Are You About to Lose Your Savings in the Global Currency War?

Currencies / Fiat Currency Feb 20, 2013 - 04:21 PM GMTBy: Money_Morning

Peter Krauth writes: You may not have even noticed, but the first shots have already been fired in the next World War.

Peter Krauth writes: You may not have even noticed, but the first shots have already been fired in the next World War.

Only this time there are no tanks, fighter jets, nuclear subs, or missiles. And it's not the North against South, or even East against West.

It's war by other means and it pits fiat currency against fiat currency in a multi-trillion dollar knock-down drag out between the world's central bankers.

At stake is nothing less than the value of your life savings.

Its goal is to cheapen worldwide currencies-which could make every dollar you own worth even less.

Thanks to horrible fiscal mismanagement, virtually every nation in the world now wants its own currency to become cheaper against those of other nations.

Welcome to the currency wars.

Think of it as a race to the bottom. But where it stops nobody knows.

The Lies Behind the Currency War

James Rickards, senior managing director of Tangent Capital Partners, and author of Currency Wars: The Making of the Next Global Crisis, thinks this battle is about an effort to get economies going by importing inflation rather than attempting to boost exports.

But I believe it's about both reflating economies and stimulating exports. After all, national leaders are becoming increasingly desperate.

And though they'd like us to think otherwise, the currency war is here, and it's escalating.

In fact, G-7 finance ministers and central bank governors recently released a statement to try and downplay the intensifying currency war noting that, "...we will not target exchange rates."

Yet true-to-form, these high profile leaders are doing the exact opposite of what they're saying.

In the wake of the financial crisis, the world had seen unprecedented yet (until now) coordinated financial stimulus. But today central banks are so addicted to the temporary "fix" from printing money, they have little concern for its effects on other nations.

Now barely a day goes by without a currency war-related headline. In fact, here are two I came across last week: "Global Monetary System Headed for Collapse" and "The Fed's Global Unintended Consequence."

There are plenty of others and you can expect quite a few more as this situation continues its downward spiral.

Upping the Ante

Of course, the U.S. has been labeling China as a currency manipulator for several years now. They claim the Yuan is kept artificially low so that Chinese imports remain cheap.

Talk about the pot calling the kettle black...

Over the last four years, America doubled the entire debt accumulated since the nation's founding, going from $8 trillion to $16 trillion in the hole. What's more, The Federal Reserve's balance sheet recently set a notorious record, ringing in at over $3 trillion for the first time ever.

Then the Swiss, hurting from the effects of a strong Franc (CHF), decided that their currency was getting too strong and set a floor under it so the EUR/CHF rate couldn't drop below 1.20.

French President Hollande also recently told members of the European parliament that EU leaders "need to think about our currency, the euro. We must have an exchange rate policy otherwise it will have rates that do not reflect the strength of its economy."

But the most aggressive player in the currency war, at least so far, is Japan.

For a host of reasons, including zombie banks and horrible demographics, Japan's economy has stagnated and deflated for an entire generation. Its flagship Nikkei index peaked near 40,000 in 1989, yet today stands at 11,300.

With two straight quarters of contraction, Japan is "officially" back in recession.

In desperation, Japan is trying ever more Keynesian sleight of hand to reflate its economy. The new prime minister, Shinzo Abe, has promised aggressive unlimited stimulus and more money printing to try and jumpstart the economy.

But with an all-in real debt-to-GDP ratio close to 500%, Japan's probably the riskiest place to carry out such an experiment.

Already the Nikkei is up 30% over the past three months, and the Yen has given up almost 20% against the greenback since early October.

Just last week the U.S. undersecretary for international affairs, Lael Brainard, supported Japan's move. She said the G-7 normally prefer exchange rates set by the market, but sometimes "excess volatility or disorderly movements" means finance ministers have to step in and manipulate rates. So much for a free market, or even market-determined exchange rates, for that matter.

The risks are so high in Japan that this could realistically be where the first major currency crisis begins. Only this time, it could initiate the trend toward a total collapse of the world's fiat money system.

Not to be outdone, Venezuela, South America's largest oil producer, has just devalued its currency by 32%. That's the fifth straight time Venezuela has devalued in only nine years. It will help with the government's budget deficit, but it tramples the buying power of Venezuelans.

The country's annual inflation is already running at 22%, but this move threatens to make it even worse.

Many Latin American leaders are pros at this game. A little over a decade ago Argentina defaulted on its foreign bonds, thanks mainly to massive government overspending and corruption, which caused the public debt to mushroom. Making matters worse, Brazil devalued the real, hurting Argentine exports.

Is any of this starting to sound familiar?

I hope so, because not long ago Argentina banned estimates of true inflation by private economists from being made public.

Now, as the authoritarian regime grows ever more desperate, they've even resorted to fixing prices. On Feb.5th, major retailers agreed to freeze their prices until April 1st.

The Currency War Endgame

Unfortunately, I believe the U.S. is on the same path as pretty much the rest of the world. The end game is a race to the bottom because really, under a fiat money system, there's nowhere else to go.

This was recently confirmed by Kyle Bass, founder and principal of Hayman Capital Management, a Dallas hedge fund. Bass has profited handsomely from prescient calls on events from the subprime mortgage meltdown to Greek sovereign debt restructuring.

In a recent discussion with a senior Obama official, Bass disclosed that he asked how the U.S. would be able to grow exports if they don't allow nominal wage deflation. The official's answer: "We're just going to kill the dollar."

By now you're probably wondering how you can protect your net worth from all these central bank shenanigans. In my view, the answer is to own and accumulate gold.

Gold is the go-to safe haven as currencies are debased. If you don't believe me, just ask the Japanese, who now have to pay more than ever to buy an ounce of gold.

They've just seen the precious metal's price in Japanese Yen break out to a new all-time high.

So I suggest you ignore what central banks say, and instead do what they do: BUY GOLD.

China has been quietly accumulating gold since it last announced its reserves. Back in 2009 it reported a total of 1,054 tonnes. Thanks to massive and growing gold imports into Hong Kong and domestic gold production, it's likely that China's official stash is much higher today, likely approaching 4,000 tonnes, with some estimates considerably higher.

That would place them ahead of Germany, whose official holdings are at 3,396 tonnes. It's little wonder why Germany has decided to bring its gold home now.

According to figures from the World Gold Council, last year central banks accumulated more gold than at any time since 1964. That's almost 535 metric tons, with Russia, Brazil, and Iraq in the lead.

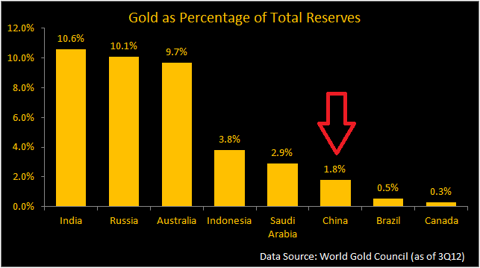

Despite this record central bank buying binge, gold still remains a dangerously small percentage of their total reserves.

It's clear that gold is regaining its rightful place as a cornerstone asset. As we continue down our current path, it's increasingly likely gold will once again assume its traditional role as true money.

The signs are there and growing louder by the day. The currency war is intensifying. I hope you'll heed its warning and buy yourself some gold.

But you should do it while your dollars still have some purchasing power.

Source :http://moneymorning.com/2013/02/20/are-you-about-to-lose-your-savings-in-the-currency-war/

Money Morning/The Money Map Report

©2013 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.