Authentic Market Trends and Investor Opportunities

Stock-Markets / Financial Markets 2013 Feb 09, 2013 - 01:15 PM GMTBy: DeepCaster_LLC

“There is no paper money in 2014 or 2015 that will be worth much of anything.”

“There is no paper money in 2014 or 2015 that will be worth much of anything.”

“You can’t get [silver coins]. They sell out….Several mints have run out of coins because everybody’s worried about the future of the world.”

“Gold has been up 12 years in a row which is extremely unusual for anything.”

“Don’t Sell Your Gold and Silver Coins: Jim Rogers The Daily Ticker, 02/07/2013

Investors are increasingly concerned, understandably, about the Reliability of Official or Quasi-Official (e.g., those emanating from Too-Big-To-Fail Banks and Ratings Agencies) Statistics and other Financial and Economic News.

Understandably so, given that the actions of Participant Mega-Financial Institutions in the LIBOR Scandal cost Borrowers Billions.

Understandably so, if the allegations in the Ratings Agency litigation are proven true, Investors in deceptively “Rated” Mortgage-Backed Securities, and other commercial Paper have taken a Financial Bath there also.

Understandingly so, given the continuing Flood of Bogus Official Economic Statsitics (See Note 1).

But the Mismatch between Bogus “Statistics” and “News” on one hand and the Real Numbers and Real News on the other provides Opportunities to Profit and Protect. This is because Bogus Statistics and Disinformation give rise to inherently Unsustainable Trends and misallocation of Capital.

As Jim Rogers points out, Investors aree fleeing Fiat Currencies for the safety of Real Assets going forward, and especially into Real Money, Gold and Silver.

That this is a Trend with “legs” going forward is virtually indisputable.

Why?

Consider what China, The Major Power With Assets, is doing.

“China's gold production rose for a sixth consecutive year and hit a record 403 tonnes in 2012…the Shanghai Securities News said on Thursday.

Compared to a year ago, gold production was up 11.7 percent, the paper said, citing data from China's Gold Association…

China has said that it aims to produce between 420 and 450 tonnes of the precious metal in 2015”

JBGJ continues to find China’s ability to increase gold production so smoothly by these huge amounts – over 40 tonnes in 2012 – without any particular geological news, very odd. It speaks of course to the massive degree of undervaluation of the yuan, possibly to China’s peculiar energy pricing policies as well. Consequently if those policies change, China may be forced into the world gold market in an even more dramatic way.

“China's 2012 gold output up 12 percent – paper”

http://in.reuters.com, 02/07/2013 and thanks to JBGJ

Clearly, China’s Acquisition of Physical Gold (and indeed Real Assets around the World) is not likely to stop any time soon.

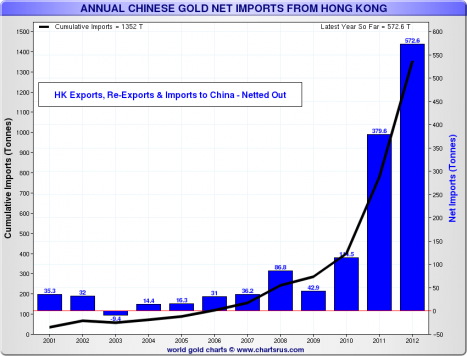

Consider The Trend reflected on the Chart “Chinese Gold Production plus Net Imports since 2000”.

In sum, the Chinese are trading Fiat Currencies (and Securities denominated therein) whose Purchasing Power is decreasing, for Gold.

A related Trend (“Related” because Fiat Currency purchasing Power Degradation generates Price Inflation) which is not honestly reported by Officialdom and Quasi-Officialdom is Inflation.

Real and Serious Price Inflation (and indeed Threshold Hyperinflation) is already with us as Tyler Durden points out

“While every central banker and policy-leech spews forth the government-supplied statistics on inflation - noting that all is well, carry on - we recently pointed out that Gas Prices are their highest ever for this time of year. Of course, the standard supply constraints (or technical) reasoning was applied to dismiss this as transitory (even though it has continued to rise since); but what is perhaps more worrisome is the broad-based nature of the real inflation that is leaking into our global supply chain. The 24-commodity heavy S&P GSCI index (widely recognized as a leading measure of general price movements and inflation in the world economy) has never been as high in early February as it is currently - ever. And with global growth stagnating at best, it seems a tough call to blame 'recovery' for this inflating (fastest pace in 8 years) raw material price leaking cost-push inflation (and margin-compression) into the real economy.”

“No Inflation? Commodities Highest Ever For This Time of Year,” Tyler Durden

Zerohedge.com, 02/05/2013

This presents an opportunity to be Profitably Long Commodities if the specific commodities selected and the timing are right. (Regarding Specific Recommendations see Notes 1, 2, 3, 4 and 5 below.)

This Commodities Inflation is reflected in the Real Numbers (as opposed to the Bogus Official Ones) conveniently provided to us by shadowstats.com

Shadowstats.com calculates Key Statistics the way they were calculated in the 1980s before Official Data Manipulation began in earnest. Consider

Bogus Official Numbers vs. Real Numbers (per Shadowstats.com)

Annual U.S. Consumer Price Inflation reported January 16, 2013

1.74% / 9.36%

U.S. Unemployment reported January 4, 2013

7.8% / 23.0%

U.S. GDP Annual Growth/Decline reported January 30, 2013

1.54% / -2.20% (i.e., a Negative 2.20%)

U.S. M3 reported January 24, 2013 (Month of December, Y.O.Y.)

No Official Report / 4.38%

The Threshold Hyperinflation which we already experience is mainly caused, it is widely and correctly acknowledged, by increased Central Bank-provided Liquidity.

And most of the Liquidity has been employed to Monetize Debt.

This has resulted in Interest Rates being held artificially low, temporarily.

And resulted in Equities being boosted artificially, but understandably, high, temporarily (a “short” Opportunity when the time is right).

The recent near record highs in the Equities Markets have, finally, resulted in “Retail” (i.e., small) investors coming back into the market ($77.9 billion in January, 2013 highest since February, 2000) late, as usual.

But “late” enterers historically signal the approach of Market Tops, as they did in the 2000-2001 Period when the Internet bubble burst. Another Short Opportunity when the time is right.

In sum, it looks like the “Smart Money” is selling and the “Retail” Money is buying, which is not a reflection of Sustainable Highs as John Hussman points out

“It’s fine to argue that perhaps investors are momentum chasers, and with profit margins now about 70% above historical norms (making stocks seem both ‘safe’ and misleadingly cheap), with stock prices up, and with low returns on cash, investors not holding stocks will be the greater fools that allow investors who do hold stocks to get out. [...] But the problem with the ‘great rotation’ argument is that somebody has to hold the debt. Somebody has to hold the cash. It cannot go anywhere, and it is impossible – in aggregate – for the markets to ‘rotate’ out of it.”

“Capitulation Everywhere”, John Hussman,

HussmanFunds.com, 01/28/2013

Be Alert to the Consequences of and Opportunities flowing from the aforementioned Trends, Be Very Alert.

And bear in mind the Longest Trend:

“Five thousand years of history show us that Gold is always money and paper always fails.”

Rep. Ron Paul (R-Tx)

Bloomsberg News, 02/08/2013

Best regards,

www.deepcaster.com

DEEPCASTER FORTRESS ASSETS LETTER

DEEPCASTER HIGH POTENTIAL SPECULATOR

Wealth Preservation Wealth Enhancement

© 2013 Copyright DeepCaster LLC - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

DEEPCASTER LLC Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.