China Stocks Offering Investors Potential for Five Fold Gains!

Companies / China Stocks Feb 14, 2013 - 05:19 PM GMTBy: DailyWealth

Steve Sjuggerud writes: When the Chinese government wants its stock market to go up, it goes up... a lot.

Steve Sjuggerud writes: When the Chinese government wants its stock market to go up, it goes up... a lot.

It's happened several times in history...

It happened from 1996 to 1997... and again in 2005. (Heck, Chinese stocks soared fivefold in just two years starting in 2005, the last time the Chinese government wanted the stock market to go up.)

Today, the Chinese government wants the stock market to go up again.

Even better, Chinese stocks are incredibly cheap, and the uptrend has begun. In short, we have the perfect conditions for a triple-digit profit, courtesy of the Chinese government. Let me explain...

I first visited China in 1996. When I realized what was happening with the Chinese government, I recommended the largest blue-chip Chinese stock I could find to my readers...

You see, to push stocks higher, the government tried floating a variety of rumors. The government rumor that sparked the biggest rise was that China was going to allow local Chinese investors to buy shares of foreigner-only stocks.

Chinese stocks soared. My readers pocketed close to a triple-digit gain in a very short period of time.

But eventually, China's government worried that its rumors pushed stocks up too much. So it floated the opposite rumor... The company we'd pocketed nearly a double on eventually lost over 80% of its value.

This has happened multiple times. The most recent time was in 2005, just before Chinese stocks soared fivefold. And it's happening again, today...

Last month, China's top securities regulator announced it would increase by 10-fold the amount of money qualified foreign institutional investors are allowed to invest in Chinese stocks.

We have seen this play out before... China gets behind its stock market, and the market soars. It's already happening, as I write. And because Chinese stocks are so cheap, I believe we have an easy shot at triple-digit gains...

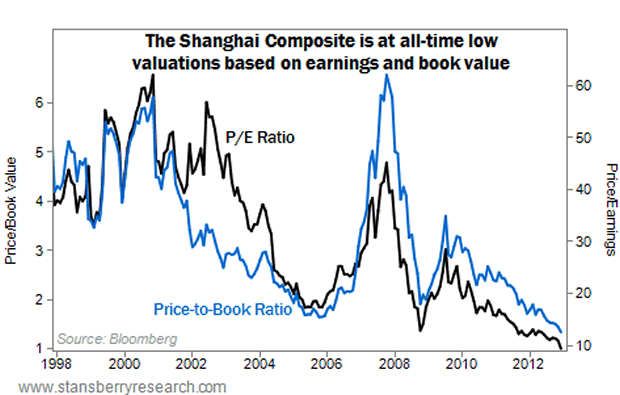

As I explained in December, the Shanghai Composite Index now trades for the cheapest price-to-earnings (P/E) and price-to-book (P/B) ratios we've ever seen. In fact, Chinese stocks are even cheaper today than they were in 2005, right before the market soared fivefold in two years. Take a look...

This index of blue-chip Chinese companies traded for over 40 times earnings in 2007. And over the last 15 years, its average P/E ratio has been over 30. Today, this index trades for less than 10 times earnings...

Our starting point is basically the cheapest point in the history of the Shanghai Composite Index (based on the P/E and P/B ratios).

Chinese stocks have bottomed, and we now have our uptrend in place. Even better, the Chinese government is doing everything it can to push the stock market higher.

If the 2005-2007 bull market is any indication, our upside potential is hundreds of percent.

I can't give away the exact details of my True Wealth recommendation for local China shares. But you can consider the Market Vectors China Fund (NYSE: PEK). It's a one-click way to trade the Shanghai Composite Index. Check it out...

Good investing,

Steve

The DailyWealth Investment Philosophy: In a nutshell, my investment philosophy is this: Buy things of extraordinary value at a time when nobody else wants them. Then sell when people are willing to pay any price. You see, at DailyWealth, we believe most investors take way too much risk. Our mission is to show you how to avoid risky investments, and how to avoid what the average investor is doing. I believe that you can make a lot of money – and do it safely – by simply doing the opposite of what is most popular.

Customer Service: 1-888-261-2693 – Copyright 2013 Stansberry & Associates Investment Research. All Rights Reserved. Protected by copyright laws of the United States and international treaties. This e-letter may only be used pursuant to the subscription agreement and any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), in whole or in part, is strictly prohibited without the express written permission of Stansberry & Associates Investment Research, LLC. 1217 Saint Paul Street, Baltimore MD 21202

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

Daily Wealth Archive

|

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.