U.S. Bond Markets Major Top, Yields Poised tor Rise

Interest-Rates / US Bonds Feb 11, 2013 - 06:12 PM GMTBy: EWI

Our long term outlook for interest rates on U.S. Treasury securities has been a contrary opinion for many years. Most commentators have been expecting either economic expansion or Fed-induced inflation to push bond yields higher. Conqier tje Crash predicted that long term rates on AAA-rated bonds would fall much further as the monetary environment shifted form lessening inflation to outright deflation.

Our long term outlook for interest rates on U.S. Treasury securities has been a contrary opinion for many years. Most commentators have been expecting either economic expansion or Fed-induced inflation to push bond yields higher. Conqier tje Crash predicted that long term rates on AAA-rated bonds would fall much further as the monetary environment shifted form lessening inflation to outright deflation.

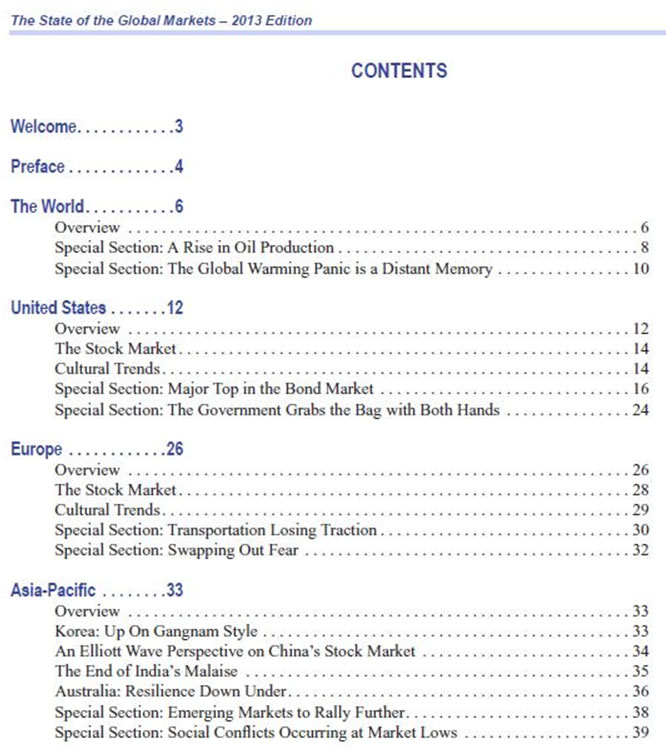

Figure 1 shows the forecast from 200, the Figure 2 updates the graph to the present.... this is an excerpt from page 7 of the 40 page The State of the Global Markets -- 2013 Edition report, FREE DOWNLOAD. Follow this link to download your free 40-page report, The State of the Global Markets -- 2013 Edition, now.

Contents Preview:

IMPORTANT: Please don't buy or sell a single share of stock -- anywhere in the world -- without reading this report first.

With our best wishes for a prosperous New Year,

P.S. This report is available to you for free for a limited time, exclusively from EWI. Please download it now while its valuable year-in-preview advice can help your portfolio in the New Year. Download the 40-page report now.

About the Publisher, Elliott Wave International

Founded in 1979 by Robert R. Prechter Jr., Elliott Wave International (EWI) is the world's largest market forecasting firm. Its staff of full-time analysts provides 24-hour-a-day market analysis to institutional and private investors around the world.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.