China And India Gold Demand Returns

Commodities / Gold and Silver 2013 Feb 18, 2013 - 01:16 PM GMTBy: GoldCore

Today’s AM fix was USD 1,611.25, EUR 1,206.39 and GBP 1,041.53per ounce. Friday’s AM fix was USD 1,629.25, EUR 1,221.42 and GBP 1,052.01 per ounce.

Today’s AM fix was USD 1,611.25, EUR 1,206.39 and GBP 1,041.53per ounce. Friday’s AM fix was USD 1,629.25, EUR 1,221.42 and GBP 1,052.01 per ounce.

Silver is trading at $30.04/oz, €22.59/oz and £19.49/oz. Platinum is trading at $1,690.20/oz, palladium at $756.00/oz and rhodium at $1,225/oz.

Gold fell $36.70 or 1.63% on Friday and closed at $1,608.90/oz. Silver slid to a low of $29.68 and finished with a loss of 2.13%. In dollar terms, gold was down 3.58% for the week while silver was off 5.28%.

Gold fell less in pound, yen and most other fiat currencies again showing that gold’s latest bout of weakness is more a function of the dollar gaining in value rather than simply gold weakness.

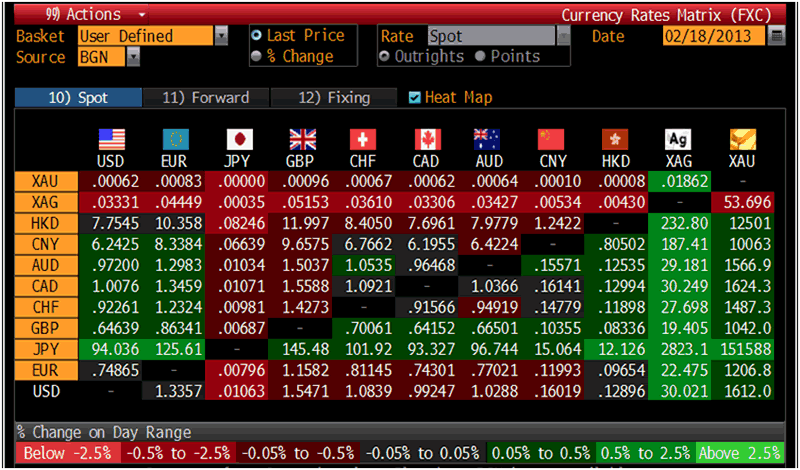

Cross Currency Table – (Bloomberg)

Gold recovered from is greatest one day drop since December on Friday, rising $6.05/oz to $1,615.11 by late morning trading in Europe.

This is a 6 month low figure for the yellow metal but has led to bargain hunters again emerging to buy on the dip. Asian jewellery buyers and bargain hunters look to lend support at these lower levels.

The U.S. and Canadian stock markets are closed today for national holidays while China has reopened after the week long Lunar New Year holiday.

Today at 1430GMT European Central Bank President Mario Draghi testifies at the European Parliament.

A group of countries including Britain, China, France, Germany, Russia and the United States, known as P5 +1, wants Iran to do more to prove that its nuclear program is for only non-military purposes and to permit wider U.N. inspections.

An anonymous source said on Friday that the P5+1 plan to offer to ease sanctions barring trade in gold and other precious metals with Iran in return for Iranian steps to close down the nation's newly expanded Fordow uranium enrichment plant.

The officials said the offer will be presented to Iran at February 26 talks in Almaty, Kazakhstan, and they acknowledged that it represents a change to proposals from last year.

