The United States of Debt Addiction

Interest-Rates / US Debt Feb 06, 2013 - 08:48 AM GMTBy: GoldSilver

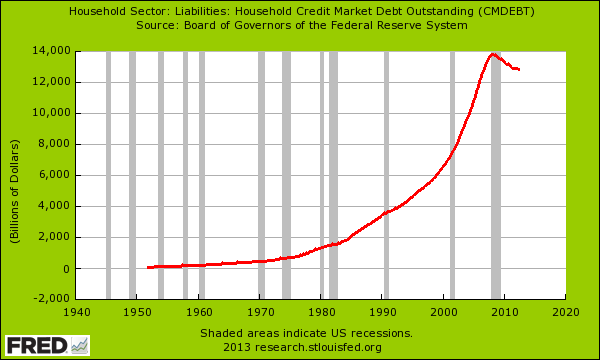

mybudget360.com writes: 16 point 7 trillion dollars. That is our current national debt. 12 point 8 trillion dollars. That is the amount households carry in mortgage and consumer debt. We are now addicted to debt to lubricate the wheels of our financial system. There is nothing wrong with debt per se, but it is safe to say that too much debt relative to how much revenue is being produced is a sign of economic problems. At the core of our current financial mess is how we use debt as a parachute for any problem. We’ve been masking the shrinking of the middle class by allowing households to take on too much debt for a couple of decades. The results were not positive. Too this degree, we have now created a massive moral hazard economy where savings are punished into oblivion. There is very little incentive to put your money in a bank account yielding zero percent interest when real inflation is eating away at your money like a hungry wolf. So what do people do? Well many simply cannot save and therefore choose to go into debt to finance cars, housing, and education with very little down. Where does this debt addiction lead us?

mybudget360.com writes: 16 point 7 trillion dollars. That is our current national debt. 12 point 8 trillion dollars. That is the amount households carry in mortgage and consumer debt. We are now addicted to debt to lubricate the wheels of our financial system. There is nothing wrong with debt per se, but it is safe to say that too much debt relative to how much revenue is being produced is a sign of economic problems. At the core of our current financial mess is how we use debt as a parachute for any problem. We’ve been masking the shrinking of the middle class by allowing households to take on too much debt for a couple of decades. The results were not positive. Too this degree, we have now created a massive moral hazard economy where savings are punished into oblivion. There is very little incentive to put your money in a bank account yielding zero percent interest when real inflation is eating away at your money like a hungry wolf. So what do people do? Well many simply cannot save and therefore choose to go into debt to finance cars, housing, and education with very little down. Where does this debt addiction lead us?

A little bit of deleveraging

US households have deleveraged from the peak in the crisis. However, much of this deleveraging has been forced via the 5 million foreclosures that have occurred:

I’m not sure if we can interpret that as some sign of a healthy and growing economy. Households have had their access to debt limited in many sectors. Yet one sector that never retreated was that in higher education. There is little doubt that there is a major bubble in higher education. Instead of addressing the problems head on we now have more access to debt as the solution. In order to compete in our service driven economy, having a skill is very important. Most will make the investment to pursue a college degree but the issue is that with easy access to debt, prices have soared. It is no surprise that college prices are following the trajectory of what happened in housing.

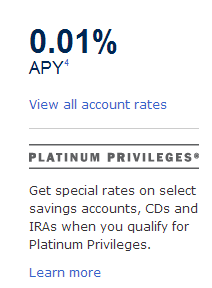

If you look at the above chart, a big part of the contraction has come from deleveraging from mortgages and credit card debt. Yet we are now once again loading up on auto debt and college debt. The system is now setup to punish any type of savings. Good luck trying to stash your money in a bank account and outrun even the steady pace of inflation.

Take a look at the current savings rate for Bank of America:

Of course the Fed has a hand in all of this. The Fed realizing that our system for over a decade has been juiced by debt spending, had to step in and make it unattractive to save to the point that people are willing to dive into risky investments yet again. Because of this however, you create moral hazard. For example, with housing you have many government backed loans that are now accessible with very little down. In fact, this has been the path of ownership for most Americans since many are without savings. One out of three Americans has no savings and nearly half are one or two paychecks away from being out on the streets.

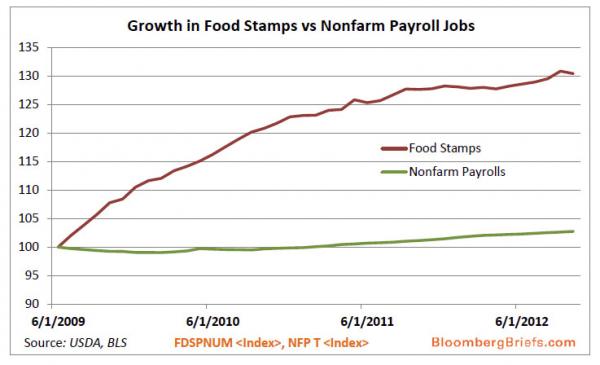

This is why we have seen such a dramatic rise in food stamp usage:

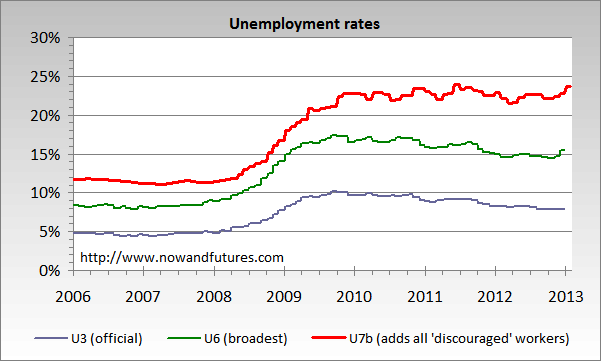

Why save to buy anything when you can simply go into debt for it? That seems to be the course we are treading on. We have reached a critical point where our national debt is now higher than our annual GDP. This crossing of the Rubicon is seen as a major financial tipping point. We have also mastered how to hide certain employment figures:

If we look at the U7b measure, the unemployed + underemployed + discouraged workers are nearly up to 25 percent. We were discussing how many younger Americans are simply riding out the weak economy by going to college.

People think that this recovery has come from organic forces when in reality, it has come because of number games and also the Fed injecting trillions of dollars into the banking industry. Ironically these banks are using this money to speculate in markets like stocks and housing where they are now crowding out working and middle class Americans. When you have access to a printing press with no restraints, it becomes too tempting to spend into oblivion. Instead of confronting the core problems of the crisis, we are simply repeating them yet again; easy access to low down payment mortgages, easy access to student debt, consumer credit slowly expanding, and major Wall Street speculation. Addictions are never easily cured and we have yet to come to terms with our insatiable appetite for debt.

Mike Maloney is the owner and founder of GoldSilver.com, an online precious metals dealership that specializes in delivery of gold and silver to a customer's doorstep, arranges for special secured storage, or for placement in one's IRA account. Additionally, GoldSilver.com provides invaluable research and commentary for its clients, assisting them in their wealth building endeavors.

© 2013 Copyright GoldSilver - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.