Gold Surges As Soros Warns EU May Collapse Like USSR

Commodities / Gold and Silver 2013 Feb 08, 2013 - 06:21 PM GMTBy: GoldCore

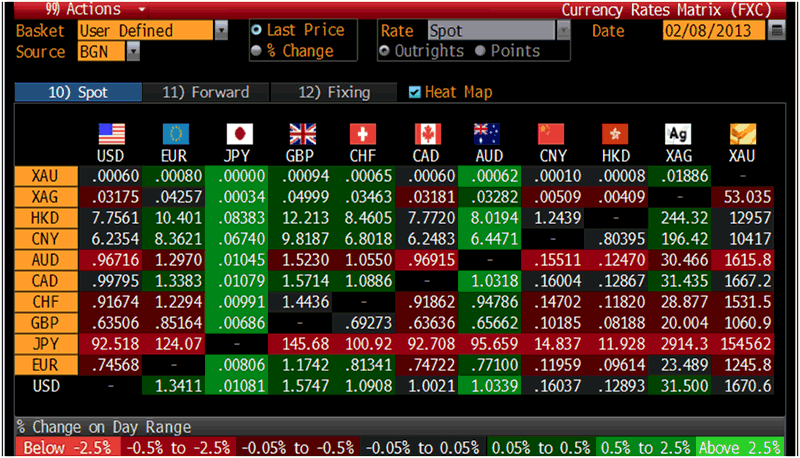

Today’s AM fix was USD 1,669.75, EUR 1,245.15 and GBP 1,059.55 per ounce.

Today’s AM fix was USD 1,669.75, EUR 1,245.15 and GBP 1,059.55 per ounce.

Yesterday’s AM fix was USD 1,675.75, EUR 1,235.99 and GBP 1,065.86 per ounce.

Silver is trading at $31.57/oz, €23.68/oz and £20.04/oz. Platinum is trading at $1,720.75/oz, palladium at $743.00/oz and rhodium at $1,225/oz.

Cross Currency and Precious Metal Table – (Bloomberg)

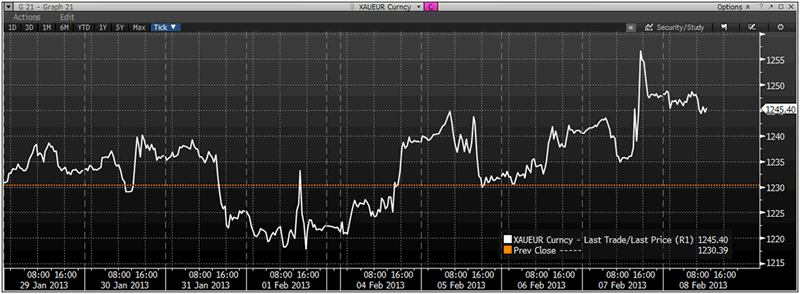

While gold fell in dollar terms yesterday, it surged 1.8% in euro terms from €1,235/oz, soon after the ECB interest rate decision, to €1,258/oz soon after. Some of the gains were quickly given up as determined selling was again seen but gold in euros closed nearly 1% higher on the day.

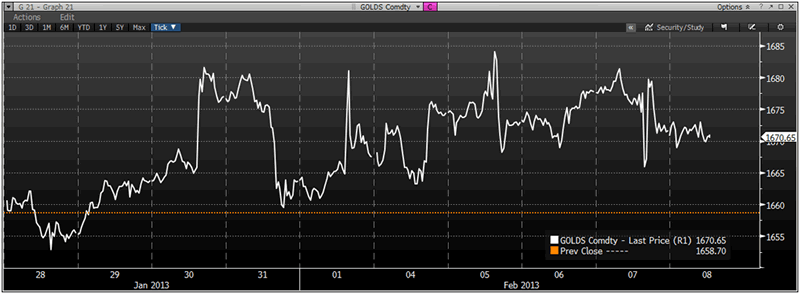

Gold in USD, 10 Day - (Bloomberg)

The price gains came as Draghi warned about slowing economic growth and complacency regarding declaring an end to the financial crisis. He also warned that the euro dollar exchange rates rise could derail the recovery in Europe and signalled that an interest rate cut may even be necessary.