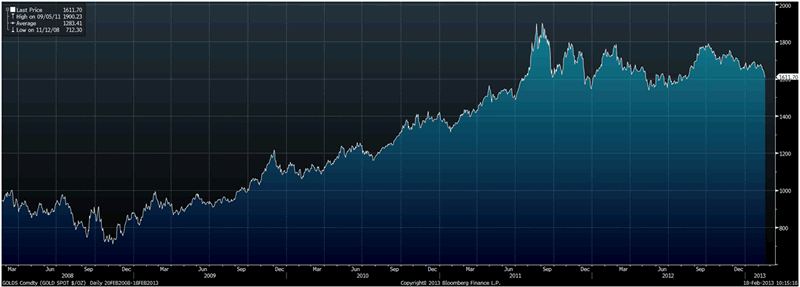

Gold Spot $/oz, 20FEB08-18FEB13 – (Bloomberg)

Investors trimmed their long positions on a rally in commodities by the highest level since November as speculators, often driven by momentum, cut their positions to the lowest level since December 2008, prior to the 23% and 27% gains seen in 2009 and 2010.

Hedge funds and other large speculators reduced net-long positions across 18 U.S. futures and options in the week ended February 12th by 15% to 757,060 contracts, the largest fall since November 13th, U.S. Commodity Futures Trading Commission data show.

Gold prices have fallen 3.8% in dollar terms since December 31, the worst start to a year since 2001. Gold finished 2001, 2% higher in spite of a bad start to the year.

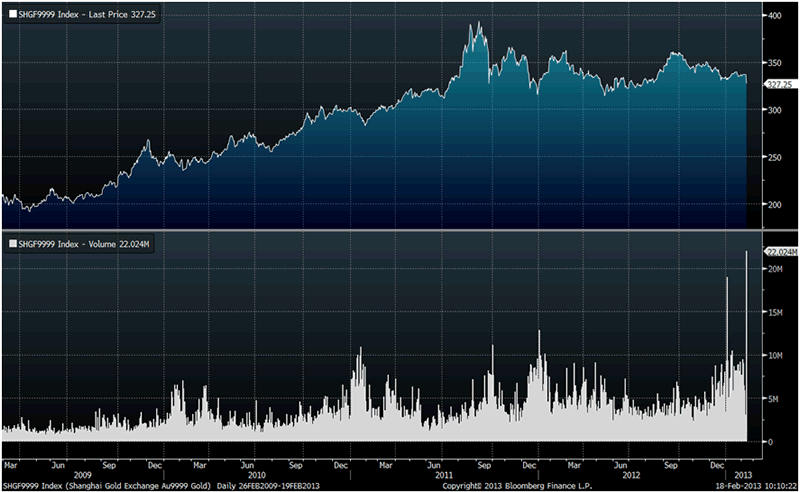

Shanghai Gold Exchange Gold volumes for the benchmark cash contract on the Shanghai Gold Exchange soared to a record today (see chart below), as the market re-opened after the New Year’s week long holiday and bargain hunters started buying.

The volume for bullion of 99.99% purity exceeded 22,000 kilograms (22 metric tons), according to data compiled by Bloomberg. Prices fell 2.8% to 327.25 yuan/gram ($1,630.29/oz) as of 5:04 p.m. Singapore time.

“Chinese investors returned to the market today after the holiday, and the slump in gold prices in the past week provided great incentive for buying as many Chinese are still holding a bullish outlook on gold,” Qu Mingyu, a trader at Bank of China Ltd., the 4th largest lender by assets, commented today.

The return of demand in Asia was not limited to China as demand in India was also seen overnight.

UBS analysts say UBS had above average demand from India after last week’s sell off.

“Appetite from India has been quite unimpressive of late, although buyers did respond to last Friday’s selloff,” said the UBS research note today which was picked up by Bloomberg.

Shanghai Gold Exchange, 26FEB09-19FEB13 – (Bloomberg)

This Wednesday at 1pm: How to Protect and Grow Your Wealth Join us for a webinar this Wednesday 20th February at 1pm with guest presenter Eddie Hobbs. Eddie will provide valuable insight into the outlook for the US and the global economies. He will also outline why he believes that gold, and now also silver, are important from a diversification point of view for Irish people who wish to both protect and grow their wealth in the coming years.

Join Eddie in this 45 minute webinar as he untangles the complexity of the global economy and how it will affect you, and presents his findings in a no-nonsense and easy-to-understand manner.

Click here to register

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.