggered the steep decline on Friday, February 15th? You had Ben Bernanke and G20 saying the global economy was improving. China was out of the market for the Lunar New Year holiday. Plus, major fund holder George Soros was dumping his position in GLD. Did that create a sentiment shift out of gold for momentum players?

Jim Steel: What you've seen this year longer term are the following:

3 Key Items taken out of the picture

1. Disruption of the fiscal cliff.

2. Hard landing in China has not materialized, outlook is better there.

3. Withdrawal of Greece from EU.

These key items all helped support the gold market. However, these risks have diminished. Therefore, gold is a barometer of geo political & economic events.

Alix Steel: Were this long term or short term investors (referring to the Friday)?

Jim Steel: Short term in duration. If you look at the COMEX over last 12 years not any one week has any of the major funds not owned gold, they have only reduced their positions.

Alix Steel: Why would anyone want to own gold? It’s a safe haven during times of crisis and things are getting better, and it doesn't pay a dividend and George Soros is selling 100 million of his gold holdings.

Jim Steel: Well you don't get much of a yield on most things. Negative real interest rates is supportive of gold bullion going forward and also there is still uncertainty in the currency markets and gold is an alternative form of currency.

Alix Steel: We haven't really seen a lift from the currency wars rhetoric?

Jim Steel: Still its within a broad range that the bull market is still intact. Don't forget it was only a few years ago when Obama took office and gold was around $900/oz.

Adam Johnson: Silver and palladium why not buy them?

Jim Steel: We're moderately bullish on all the precious metals. We adjusted our silver forecast up to $33/oz from $32/oz for this year based on electronic strength in that space as 1/2 of it goes to industrial applications.

Adam Johnson: What are precious metals correlating to?

Jim Steel: That's what makes gold interesting, the Dunbar quant team in London have researched that gold is uncorrelated for risk on and risk off assets. It is precisely that which makes it interesting to portfolio managers.

Today: (GoldCore Webinar ) - How to Protect and Grow Your Wealth

Join us for a webinar today Wednesday 20th February at 1pm with guest presenter Eddie Hobbs. Eddie will provide valuable insight into the outlook for the US and the global economies. He will also outline why he believes that gold, and now also silver, are important from a diversification point of view for Irish people who wish to both protect and grow their wealth in the coming years.

Join Eddie in this 45 minute webinar as he untangles the complexity of the global economy and how it will affect you, and presents his findings in a no-nonsense and easy-to-understand manner.

Click here to register.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.