Continuing ultra loose monetary policies in the Eurozone will support gold and should lead to higher prices in 2013.

In dollar terms, gold fell $5.70 or 0.34% yesterday closing at $1,671.80/oz. Silver slid to a low of $31.28 and finished with a loss of 1.16%.

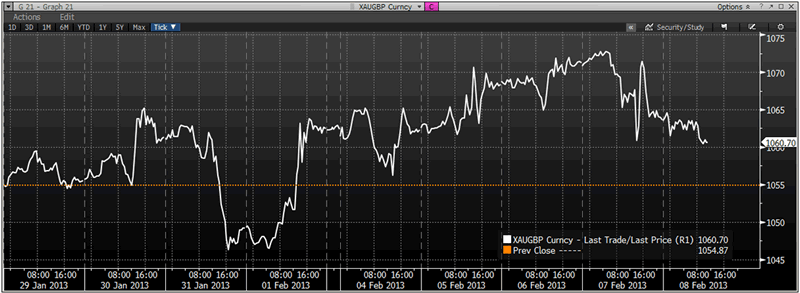

Gold in GBP, 10 Day - (Bloomberg)

Gold is flat in most currencies today despite concerns over the health of the eurozone economy but gold is on course for a second week of gains which would be bullish from a technical perspective.

Trading action was again peculiar yesterday with determined sellers capping the price at certain levels. There is a distinct feel that influential players are getting long and into position for the long awaited upward price move.

China's gold production increased for a sixth year in a row and hit a record 403 tonnes in 2012, keeping its ranking as the world's largest bullion producer, reported the Shanghai Securities News.

Silver continues to see determined selling at the $32/oz level.

On Wednesday, the Commodity Futures Trading Commission (CFTC) fined Royal Bank of Scotland (RBS) $612 million for fixing the Libor interest rate. Given the significant delay in concluding the CFTC’s investigations of price manipulation in the silver market, many investors continue to ask the question as to whether certain banks are manipulating and capping the silver price thereby pocketing millions in profits at the expense of traders and investors.

Bart Chilton, commissioner at the CFTC, said as long ago as October 2010 that “members of the public “and” publicly available documents convinced him the silver markets are tainted by violations of federal commodities law.

"I do believe that there have been repeated attempts to influence prices in the silver markets," Mr Chilton said. "There have been fraudulent efforts to persuade and what I consider deviously control the price."

The Financial Times recently acknowledged the Gold Anti-Trust Action Committee’s (GATA) important contribution regarding establishing transparency in the gold market. GATA has also called for transparency in the silver market and it is not before time that the CFTC fulfils their duty and announces the findings of their investigations into whether Wall Street banks have been manipulating the silver market.

Manipulation or not, silver buyers will again be rewarded if they remain patient and fade out the considerable noise that emanates from the silver market.

Gold in EUR, 10 Day - (Bloomberg)

The EU may suffer the fate of the USSR and “collapse” according to billionaire investor George Soros.

Soros said that incorrent economic and monetary policies and the monetary union itself may lead to currency wars and the collapse of the European Union.

In saving the euro, the continent’s financial powers have damaged the economy of the euro zone and created dangerous new political imbalances. As a result, “we have quite a turbulent time ahead for 2013.”

“I am rather concerned that the euro is in danger of destroying the European Union”. There is a real threat when the possible resolution of financial difficulties of eurozone might cause a political issue,” Soros told Dutch TV in an interview.

The attempts of the European leadership to keep the common European currency are leading to the escalation of political and social issues in the EU which may eventually destroy it.

Recent SEC filings show that Soros’ hedge fund had again increased allocations to gold.

For the latest news and commentary on financial markets and gold please follow us on Twitter.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.